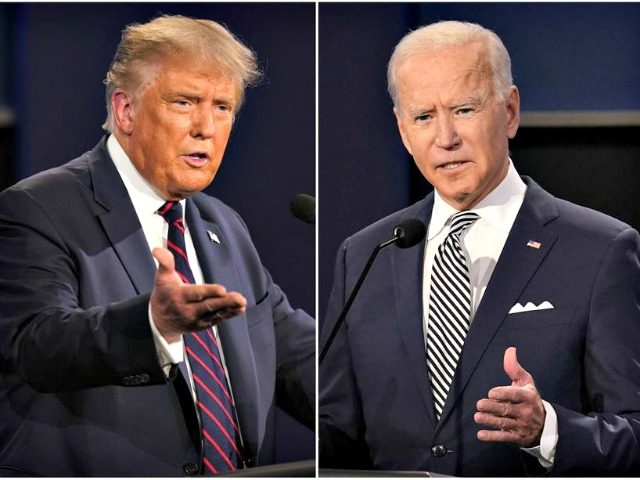

President Joe Biden’s Labor Department announced Wednesday that it would not enforce a Trump-era rule that barred 401(k) plans from using political considerations when investing employee funds.

The agency said it would hold off on enforcing the rule while it undertakes a review.

The rule would have barred employer-provided 401(k) managers from investing employee money in funds pursuing nonfinancial goals as default investments. It also said fund managers who place employee money in funds built around environmental, social, and corporate governance goals—known as ESG funds—would have to show the returns of those funds would be just as strong as funds focused solely on financial returns.

ESG funds typically pursue goals supported by the American left and the Democratic party.

Last year, ESG funds more than doubled their assets under management in a single calendar year.

“They captured $51.1 billion of net new money from investors in 2020 — the fifth consecutive annual record,” said the report from CNBC. “In 2019, investors funneled roughly $21 billion into funds that apply environmental, social, and governance principles.”

By subscribing, you agree to our terms of use & privacy policy. You will receive email marketing messages from Breitbart News Network to the email you provide. You may unsubscribe at any time.

The Labor Department stated that the stakeholders they spoke to feel the rulemaking was unnecessarily rushed and the evidence that was submitted to support the ruling was not substantial enough.

The press release from the Labor Department said:

Stakeholders have also questioned whether those rulemakings were rushed unnecessarily and failed to adequately consider and address the substantial evidence submitted by public commenters on the use of environmental, social, and governance (ESG) considerations in improving investment value and long- term investment returns for retirement investors. The Department has also heard from stakeholders that the rules, and investor confusion about the rules, have already had a chilling effect on appropriate integration of ESG factors in investment decisions, including in circumstances that the rules can be read to explicitly allow. Accordingly, the Department intends to revisit the rules.

Until it publishes further guidance, the Department will not enforce either final rule or otherwise pursue enforcement actions against any plan fiduciary based on a failure to comply with those final rules with respect to an investment, including a Qualified Default Investment Alternative, or investment course of action or with respect to an exercise of shareholder rights.

Ali Khawar, principal deputy assistant secretary at the Employee Benefits Security Administration, told the Wall Street Journal that the agency intends to do more outreach to stakeholders for determining a better way to create better rules.

The agency staffers “recognize the important role that environmental, social and governance integration can play in the evaluation and management of plan investments while continuing to uphold fundamental fiduciary obligation,” Khawar said.

The rule is not expected to survive the review.

COMMENTS

Please let us know if you're having issues with commenting.