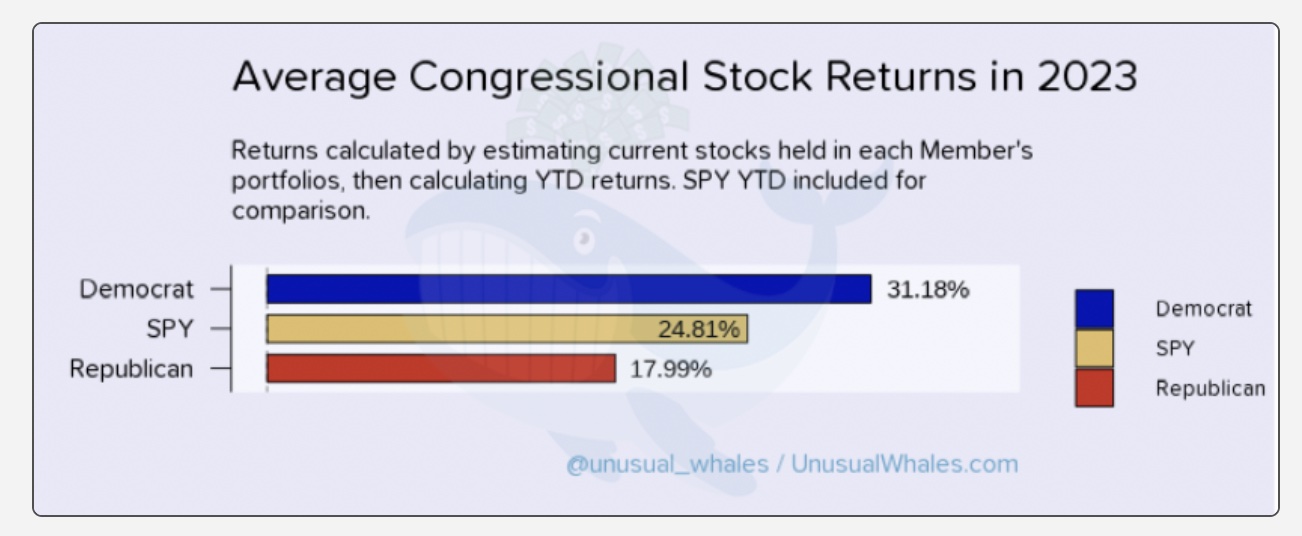

Congressional Democrats’ stock returns beat the S&P 500 by seven points in 2023, a report by Unusual Whales found Tuesday, raising concerns that many members of Congress trade stocks based on information unavailable to the public.

Beating the S&P is very difficult for stock traders due to the challenge of regularly identifying stocks that will gain more than the S&P:

- The S&P 500 is a stock market index tracking the stock performance of the 500 largest companies listed on the U.S. stock exchanges.

- The S&P provides diversified exposure, reducing portfolio risk.

- The S&P 500’s composition incorporates factors of size, value, quality, and volatility

“Democrats came out on top significantly, due to their heavy tech portfolios. Republicans only returned around 18%, which is still great,” the report found. “They underperformed as an aggregate because their portfolios are mainly in financials, oil, and commodities, which had a difficult year due to the banking collapses and high rate hikes.”

- Democrats are up seven points (31 percent up), Unusual Whales showed.

- Republicans did not beat the S&P, falling short by 6 points (18 percent up).

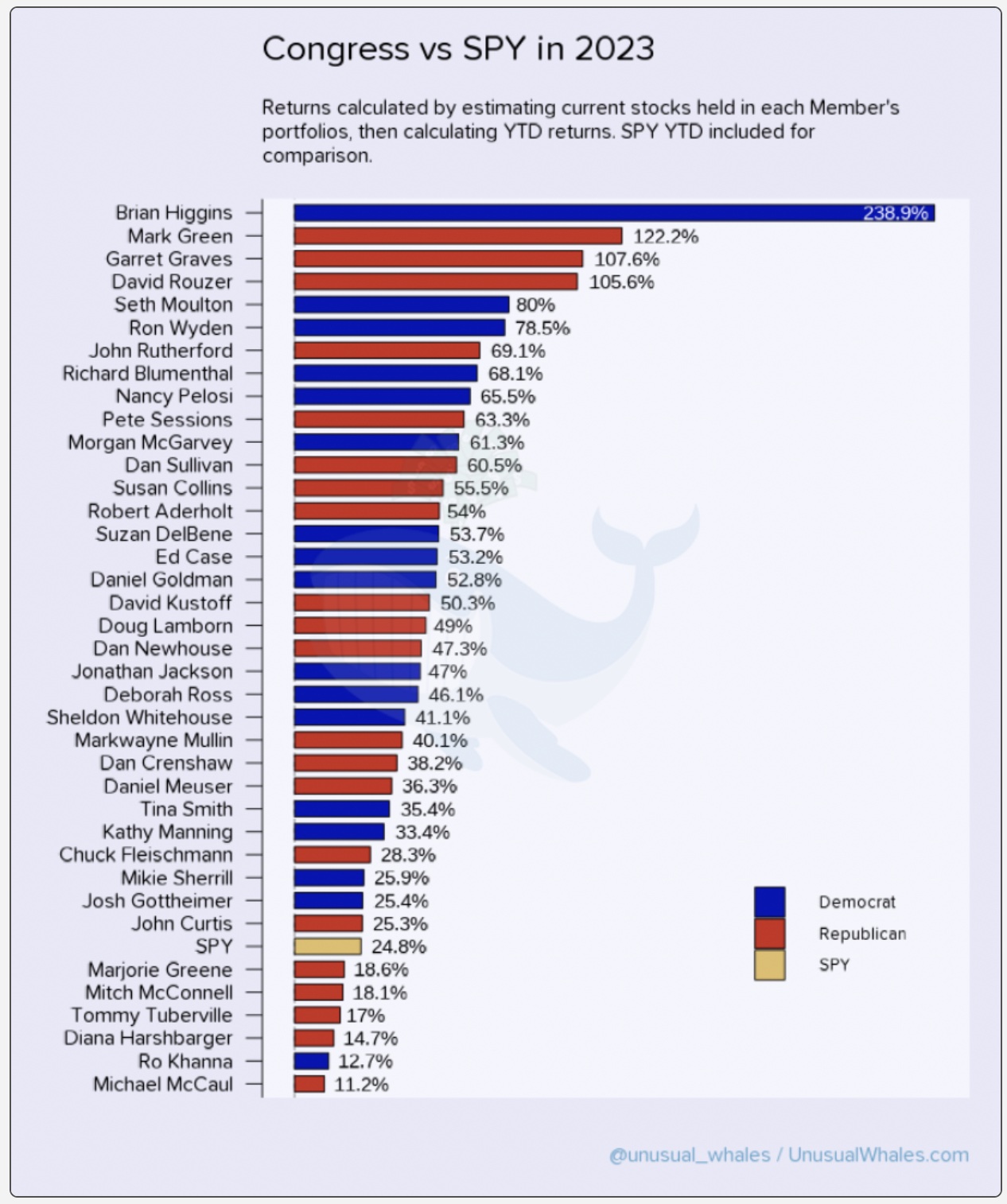

The report calculated the returns of the members whose portfolios performed the best. Among them are Rep. Nancy Pelosi (D-CA), Sen. Susan Collins (R-ME), Rep. Dan Goldman (D-NY), Rep. Dan Crenshaw (R-TX), and Sen. Mitch McConnell (R-KY).

The top member was Rep. Brian Higgins (D-NY) who represents the Buffalo area. He was first elected in 2005 and sits on the House Committees on the Budget and Ways and Means:

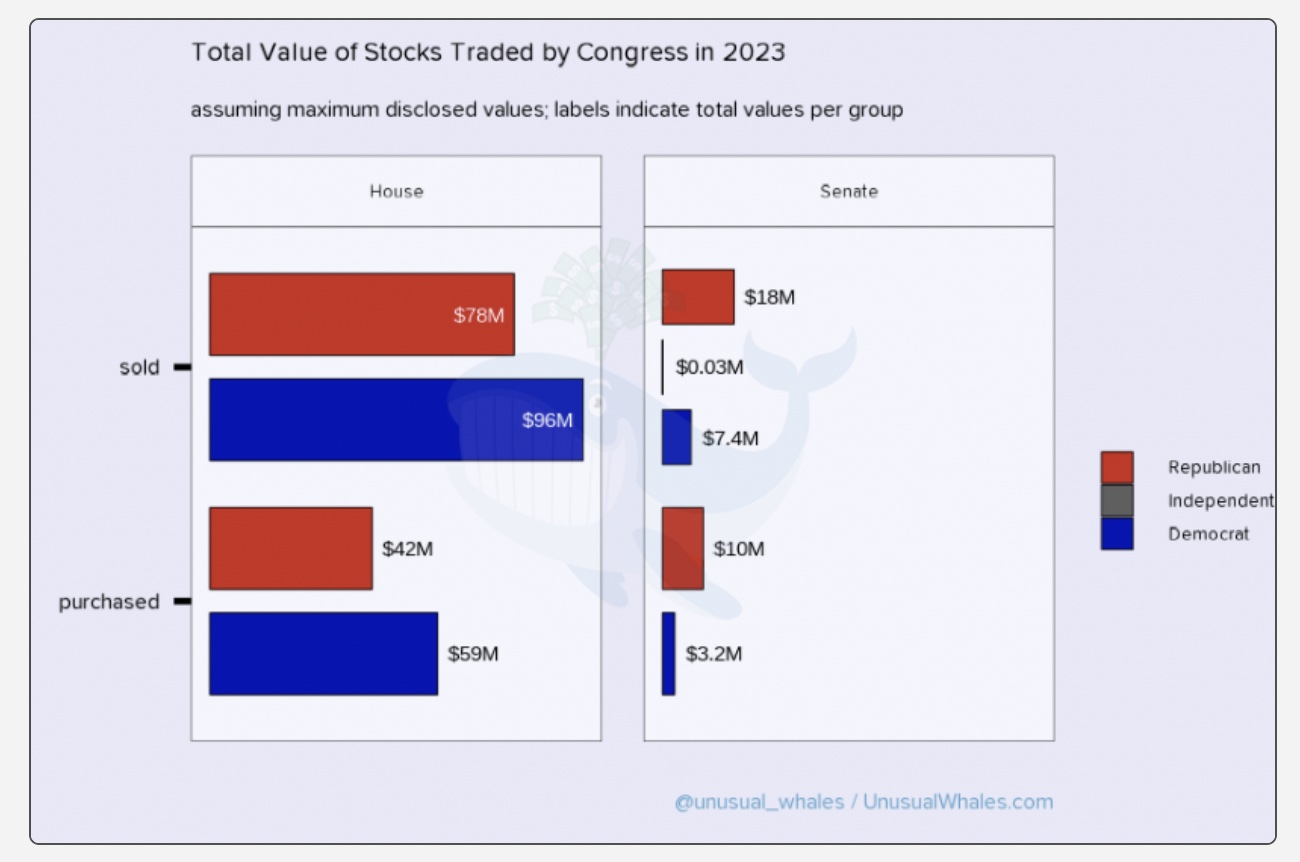

Overall, the report found trades were down in 2023, although the value of the transactions as a whole was comparable to 2022:

The following two charts show that Congress has been selling more stocks than buying in the past couple years. They’ve also been selling more government securities (like Treasury bills, bonds and notes) in 2023 than previous years. They were buying more corporate securities (bonds and notes) in the last two years.

Generally, Congress has decreased their stock trading (when compared to previous years, with around $150M in transactions by both parties). Trading activity in other assets has increased.

The report showed the members of Congress traded fewer stocks due to House members selling stocks more than buying them. “Senate Republicans were busier than Senate Democrats by selling more stocks and buying more comparatively,” the report found:

More information on congressional stock trading from 2022 is here.

Follow Wendell Husebø on “X” @WendellHusebø. He is the author of Politics of Slave Morality.

COMMENTS

Please let us know if you're having issues with commenting.