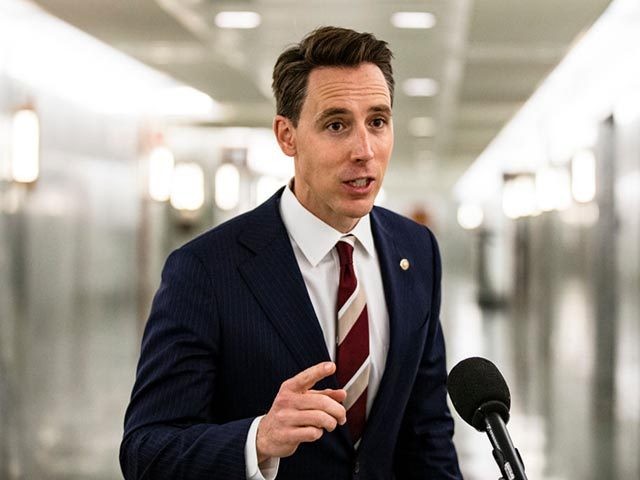

Sen. Josh Hawley (R-MO) introduced legislation Monday that would create a tax credit aimed at helping working-class Americans overcome financial and economic barriers to start a family.

Hawley introduced legislation that would establish a Parent Tax Credit, a fully refundable tax credit provided through monthly advances. Hawley’s bill would create a $6,000 credit for single parents and $12,000 for married parents.

Current federal childcare programs and policies mandate both parents have a job and require their children to enroll in commercial childcare. Hawley’s office wrote in the press release that the Child and Dependent Tax Credit “frequently reserves the greatest benefits for upper-income earners.”

“Current law does little or nothing for the millions of working families who would prefer to care for their children at home,” Hawley’s office wrote.

Hawley said in a statement Monday that his legislation would give Americans the flexibility to start families:

Starting a family and raising children should not be a privilege only reserved for the wealthy. Millions of working people want to start a family and would like to care for their children at home, but current policies do not respect these preferences. American families should be supported, no matter how they choose to care for their kids.

Families that have children under the age of 13 would be eligible for the tax credit.

Until President Donald Trump ran for office, many Republicans typically shied away from proposing policies that would boost American families. During Trump’s administration, Trump called on Congress to enact bipartisan paid family leave.

Now, Hawley is moving to enact his pro-family policies with his latest bill.

“We need a plan to help working parents that is pro-family and pro-work. I’ll be proposing legislation this coming week that gives a major tax cut to working parents to help them afford to start a family and raise their kids,” Hawley wrote Saturday.

Sean Moran is a congressional reporter for Breitbart News. Follow him on Twitter @SeanMoran3.

COMMENTS

Please let us know if you're having issues with commenting.