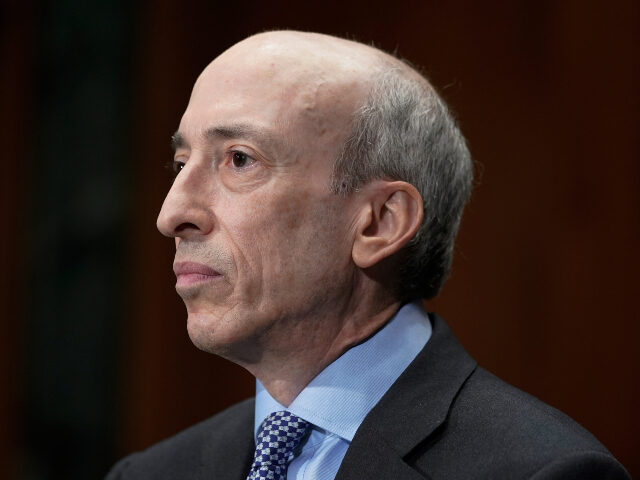

Securities and Exchange Commission (SEC) chairman Gary Gensler will resign in January, which would allow for President-elect Donald Trump to select a pro-crypto, anti-climate-change-policy chairman.

Gensler inflamed controversy during his time as chair by pushing onerous climate change policies, targeting cryptocurrency companies, and other actions.

The Wall Street Journal (WSJ) reported in 2023 that the SEC’s proposed climate change disclosure rule would require companies to disclose a staggering amount of data:

The proposed reporting rules would require public companies to include a raft of climate data in their audited financial statements. The mandated disclosures cover everything from costs caused by wildfires to the loss of a sales contract because of climate regulations, such as a cap on carbon emissions.

Companies would have to analyze climate-related costs and risks for each line item of their financial statements, such as revenue, inventories or intangible assets. Any climate costs that are 1% or more of each line item total would have to be reported.

Under current rules, companies are generally required to disclose only those climate costs and risks they judge to be material, or significant, for investors. SEC officials are concerned that too few companies are reporting such important climate costs and risks.

As SEC chairman Gensler also had many contentious disputes with the crypto industry, which led to the regulatory agency suing several large digital asset companies and exchanges over how they handled and sold cryptocurrency.

Gensler investigated Elon Musks’s Telsa for potential fraud surrounding his $44 billion acquisition of Twitter, which he rebranded X.

In January 2024, Rep. Byron Donalds (R-FL) said that Gensler’s investigation of free speech platform Rumble may have been interfering the site’s role in the 2024 presidential election.

Trump can now choose a new chairman for the SEC. Two other commissioners’ terms will expire during Trump’s time in office as well. It is expected that he would nominate commissioners friendlier to the cryptocurrency industry and other financial technology industries.

American-based digital exchange Coinbase described the fight against Gensler and the SEC as “existential.”

In an interview with Breitbart News, Rep. French Hill (R-AR), who is running to be chairman of the House Financial Services Committee, said he would seek to end the targeting and “debanking” of cryptocurrency companies happening under the Biden-Harris administration.

“I want to increase competition, make community banking great again, and end the regulatory administrative state’s dominance of the regulatory system,” Hill remarked.

House Majority Whip Tom Emmer (R-MN) wrote, “Good riddance,” referring to Gensler’s resignation.

Sean Moran is a policy reporter for Breitbart News. Follow him on X @SeanMoran3.

COMMENTS

Please let us know if you're having issues with commenting.