The following content is sponsored by Money.com.

Investing in gold IRAs allows investors to diversify retirement portfolios with physical gold, providing a hedge against market volatility. The best gold IRA companies offer exceptional customer service, transparent pricing and secure storage options. They guide clients through the complex setup process — ensuring compliance with IRS regulations — and provide expert insights into market trends to maximize returns.

Here’s what you need to know about the best gold IRA companies of 2024:

Best Gold IRA Companies of 2024

- Thor Metals Group — Best Overall

- Advantage Gold — Best Buy-Back Service

- American Hartford Gold — Best for Low Minimum Deposit

- Priority Gold — Best for Complimentary Storage

- Preserve Gold — Best for Customer Satisfaction

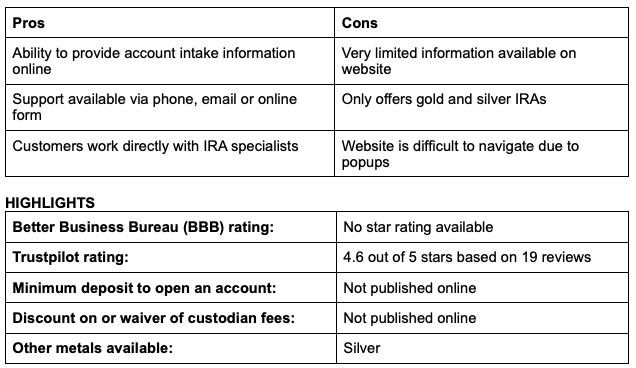

Best Overall: Thor Metals Group

Why we chose it: Thor Metals Group is a newer company in the gold IRA sector that stands out for its tailored customer support and flexible contact options.

Although relatively newer than some of its competitors, Thor Metals Group places a strong emphasis on building lasting relationships with its customers. This is achieved through a tailored approach where clients can easily access support via phone, email or online form.

Thor Metals Group assigns IRA specialists to work directly with clients, helping tailor investment strategies to their unique financial goals and circumstances. This focused approach is designed to simplify the often complex process of setting up and managing a gold IRA.

Investors can diversify their retirement portfolios with gold and silver, providing a hedge against market volatility and inflation. Additionally, Thor Metals Group guarantees a free IRA set-up, eliminating initial costs that could otherwise become a barrier for new investors.

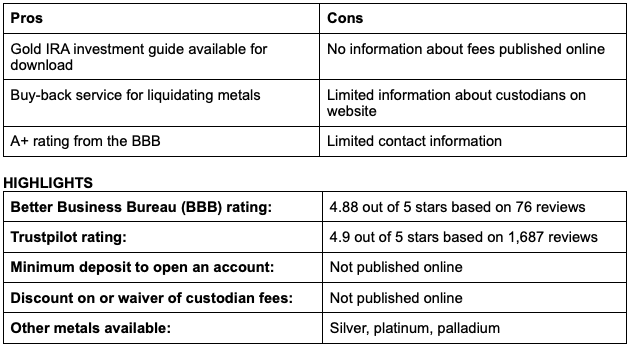

Best Buy-Back Service: Advantage Gold

Why we chose it: Advantage Gold’s buy-back service lets investors confidently enter and exit their positions with its buy-back service.

Advantage Gold is known for providing investment education and comprehensive customer service. It specializes in helping individuals diversify their retirement portfolios through the inclusion of precious metals like gold, silver, platinum, and palladium. Advantage Gold offers an extensive range of resources, including a downloadable gold IRA investment guide, that empower investors with the knowledge needed to make informed decisions about their retirement savings.

Advantage Gold assists clients in purchasing IRS-approved precious metals, ensuring each purchase qualifies for inclusion in a retirement account. The company offers seamless account setup, providing clients with a smooth and efficient transition to a gold-backed retirement plan. The company also offers a buy-back service that makes it ideal for clients looking to liquidate their precious metal investments.

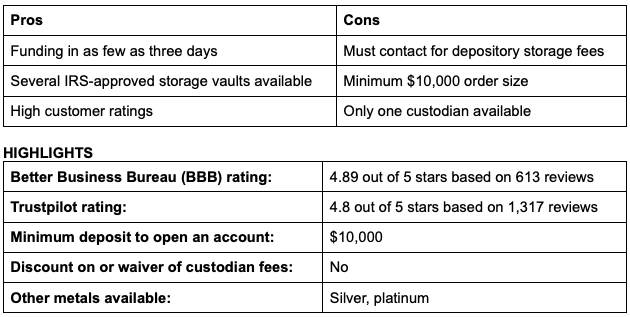

Best for Low Minimum Deposit: American Hartford Gold

Why we chose it: American Hartford Gold‘s low minimum deposit requirement and high customer ratings help the company stand out among gold IRA companies.

American Hartford Gold specializes in precious metals investment, including gold IRAs, and is known for its comprehensive offerings and high-quality customer service. The company has garnered a strong reputation in the industry and has an A+ rating from the Better Business Bureau (BBB). It provides a wide range of investment products beyond gold, including silver and platinum, allowing clients to further diversify their portfolios.

American Hartford Gold offers an efficient investing process, with account funding in as few as three days. The company offers several IRS-approved storage vaults, ensuring client investments remain safe and compliant with regulatory standards. High customer ratings further demonstrate the company’s dedication to client satisfaction and service excellence. Customers can also benefit from expert insight into market trends that make informed investment decisions easier.

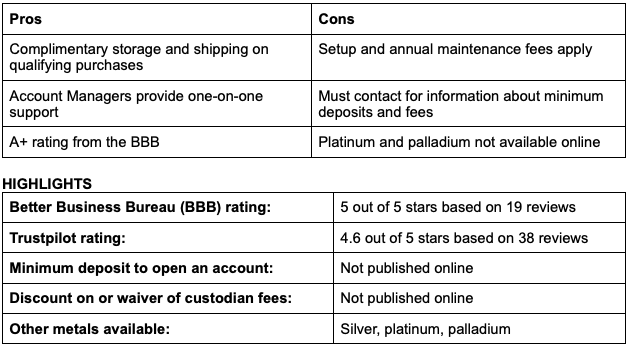

Best for Complimentary Storage: Priority Gold

Why we chose it: Priority Gold can reduce the cost of investing in a gold IRA by offering complimentary storage and shipping on qualifying purchases.

Founded over 20 years ago in 2001, Priority Gold focuses on personalized service by providing each client with a dedicated account manager who guides them through the investment process. This one-on-one support is instrumental in simplifying the complexities associated with setting up and managing a gold IRA. As a trusted player in the industry, Priority Gold has built its credibility with an A+ rating from the BBB and high customer ratings.

Clients can diversify their portfolios with options in silver, platinum and palladium — though platinum and palladium are not available online. Priority Gold also provides complimentary storage and shipping on qualifying purchases, which can reduce the physical storage costs associated with precious metals. Furthermore, the detailed guidance provided by account managers ensures clients receive timely, accurate information tailored to unique investment goals.

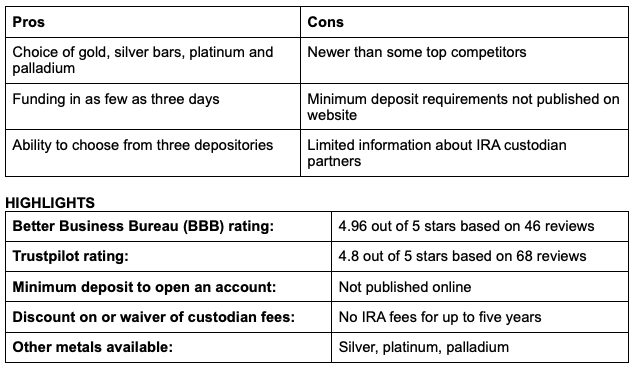

Best for Customer Satisfaction: Preserve Gold

Why we chose it: Despite its more recent establishment, Preserve Gold has a reputation for exceptional customer satisfaction and an A rating from the BBB.

Preserve Gold is a relatively new player in the gold IRA market, having been founded in 2022. The company lets investors diversify their retirement portfolios with a range of metals. Preserve Gold customers can choose from a variety of metal forms, including gold, silver, platinum and palladium options. The company also provides flexible storage options, allowing clients to select from three different depositories, tailoring the storage solution to fit their specific needs.

The funding process is fast, potentially setting up new accounts in as few as three days. Compared to more established companies, Preserve Gold‘s newness in the industry is offset by its focus on client experience, reflected in high ratings from both the Better Business Bureau and Trustpilot. The company’s commitment to transparency and excellence is further evidenced by its policy of waiving IRA fees for up to five years.

What Is a Gold IRA?

A gold IRA, or individual retirement account, is a type of self-directed IRA that allows investors to own physical gold, silver, platinum and palladium instead of the more traditional assets like stocks and bonds. This investment option offers individuals the opportunity to diversify their retirement portfolio with tangible precious metals, which can serve as a hedge against inflation and economic uncertainty.

What’s the difference between a gold IRA and a traditional IRA?

A gold IRA differs from a traditional IRA primarily in the types of assets it holds. While a traditional IRA typically includes investments in stocks, bonds and mutual funds, a gold IRA focuses on physical precious metals such as gold, silver, platinum and palladium.

The management and storage of assets within a gold IRA require adherence to specific IRS rules and regulations, including the use of an approved custodian for asset storage. Like other types of IRAs, gold IRAs aim to provide tax advantages for retirement savings, but a gold IRA’s inclusion of precious metals offers a distinct approach to risk management and wealth preservation.

How Does a Gold IRA Work?

Establishing a gold IRA involves a few critical steps to ensure compliance with IRS regulations and to protect the investment. First, an investor must choose a trusted custodian who specializes in handling self-directed IRAs, as they are required by law to administer these accounts. The custodian manages the account paperwork and facilitates the purchase and storage of the precious metals.

After selecting a custodian, the investor needs to open the gold IRA account and fund it. This funding can be done through a rollover from an existing IRA or another qualified retirement plan, or through direct contributions, adhering to the IRS contribution limits. Once the gold IRA is funded, the investor works with their custodian and metal dealers to purchase the desired precious metals. It’s essential to ensure that the chosen metals meet the IRS’s requirements for purity and type. Common options include specific gold bullion bars or coins that adhere to these standards.

After the purchase, the metals are stored securely, typically in an IRS-approved depository that offers advanced protection against physical theft or damage. The custodian oversees these assets, maintaining their integrity and compliance. Throughout the investment period, the value of these metals may fluctuate with market trends, but they provide a form of diversification that can help protect against inflation and economic uncertainties, aligning with long-term retirement goals.

Pros and Cons of Gold IRAs

Pros

- Ability to hedge against inflation: Gold has historically been considered a strong hedge against inflation. Unlike paper currency, its value tends to remain stable or even appreciate over time, especially during periods of economic uncertainty. This stability can help preserve your purchasing power over the long term, making gold a reliable component of a diversified retirement portfolio.

- Portfolio diversification: Including gold in your IRA helps to diversify your investment portfolio. Diversification is a crucial strategy for reducing risk because it spreads investments across different asset classes. Gold often exhibits low or negative correlations with traditional classes like stocks and bonds, meaning it can help mitigate losses during market downturns.

- Tangible asset: Unlike most financial assets, gold is a physical commodity, offering you peace of mind with tangible ownership. This can be especially appealing during times of political or financial instability when the reliability of digital or paper assets might come into question.

- Potential for appreciation: Over the past decades, the price of gold has witnessed substantial growth, and while past performance doesn’t guarantee future results, many see gold as an asset that could increase in value over time as demand expands and resources become more scarce.

- Safe haven asset: Gold is often referred to as a “safe haven” asset due to its ability to retain value during economic crises. Investors tend to flock to gold during times of market volatility, financial instability or geopolitical uncertainty, driving up its price and maintaining its demand.

Cons

- Higher fees and expenses: Gold IRAs typically have higher fees compared to traditional IRAs or other investment accounts. These fees can include account setup fees, storage fees and custodian management fees. Over time, these costs can erode the returns on your investment, making it less cost-effective, especially if you do not hold the gold for a significant duration.

- No income potential: Unlike stocks or bonds that may offer dividends or interest, gold does not provide any income. This lack of income generation means the investment relies solely on price appreciation for returns. Consequently, during periods when gold prices are stagnant or decreasing, investments may not yield the same level of income or growth as other investment vehicles.

- Complex management: Investing in a gold IRA involves dealing with additional regulations and requirements set by the IRS. This includes choosing an approved custodian and selecting a trustworthy depository to hold the physical asset. Increased complexity can demand more time, effort and knowledge on the part of the investor.

- Market risks and volatility: While gold is often seen as a stable asset, it is not immune to market fluctuations. The gold market can experience periods of significant volatility that may lead to short-term fluctuations, which could be concerning for those seeking stable returns.

- Liquidity constraints: Selling physical gold from a gold IRA can be more challenging compared to more liquid assets like stocks or mutual funds. There may be restrictions on when and how you can liquidate your holdings, potentially resulting in delays or additional costs.

Who Gold IRAs Are Right For

Gold IRAs can be an excellent investment option for individuals looking to diversify their retirement portfolio and safeguard their wealth against economic uncertainties and inflation. This investment vehicle appeals to a range of investors with specific financial goals and risk tolerances. Investors fitting these profiles may find that adding a gold IRA to their retirement strategy aligns well with their financial objectives and mitigates risks associated with other investment types.

These are some individuals who might find gold IRAs particularly beneficial:

- Risk-averse investors: Individuals concerned about market volatility and seeking a more stable, diversified portfolio may benefit from the security gold IRAs offer. Gold’s reputation as a safe haven can provide peace of mind during economic downturns.

- Inflation-wary savers: Those looking to protect their retirement savings from inflation will find gold IRAs attractive due to gold’s historical ability to maintain or increase its value over time, even as currency values diminish.

- Long-term investors: Investors with a long-term horizon who are willing to hold onto their assets for extended periods can take advantage of gold’s potential for appreciation. They might benefit from its value increase as demand grows and resources become scarce.

- Tangible asset enthusiasts: Those who prefer owning a physical asset rather than digital or paper investments may appreciate the tangible nature of gold. This aspect is particularly appealing in times of political or financial instability.

- Sophisticated investors: Individuals who understand and are willing to navigate the complexities and regulations involved in managing a gold IRA can leverage the tax advantages of this retirement account while enjoying a diversified asset base.

How to Choose a Gold IRA

Selecting the right gold IRA is crucial for optimizing your investment strategy and achieving your financial goals. With various providers and options available, it’s important to carefully evaluate and compare each choice to ensure you make an informed decision. Below are the key steps to take when comparing and choosing a gold IRA, along with explanations for each step:

- Research and select the best gold IRA companies. Begin by researching different custodians who specialize in gold IRAs. Look for a company with a solid reputation, transparent fees and strong customer reviews. A reputable custodian will securely manage your investments and provide expert guidance.

- Evaluate available fee structures. Compare the fee structures of various custodians, including account setup fees, annual maintenance fees and storage fees. Understanding the total cost of ownership will help you choose a gold IRA that aligns with your budget and financial strategy.

- Assess storage options. Ensure the custodian offers secure storage options for your physical gold. Consider whether each option provides segregated or commingled storage and the security measures in place to protect your assets.

- Understand IRS regulations and compliance. Familiarize yourself with IRS rules regarding gold IRAs to ensure compliance. Choose a custodian who fully adheres to these regulations and offers guidance to simplify account setup and management.

- Review customer support and educational resources. Quality customer support and access to educational resources are critical when managing a gold IRA. Select a custodian that provides responsive customer service and offers resources to help you make informed investment decisions.

- Consider the range of investment options. Investigate the variety of gold products and other precious metals available for investment. A diverse range of options will allow you to tailor your portfolio to meet specific goals and risk tolerance.

- Examine historical performance and market insights. As with other investments, past performance doesn’t guarantee future results, but understanding historical trends and insights can aid in your decision. Choose a custodian who offers market insights and analysis to help guide your investment decisions.

How to Open a Gold IRA

To successfully open a gold IRA, it’s essential to follow a series of steps to ensure a smooth process and compliance with all regulatory requirements.

- Choose a qualified custodian. Before opening a gold IRA, select a custodian approved by the IRS to manage precious metal investments. Look for a custodian with a strong reputation, experience in gold IRAs and excellent customer service.

- Complete the application process. Fill out the necessary application forms provided by your chosen custodian. This step typically involves submitting your personal information, financial details and account preferences to establish your account.

- Fund your IRA. Transfer funds into your new gold IRA by rolling over an existing retirement account, such as a 401(k) or traditional IRA, or by making a direct contribution. Ensure the transaction complies with IRS guidelines to avoid penalties or tax implications.

- Select your precious metals. Work with your custodian to choose the specific gold products or other precious metals you’d like to include in your portfolio. Consider factors such as purity, type and current market performance to align your investments with your goals.

- Arrange for secure storage. Once you select your metals, coordinate with the custodian to arrange for secure storage. Choose between segregated or commingled storage options at an approved depository to ensure your assets are protected and meet IRS requirements.

- Monitor and manage your investments. Regularly review and manage your gold IRA holdings with the support of your custodian’s resources. Stay informed about market trends and assess how your assets align with your long-term financial goals, making adjustments as necessary.

Gold IRA Alternatives

In addition to gold IRAs, there are several other investment strategies that individuals can consider to diversify their retirement portfolios and hedge against market volatility. Each option provides unique benefits and may better suit different financial goals and risk appetites.

- Traditional IRAs: Investing in a traditional IRA allows individuals to benefit from tax-deferred growth on earnings. Contributions may be tax-deductible, and distributions during retirement are taxed at the retiree’s current income tax rate.

- Roth IRAs: Unlike traditional IRAs, Roth IRA contributions are not tax-deductible. However, these accounts grow tax-free and allow withdrawals during retirement to be tax-free if certain conditions are met. Because contributions are after-tax, Roth IRAs are often a good choice for individuals expecting higher tax rates in retirement.

- Real estate investments: Direct investment in real estate properties can provide income through rental yields and potential appreciation. Real estate investments also add tangible assets to your portfolio, offering a buffer against inflation and market downturns.

- Stocks and bonds: These conventional investment options remain popular for their liquidity and potential for long-term growth. Stocks provide ownership stakes in companies, while bonds offer fixed-income returns, which can stabilize a more volatile portfolio.

- Treasury Inflation-Protected Securities (TIPS): TIPS are government bonds designed to protect investors from inflation. The principal value of TIPS increases with inflation, ensuring your investment maintains its purchasing power over time.

- Cryptocurrencies: For those seeking cutting-edge alternative investments, cryptocurrencies may offer a high-risk, high-reward option. However, these digital assets are volatile.

Gold IRA FAQ

Is a gold IRA a good investment in 2024?

A gold IRA can be a strategic investment in 2024, offering portfolio diversification and a hedge against economic instability. Its value tends to rise during market downturns. However, consider market conditions, fees and your financial goals before investing. Consulting a financial advisor can provide tailored advice for your specific circumstances.

Are gold-backed IRAs a good idea?

Gold-backed IRAs can be a good idea for diversifying your retirement portfolio and protecting against inflation. However, they’re not suitable for everyone. Consider factors like investment goals, risk tolerance and fees before proceeding. Consult a financial advisor to ensure a gold-backed IRA aligns with your overall strategy and long-term financial objectives.

Do you pay taxes on a gold IRA?

Taxes apply to a gold IRA similarly to traditional IRAs. Contributions are typically tax-deductible, and withdrawals are taxed as ordinary income during retirement. However, early withdrawals before 59 1/2 may incur penalties and taxes. Rollover transactions are tax-free if IRS guidelines are followed. Consult a tax professional for personalized advice.

Are gold IRA companies trustworthy?

Gold IRA companies can be trustworthy but always perform due diligence to choose a reputable company. Look for firms with strong reputations, transparent fee structures and excellent customer service. Check for accreditation with regulatory bodies like the Better Business Bureau and read customer reviews. Consulting financial advisors can also help you choose a reputable company for your investments.

Is a gold IRA the best investment for a senior citizen?

A gold IRA is typically not the best investment for a senior citizen because there are age-related requirements that make IRAs less beneficial for seniors. In addition, the short investment horizon of seniors often means older investors won’t benefit from the tax advantages available with IRAs. Senior citizens who are interested in buying gold can explore doing so outside a gold IRA.

Where is the physical gold stored in a gold IRA?

Physical gold in a gold IRA is stored at an approved depository, ensuring it meets IRS requirements for security and compliance. Investors can typically choose between segregated storage, where their assets are stored separately, or commingled storage, where they’re stored with others’, depending on personal preference and the custodian’s available options.

Can I withdraw the physical gold from a gold IRA?

You can withdraw physical gold from a gold IRA, but it involves a distribution process. Upon withdrawal, the gold is subject to taxes and potential penalties if you’re under 59 1/2. There’s also a mandatory withholding period. Consult with your custodian to understand the procedure and implications before proceeding with the withdrawal.

How We Chose the Best Gold IRA Companies of 2024

Selecting the best gold IRA companies in 2024 involved carefully evaluating several key elements that play a crucial role in determining the reliability and suitability of a gold IRA provider.

- Reputation and credibility: We assessed the companies based on their track record, customer reviews and ratings from the Better Business Bureau and Trustpilot.

- Fee structures: Transparent and reasonable fee structures were a priority to ensure investors understand all potential costs involved.

- Customer service: A strong customer support team was vital for assisting investors with their inquiries and providing guidance throughout the investment process.

- Investment options: We evaluated the range of investment products offered, including the variety of precious metals available for purchase.

- Storage solutions: Secure and compliant storage options were considered.

- Educational resources: Companies offering educational materials and resources were given preference to help investors make informed decisions.

COMMENTS

Please let us know if you're having issues with commenting.