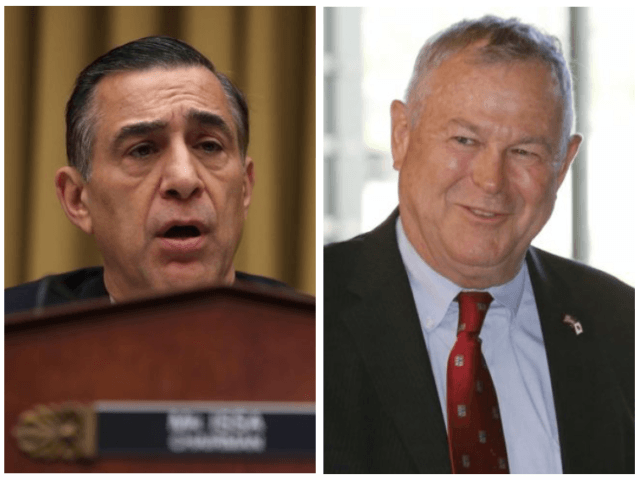

Two California Republicans, Darrell Issa (R-CA) and Dana Rohrabacher (R-CA), voted against the tax reform bill on Tuesday.

They were the only Republican members of California’s congressional delegation to do so. Every one of California’s Democrats did so, and Sens. Dianne Feinstein (D-CA) and Kamila Harris (D-CA) are also expected to vote against the bill.

Ten other Republicans also voted against the tax reform bill, most from other high-tax states, notably New York and New Jersey.

Both Issa and Rohrabacher are considered vulnerable in the 2018 midterm elections, after Hillary Clinton won their districts in 2016. Both are among seven Republicans in the Golden State who are being targeted by Democrats.

Issa was barely re-elected in 2018, and faces four Democratic challengers next year; Rohrabacher already faces seven Democratic challengers (plus two Republicans, one Libertarian, and an Independent) in next year’s primary. Notably, five of those Republicans still voted for the tax reform bill.

Rohrabacher has stated publicly that he opposes the tax reform bill because he is concerned that the partial repeal of the state and local tax (SALT) deduction, and the cap on mortgage interest deductions, could see taxes raised on some of the residents of his district despite the lowering of income tax and corporate tax rates.

Issa opposes the bill for the same reason, but also publicly blamed Governor Jerry Brown and California Democrats for the dilemma facing California taxpayers.

One Republican who switched from “no” to “yes” was conservative Rep. Tom McClintock (R-CA), who voted against the original House version of the bill but supported the compromise bill drafted with the Senate because of revisions that addressed his concerns.

In a speech on the House floor, he said, in part:

The new version leaves the casualty loss, medical expense and student interest deductions intact. No family needs to fear being ruined by taxes after a major declared disaster or illness, and graduates can continue to plan their lives knowing interest on their student loans will not be taxed. The new bill eases the proposed limit on mortgage interest deductions and allows up to $10,000 of state and local taxes to be deducted – all important improvements for Californians.

Most importantly, the lower tax rates in this bill now more than compensate in almost every case for the remaining limits on state and local tax and mortgage interest deductions. Even taxpayers who lose tens of thousands of dollars of deductions will still pay lower taxes than they do today.

The House will have to vote again on the bill, after two minor provisions in the legislation ran afoul of Senate parliamentary rules for reconciliation (which allows votes pertaining to budget issues to pass on a simple majority rather than a 60-vote supermajority). Rohrabacher and Issa are expected to repeat their “no” votes.

Joel B. Pollak is Senior Editor-at-Large at Breitbart News. He was named one of the “most influential” people in news media in 2016. He is the co-author of How Trump Won: The Inside Story of a Revolution, is available from Regnery. Follow him on Twitter at @joelpollak.

COMMENTS

Please let us know if you're having issues with commenting.