Kushner Cos. — the New York City-based real estate development and lending company controlled by the Kushner family — is nearing an agreement to off-load 666 Fifth Avenue, the 41-story office building it significantly overpaid for over a decade ago, according to the Wall Street Journal.

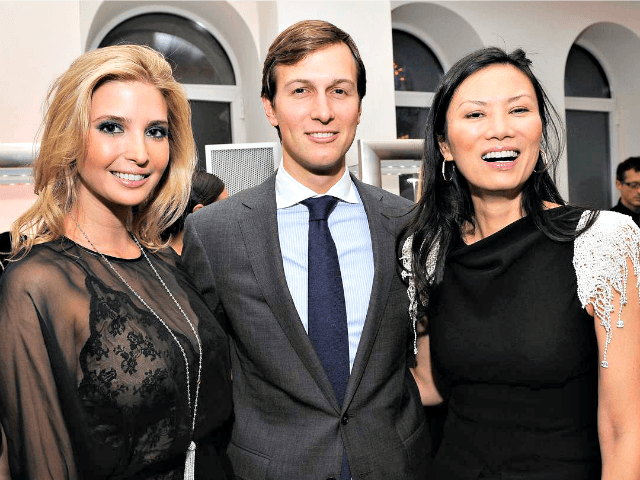

The Kushner family has entered into an agreement with Brookfield Asset Management, one of the largest alternative asset managers in the world, to lease the tower for 99 years, reported the Wall Street Journal’s Peter Grant. The perilous financial situation surrounding 666 Fifth Avenue — acquired by the Kushner Cos. for a whopping $1.8 billion in 2007 — has attracted unwanted media attention for Jared Kushner, both a senior advisor to President Trump and husband to his daughter Ivanka Trump. At the time, the purchase price was the highest ever for an office tower.

“With its ‘Main and Main’ location, direct transportation access and currently unrefined physical characteristics, 666 Fifth Avenue has the potential to be one of New York City’s most iconic and successful office properties,” said Brookfield Property Group executive Ric Clark in a statement. “Given Brookfield’s experience in successfully redeveloping and repositioning major office assets in New York and other cities around the world, we are well placed to capitalize on that opportunity.” Brookfield Properties says it will manage 666 Fifth Avenue and invest in a “major redevelopment program to upgrade it.”

Terms of the agreement were not made public.

A Kushner Co. spokesperson has yet to release a statement on the deal.

The Wall Street Journal writes:

Talks between Brookfield and Kushner Cos., the family company, about Brookfield possibly purchasing a stake in 666 Fifth were reported earlier this year. Terms of the deal weren’t disclosed. People who have been involved in the talks have said that the proceeds would give the family enough to pay off the more than $1.1 billion of debt on the building and buy out its partner, Vornado Realty Trust, for $120 million so it can transfer 666 Fifth to Brookfield unencumbered.

…

In 2017, soon after Mr. Trump took office, Mr. Kushner’s father, Charles Kushner, was negotiating with Anbang Insurance Group, a Chinese insurer with connections to Beijing government. The elder Mr. Kushner’s plan at the time was to use Anbang’s capital in a $7.5 billion plan to convert 666 Fifth Ave. into a 1,400-foot-tall mixed use skyscraper with retail, hotel and condominiums. The Anbang talks soon collapsed.

COMMENTS

Please let us know if you're having issues with commenting.