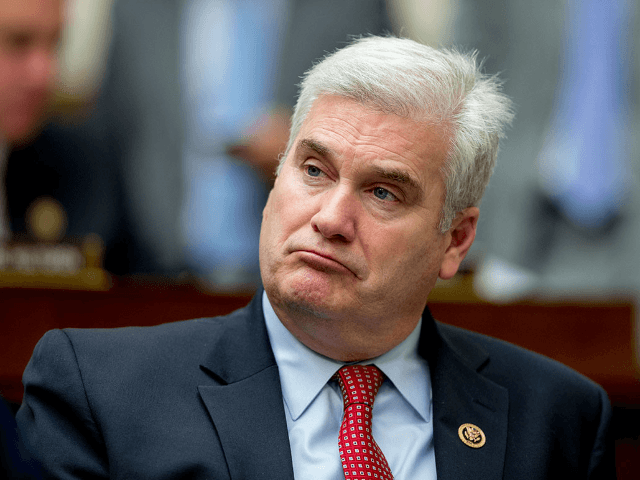

Rep. Tom Emmer (R-MN) told Breitbart News in an exclusive interview that Bitcoin and other digital currencies can serve as a check on bad monetary policy as Americans continue to feel the brunt of record-level inflation.

Emmer first spoke with Breitbart News about how Democrats are experiencing a total “political nuclear meltdown” and how Republicans can flip any district that President Joe Biden won by 12 points or less.

Now, Emmer says that Bitcoin can serve as the solution for America’s runaway inflation, which has yet to subside despite the Federal Reserve’s increasingly tighter monetary policy.

“There’s a lot of folks in the crypto industry who believe that if done right crypto can actually be the savior for the U.S. dollar,” Emmer said.

Other Republicans, such as Sen. Rand Paul (R-KY), have questioned whether cryptocurrencies could serve as a safe haven, even the world’s reserve currency, as people continue to lose more faith in government-controlled money.

Emmer’s contention could serve as a relief for many Americans that continue to suffer from decades-high inflation under Biden.

The Consumer Price Index (CPI) rose to 9.1 percent in June, the highest rate of inflation since 1981. This even surpassed economists’ expected CPI rate of 8.8 percent. To make matters worse, inflation has surpassed rising wage gains. Now, Bank of America has forecast a “mild recession.”

In the wake of the coronavirus pandemic and subsequent lockdowns, the Federal Reserve slashed interest rates to near zero and printed trillions of dollars, pumping them into the financial markets to avoid what they perceived would be an economic meltdown. Although this “supercharged” Wall Street businesses, public stock offerings, and corporate bond sales in the short term, it created the long-term conditions for rampant inflation.

As inflation began to heat up in 2021, Federal Reserve chairman Jerome Powell claimed that inflation would be “transitory,” a phrase often used at that time by the Biden administration.

As the Fed failed to curb inflation, it has moved to hike interest rates to fight back against decades-high inflation.

By subscribing, you agree to our terms of use & privacy policy. You will receive email marketing messages from Breitbart News Network to the email you provide. You may unsubscribe at any time.

To aid cryptocurrencies’ mission to serve as a counterbalance to mismanaged monetary policy, Emmer said the federal government could provide a more clear regulatory environment and ensure that Securities and Exchange Commission (SEC) chairman Gary Gensler does not have “rogue authority” to regulate the burgeoning crypto industry.

Emmer said, “In order for us to start to move forward on this you have to at least start to define what is cash? What is a commodity, what is a security? It makes, frankly, securities lawyers rich. They like to go when we got the Howey Test. The Howey Test was created during a time when digital currencies weren’t even a thing. I think it’s time to define those terms.”

The Howey Test refers to the U.S. Supreme Court case for determining whether a transaction amounts to an “investment contract” and would be a security and thus subject to disclosure and registration requirements under the SEC.

The Howey Test is an important issue in the digital currency community, as many digital currencies and blockchain technologies such as Ethereum may qualify as a security, and thus fall under Gensler’s regulatory purview.

The Minnesota Republican sponsored the Securities Clarity Act to help innovation flourish by clarifying that a digital currency token is separate and distinct from a traditional security.

Emmer continued, “I don’t believe in creating another regulatory or regulator and other regulatory agency. I think we can do it within the ones we already have. But we have to start defining them so we know that Gary Gensler does not have rogue authority over every aspect of the crypto community. I think that would be first and foremost from a general statement, what we’d need to do.”

Emmer, a member of the Congressional Blockchain Caucus, sponsored many bills to provide a more clear regulatory approach and to prevent stifling innovation in the financial technology sphere. This includes:

- H.R. 6415, which would prohibit Federal Reserve banks from offering central bank digital currencies (CBDCs), which many argue would grant nearly totalitarian levels of control over Americans’ money

- The Blockchain Regulatory Certainty Act, which would provide regulatory clarity to blockchain innovators.

Emmer also said that Republicans, if they take the House majority during the congressional midterms, would hold members of the Biden administration accountable, such as Gensler, Consumer Financial Protection Bureau (CFPB) Director Rohit Chopra, and Treasury Secretary Janet Yellen.

“These people think they’re above the law, above Congress’s supervision, and they’re not,” Emmer said. He said the Biden administration remains hostile to crypto despite the potential it has for the country and the world.

By subscribing, you agree to our terms of use & privacy policy. You will receive email marketing messages from Breitbart News Network to the email you provide. You may unsubscribe at any time.

Emmer said, “This administration is not just the guy at the top, but the administration is littered with people who I would argue are not favorable towards the crypto space in frankly, the promise that it holds in terms of opportunity for all Americans and people around the world.”

Sean Moran is a congressional reporter for Breitbart News. Follow him on Twitter @SeanMoran3.

COMMENTS

Please let us know if you're having issues with commenting.