‘The Choice Is Simple’: Trump Campaign Unveils Site Warning of Major Tax Hikes if Kamala Harris Is Elected

A website Donald Trump’s campaign created warns voters in every state that their taxes will increase if Kamala Harris is elected in November.

A website Donald Trump’s campaign created warns voters in every state that their taxes will increase if Kamala Harris is elected in November.

Americans for Tax Reform (ATR), the Heritage Foundation, and more than 30 conservative groups on Tuesday announced that they oppose Vice President Kamala Harris’s rent price control proposal, Breitbart News has learned exclusively.

Vice President Kamala Harris — who on Saturday copied a campaign promise first announced by former President Donald Trump to eliminate taxes on tips — voted in 2022 to pass legislation that allowed the IRS to track down workers’ tips so that they could be taxed.

Conservatives and community banks across the political spectrum are sounding the alarm over an onerous payment processing bill worming its way through the Florida legislature.

Americans for Tax Reform (ATR) has listed several taxes in in the so-called “Inflation Reduction Act” that passed on Sunday — which Democrats now hail as a “climate” bill, since the Congressional Budget Offices says it will not reduce inflation.

The Biden administration has once again used coronavirus emergency powers to extend a pause on student loan repayment, capitulating to his left flank and costing taxpayers billions of dollars.

Democrats are looking for ways to pay for their $3.5 trillion spending plan, including raising corporate taxes.

Conservative group Americans for Tax Reform (ATR) announced Monday they will launch an ad campaign in House battle ground districts to oppose President Joe Biden’s “tax-and-spend blowout” $3.5 trillion reconciliation package.

Senate Democrats are considering several ways to tax Americans in order to pay for their multi-trillion dollar leftist wishlist.

A group of “free-market and low-tax advocates” are urging House Republicans to back off plans to take antitrust action against Big Tech companies.

Joe Biden pledged to eliminate all of President Donald Trump’s tax cuts while campaigning in Iowa over the weekend.

A new report finds that electric, gas, and water rates have fallen across the country due to the tax cuts put in place by President Donald Trump and the GOP.

The U.S. Bureau of Labor Statistics report released on Friday revealed that the economy added 148,000 jobs in December; the unemployment rate remains at 4.1 percent.

More than 100 U.S. companies are giving their employees up to $2,000 in bonuses after President Trump’s tax reform package became law.

Federal Communications Commission (FCC) Chairman Ajit Pai plans a December vote to repeal the agency’s net neutrality rule.

An Environmental Protection Agency (EPA) employee based out of Las Vegas paid for nearly $15,000 worth of one-year gym memberships for 37 people using a government credit card, documents show.

Speaker of the House Paul Ryan (R-WI) hosted a small group of allied outside group leaders to thank them for their support for his American Health Care Act, Ryancare, and to talk with them about his next attempt to bring the bill to the House floor.

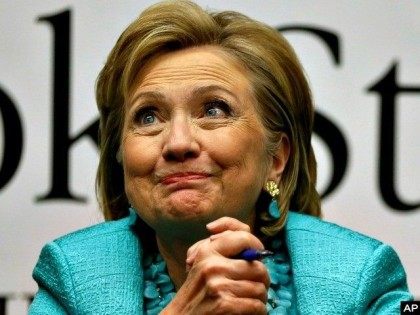

Hillary Clinton says she’ll push for a ten year, trillion dollar tax hike if she is elected, despite the example of President Barack Obama’s seven year, borrow-and-spend economic plan.

Recently, the Los Angeles Times exposed that special interest groups representing certain “business” interests in Sacramento have put serious pressure on the California Republican Party not to fund the potential candidacy of Assembly Republican Leader Kristin Olsen in a bid against incumbent State Senator Kathleen Galgiani, a Democrat.

The anti-tax group, Americans for Tax Reform, said today that Donald Trump’s tax reform proposal meets its “Taxpayer Protection Pledge” to oppose net tax increases. In this Presidential cycle, Grover Norquist’s Americans for Tax Reform got every GOP candidate, except Trump,

Sen. Rand Paul (R-KY) is calling on Republicans in the House—and the grassroots nationwide—to oppose efforts by House Ways and Means Committee chairman Rep. Paul Ryan (R-WI) to revive Obamatrade via a tax increase hidden inside the Trade Adjustment Assistance (TAA) portion of the deal.

The Washington Post’s Robert Costa reports Wisconsin Gov. Scott Walker is in Washington, D.C., this weekend for the National Governors Association’s winter meeting. While there, he’ll also be meeting with Americans for Tax Reform President Grover Norquist and other influential Republicans in his circle.

Grover Norquist is firing back at what he described as “garbage,” “crap,” and “lies” perpetrated by Frank Gaffney and his allies.

Americans for Tax Reform (ATR) president Grover Norquist has written a letter to several members of the NRA’s board of directors fervently denying allegations of his ties to Muslim Brotherhood leaders as “conspiracies.”

Tom Brady wants to give the 2015 Chevrolet Colorado truck he won as the MVP of Super Bowl 49 to game-winning hero Malcolm Butler, but the Internal Revenue Service is going to make him pay for that act of gratitude