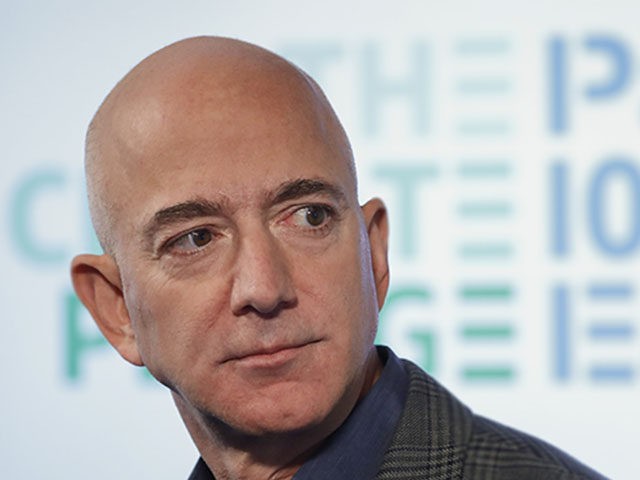

Jeff Bezos, one of the richest men in the world, is looking to expand his portfolio to include real estate, specifically contributing to a platform for investing in single-family home rentals.

According to a report, the Amazon founder and owner of the left-wing Washington Post has made a second investment in Arrived Homes.

Arrived Homes is described as “the first SEC-qualified real estate investing platform that allows virtually anyone to buy shares in single-family rental properties with a minimum investment of only $100.”

Benzinga reported:

The company acquires rental homes and allows individual investors to become owners in the properties by purchasing shares through the platform. Arrived Homes manages the assets, while investors collect passive income through quarterly dividends in addition to earning a return through appreciation.

Arrived Homes, however, utilizes the more stringent Regulation A in order to provide access to non-accredited investors. This requires qualification by the Securities and Exchange Commission (SEC), which is a much more costly and time-consuming process than offering securities through Regulation D.

Another option for non-accredited investors that’s gaining traction in the real estate industry is Regulation CF, which allows companies to raise up to $5 million annually from non-accredited investors. Regulation CF is widely used by startups to raise capital through funding portals like Wefunder, StartEngine and Republic.

The article also cited a FINRA regulated Regulation CF funding portal, Invown, which offers a marketplace for non-accredited individuals in several types of properties.

The reason for a growing interest in the single family home rental market is statistics like this one: the average rent in the U.S. has increased nearly 15 percent in the past 12 months and as high as 38 percent in U.S. cities such as Miami over the same period.

Bezos joins the some trend happening on Wall Street, which is also eyeing the single-family rental market. Analysts say the convergence of rising home prices, changing rental preferences, and advancing technology is driving the phenomenon.

Follow Penny Starr on Twitter

COMMENTS

Please let us know if you're having issues with commenting.