Wages accelerated for the fourth month in a row during July, according to a survey by Paychex, a firm which provides payroll management services for 350,000 clients.

The biggest gainers were manufacturing employees, whose wages were up 4.22 percent from a year ago, according to Paychex.

“Hourly earnings growth reached its strongest rate in more than a year at 2.70 percent in July, and weekly earnings growth improved to 2.57 percent,” the survey reported. “One-month annualized weekly earnings growth hit a new peak (4.11 percent) in July,” the report said.

The wage gains show the go-go economy has created a “tight labor market,” according to Paychex’s CEO. “Finding good candidates continues to present hiring challenges for small employers [and] the data shows that employees are seeing steady increases in hourly earnings,” said CEO Martin Mucci.

But the claim of a tight labor market seems incomplete, at best.

There are still almost no media reports of companies trying to hire each others’ employees. Corporate raids on rivals’ workforces would be a strong signal of a tight labor market because they would show that companies have finally begun competing for workers, usually with offers of higher wages.

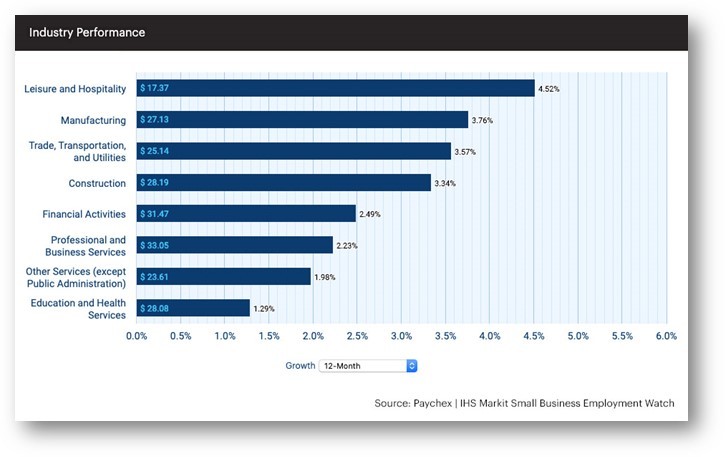

Also, the company’s data showed that blue-collar wages rose faster than white-collar salaries. For example, employers in “trade, transportation and utilities’ gained 3.57 percent in wages, while salaries for “professional and business services” gained 2.2 percent.

This blue-beats-white trend has been underway for some time, and it likely reflects the growing damage done to U.S. graduates by white-collar immigration, foreign contract-workers, and outsourcing.

Also, the Paychex reports of higher wages include government-directed wage increases. For example, Chicago’s minimum wage jumped to $13 in July, helping push the city to the top of Paychex’s charts.

The wage data is also complicated by changes in the number of hours worked per week. For example, Paychex reports that:

At 4.52 percent, Leisure and Hospitality has the strongest hourly earnings growth among industry sectors, though a significant decrease in weekly hours worked brings its weekly earnings growth down nearly a full percent (3.57 percent). Though Manufacturing has the weakest jobs [gain] index among industry sectors, it has the best weekly earnings growth (4.22 percent), pairing a strong hourly earnings rate with positive weekly hours worked year-over-year.

President Donald Trump’s low-immigration policy of “Buy American, Hire American” has likely helped raise blue-collar and white-collar salaries.

That policy will likely pay dividends in November 2020 largely because voters do not want companies importing foreign workers for jobs that can be filled by sidelined Americans, including disabled Americans, people with drug problems, and ex-convicts.

Wages are likely to nudge up somewhat faster as Trump gradually reduces the migration of Central Americans into blue-collar jobs, despite the D.C. establishment’s effort to protect the inflow of foreign workers and renters via illegal migration.

Immigration Numbers

Each year, roughly four million young Americans join the workforce after graduating from high school or university. This total includes roughly 800,000 Americans who graduate with skilled degrees in business or healthcare, engineering or science, software or statistics.

But the federal government then imports about 1.1 million legal immigrants and refreshes a resident population of roughly 1.5 million white-collar visa workers — including approximately 1 million H-1B workers and spouses —plus roughly 500,000 blue-collar visa workers.

The government also prints out more than one million work permits for foreigners, tolerates about eight million illegal workers, and does not punish companies for employing the hundreds of thousands of illegal migrants who sneak across the border or overstay their legal visas each year.

This policy of inflating the labor supply boosts economic growth for investors because it transfers wages to investors and ensures that employers do not have to compete for American workers by offering higher wages and better working conditions.

This policy of flooding the market with cheap, foreign, white-collar graduates and blue-collar labor also shifts enormous wealth from young employees towards older investors, even as it also widens wealth gaps, reduces high-tech investment, increases state and local tax burdens, and hurts children’s schools and college educations.

The cheap-labor economic strategy also pushes Americans away from high-tech careers and sidelines millions of marginalized Americans, including many who are now struggling with fentanyl addictions.

The labor policy also moves business investment and wealth from the heartland to the coastal cities, explodes rents and housing costs, shrivels real estate values in the Midwest, and rewards investors for creating low-tech, labor-intensive workplaces.

“If there is a growing flood of foreign labor, the American middle class is no longer going to exist, and Republicans will not have a constituency,” said Hilarie Gamm, a co-cofounder of the American Workers Coalition.

COMMENTS

Please let us know if you're having issues with commenting.