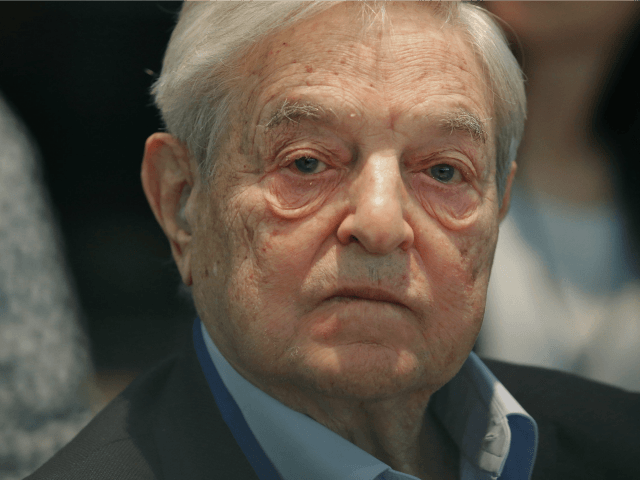

A group of 20 wealthy individuals – including left-wing financier George Soros – signed a letter Monday, begging for a wealth tax and arguing that the U.S has a “moral, ethical, and economic responsibility” to tax wealthy individuals more.

Although the letter is framed as a nonpartisan plea, it is linked to Soros and speaks highly of proposals put forth by Democrat candidates like Sen. Elizabeth Warren (D-MA).

The signers call for “a moderate wealth tax on the fortunes of the richest one-tenth of the richest 1 percent of Americans — on us.”

The signers argue that the “moderate wealth tax” could help solve a plethora of issues. It could, they say, “address the climate crisis, improve the economy, improve health outcomes, fairly create opportunity, and strengthen our democratic freedoms.”

In addition to better rules on carbon pollution, more American investment is needed now to tackle climate change. This could both accelerate innovation and speed implementation of solutions that create a clean energy economy and a low-carbon future. A wealth tax asks those of us who have benefitted most from our economic system to help fix one of its most devastating and fatal flaws.

The letter also characterizes the proposed tax as “patriotic.”

In our republic, it is the patriotic duty of all Americans to contribute what they can to the success of the country, and the wealthiest are no exception. Others have put far more on the line for America. Those of us in the richest 1/10 of the richest 1% should be proudto payabit more of our fortune forward to America’s future. We’ll be fine—taking onthis tax is the least we can do to strengthen the country we love.

The letter is signed by Soros, as well as Facebook co-founder Chris Hughes and others including: Louise J. Bowditch, Robert S. Bowditch, Abigail Disney, Sean Eldridge, Stephen R. English, Agnes Gund, Catherine Gund, Nick Hanauer, Arnold Hiatt, Molly Munger, Regan Pritzker, Justin Rosenstein, Stephen M.Silberstein, Ian T. Simmons, Liesel Pritzker Simmons, and Alexander Soros.

“We thought it would be a good idea,” Blue Haven Initiative co-founder Ian Simmons said, according to the New York Times. “Liesel and I decided to reach out to some other folks to see if they thought it was a good idea, too.”

While signers claim the letter “does not represent an endorsement of any presidential candidate,” it specifically references Sen. Elizabeth Warren (D-MA), Pete Buttigieg (D), and Beto O’Rourke, seemingly pushing for and endorsing their various versions of a wealth tax.

The letter states:

Several candidates for President, including Senator Elizabeth Warren, MayorPete Buttigieg, and Representative Beto O’Rourke, are already supportive of the idea. The first specific candidate proposal, introduced by Senator Warren, would provide millions of families with a better shot at the American dream by taxing only 75,000 of the wealthiest families in the country.” The proposal is straightforward: It puts in place a tax of 2 cents on the dollar on assets after a $50 million exemption and an additional tax of 1 cent on the dollar on assets over $1 billion. If you have $49.9 million or less you are not paying the tax. It is estimated to generate nearly $3 trillion in tax revenue over ten years.”

There is currently no law barring wealthy individuals from voluntarily paying more in taxes.

COMMENTS

Please let us know if you're having issues with commenting.