The House passed the Family Savings Act of 2018 Wednesday which would expand 529 education savings account plans to include unborn children for the first time in the U.S. tax code.

The bill, H.R. 6757, allows parents, grandparents, or other relatives to start a 529 plan for an unborn child to begin saving for the child’s education.

According to the bill:

(6) TREATMENT OF UNBORN CHILDREN.—

“(A) IN GENERAL.—Nothing shall prevent an unborn child from being treated as a designated beneficiary or an individual under this section.

“(B) UNBORN CHILD.—For purposes of this paragraph—

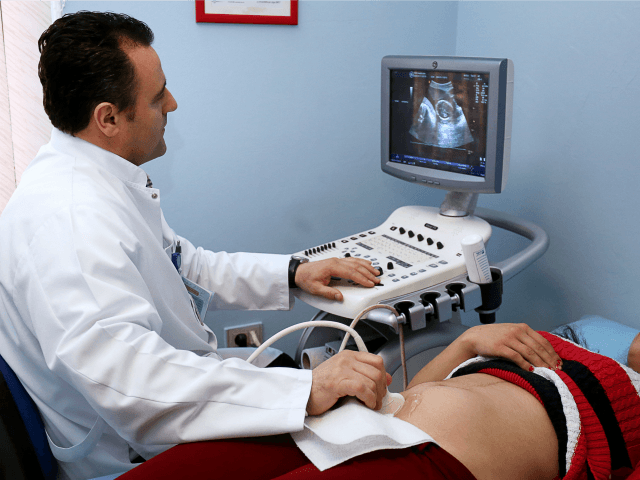

“(i) IN GENERAL.—The term ‘unborn child’ means a child in utero.

“(ii) CHILD IN UTERO.—The term ‘child in utero’ means a member of the species homo sapiens, at any stage of development, who is carried in the womb.”.

The bill, introduced by Rep. Mike Kelly (R-PA), also allows new parents to withdraw funds from their retirement plans during the first year of a newborn child’s life or within one year of the child’s legal adoption. Homeschooling costs can also be included in 529 education savings plans, which currently cover private and religious schools.

The measure now heads to the Senate.

Family Research Council (FRC) applauded passage of the bill in the House and lawmakers who are recognizing – for the first time in the tax code – unborn children.

“Our vision is to see families flourish and that includes pregnant mothers and their unborn children,” said FRC president Tony Perkins in a statement. “This bill recognizes that families are at the heart of our economy. When families thrive, everyone benefits. We urge the U.S. Senate to pass the Family Savings Act so that President Trump can sign it into law.”

In November 2017, a similar plan to recognize an “unborn child” in the tax code was condemned by abortion rights activists.

COMMENTS

Please let us know if you're having issues with commenting.