Breitbart News Senior Editor-at-Large Peter Schweizer, author of the landmark book Clinton Cash and president of the Government Accountability Institute, talked about the suddenly newsworthy STOCK Act on Thursday’s Breitbart News Daily.

Schweizer explained, “[This legislation] was something that came about after an investigation we did, that came out in a book called Throw Them All Out, and then 60 Minutes did a segment that showed members of Congress had this extraordinary ability to pick stocks at the right time.”

“There was an academic study that showed, for example, that the average U.S. senator was beating the stock market averages by 12 percent a year in their stock picks – which is much higher than hedge funds, Warren Buffett, anyone else,” he recalled.

“So the STOCK Act was an act that was passed, which said it is illegal for members of Congress, their staffs, and senior executives in the executive branch of government to trade stock on inside information. We’re all familiar, Alex, with insider trading laws and corporations. Well, those laws didn’t really cover politicians, so the STOCK Act was supposed to cover politicians,” he told SiriusXM host Alex Marlow. “There’s kind of a debate about how effective it is. That’s another story.”

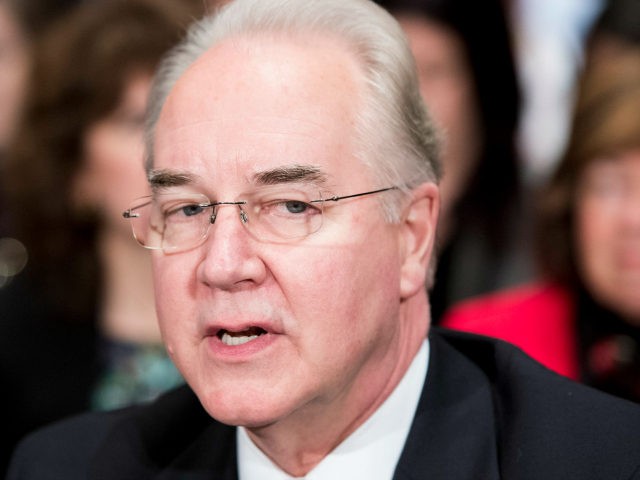

He said the STOCK Act has come into play with the nomination of Rep. Tom Price (R-GA), President-elect Donald Trump’s nominee for Health and Human Services secretary.

“He is somebody who does trade stocks actively,” Schweizer noted. “He’s been involved in the healthcare debate for a while. He has traded healthcare stocks while he’s been involved in that debate. So Democrats are arguing that he has violated the STOCK Act, which actually is not accurate and true.”

Marlow pointed out that Price has been grilled in his confirmation hearings for transactions that netted only a few hundred dollars in profit, notably including a lengthy harangue from Senator Elizabeth Warren (D-MA), a portion of which Marlow played.

Schweizer said Warren’s basic timeline of Price’s stock transactions was correct, but “the problem is, I think the stock purchase was for about $3,000. If you’re going to go in big on insider trading – that’s the allegation here – you would expect it to be more than $3,000.”

“I do think, look, this is the problem that the HHS nominee has, and I’ve been critical of Republicans and Democrats on this in general,” he said. “Congressman Tom Price is very smart and involved in the healthcare debate. Beyond just this Zimmer stock trade, going back to 2009, when there were efforts to amend and change Obamacare, there’s no question he has been actively trading healthcare stock for a long time. It’s a problem. I just don’t believe that politicians should be trading stocks in areas where they have a responsibility.”

“You’ve got senators on the Senate Armed Services Committee who are determining which jet fighter is going to get a contract from the Pentagon,” he pointed out. “And they are free to, and often do, trade stocks in those companies. That said, Congressman Price is correct, in what he has done is precisely what members of that committee, and all sorts of members of Congress and the Senate do.”

“The selective outrage that we’re going to bring this up in this one case, involving this guy, because we don’t like his political views, to me, is a little bit off base,” Schweizer declared. “What I would love to see is Senator Elizabeth Warren and Tea Party Republicans come together and pass a bill that says members of Congress either have to have a blind trust, or the only stocks they should trade in are in index funds that don’t follow individual stocks.”

“That’s what should be done. But to sort of use this as a form of political collective outrage, I think, is a little bit ridiculous and really does a disservice to efforts to actually reform things in this area,” he said.

Breitbart News Daily airs on SiriusXM Patriot 125 weekdays from 6:00 a.m. to 9:00 a.m. Eastern.

LISTEN:

COMMENTS

Please let us know if you're having issues with commenting.