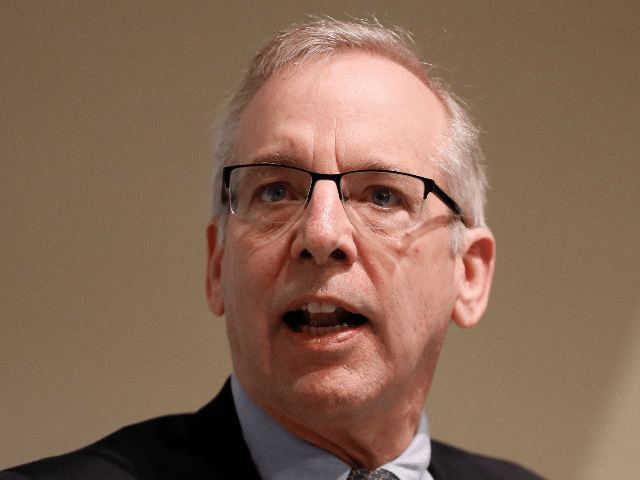

Former New York Federal Reserve President Bill Dudley urged his former colleagues on Tuesday not to help President Donald Trump in his trade war against China. He even urged the central bank to consider how its monetary policy might impact the 2020 presidential election.

Dudley urged Federal Reserve officials not to lower interest rates as a backstop while the president continues his battle against China. Trump has recently increased tariffs on Chinese goods and has called on the nation’s central bank to sharply lower interest rates to help fight the trade war against China.

“Central bank officials face a choice: enable the Trump administration to continue down a disastrous path of trade war escalation, or send a clear signal that if the administration does so, the president, not the Fed, will bear the risks — including the risk of losing the next election,” Dudley wrote in a post for Bloomberg.

The former New York Federal Reserve bank president said that the Fed could and should try to influence the election against the sitting president. Mainstream economists often assert that the Federal Reserve has to stay independent from political influence.

Dudley said:

After all, Trump’s reelection arguably presents a threat to the U.S. and global economy, to the Fed’s independence and its ability to achieve its employment and inflation objectives. If the goal of monetary policy is to achieve the best long-term economic outcome, then Fed officials should consider how their decisions will affect the political outcome in 2020.

Dudley suggested that the Federal Reserve should not accommodate Trump’s “bad choices” on trade policy.

“Officials could state explicitly that the central bank won’t bail out an administration that keeps making bad choices on trade policy, making it abundantly clear that Trump will own the consequences of his actions,” Dudley said.

COMMENTS

Please let us know if you're having issues with commenting.