A landmark article in the March 26 edition of The Economist, headlined, “The problem with profits,” gets one to thinking about the fundamentals of our economy.

By way of introduction, we should note that for nearly two centuries, The Economist has been a stalwart champion of free markets and free trade. And yet, as the article makes clear, today the political viability of both is under siege, threatened by the economically, and politically, toxic accumulation of oversized profits — and undersized wages. As the piece puts it:

America used to be the land of opportunity and optimism. Now opportunity is seen as the preserve of the elite: two-thirds of Americans believe the economy is rigged in favour of vested interests.

So how did this happen? And what can be done about it? We’ll come back to The Economist, and hopefully some answers to those questions, in a moment.

But first, let’s add another piece to the puzzle: The apparent success of Donald Trump in his quest to win the 2016 Republican nomination — he is now the strong favorite. With his swaggering persona and iconoclastic rejection of conservative economic orthodoxy, some might think that electing Trump as president would be, by itself, sufficient to bring about big change and renewed growth. In his foreign policy speech on April 27, he mentioned the economy no fewer than 10 times; he is making it very clear that a strong America in the world depends upon a strong American economy at home.

As Trump has always said, the goal is simple: “Make America Great Again.” And if that means out-of-the-box thinking, well, the author of The Art of the Deal has always been about new and creative approaches. Meanwhile, the explosion of grassroots energy surrounding the Trump campaign can be seen as a validation of his nationalistic message.

Yet the news, on April 28, that the economy is growing perilously slowly — just .5 percent in the first quarter — has a double-edged effect: On the one hand, worsening economic stagnation under the Obama administration makes voters more likely to seek real change at the ballot box in 2016.

Yet on the other hand, it’s obvious that the middle class is in a deeper hole than many had realized; so even if we can start the turnaround with a pro-growth president in 2017 — no sure bet, as of this writing — it will take a long time before the economy fully recovers its capacity to improve the lives of ordinary Americans.

Thus we are left with the sobering realization that the struggle for a new economic order will not be won by a single candidate in a single election year. And that only makes sense: If it took many years, and many forces, to get us into this hole, it will take a long time to get us out of it.

So let’s look at some of the negative factors.

1. The Problem: The Middle Class Has Lost the Class War

For the last 40 years, there’s been a class war — and the middle class has lost.

We can outline this class war in a single paragraph, from social scientists Ruy Teixeira and Alan Abramowitz, writing for the Brookings Institution:

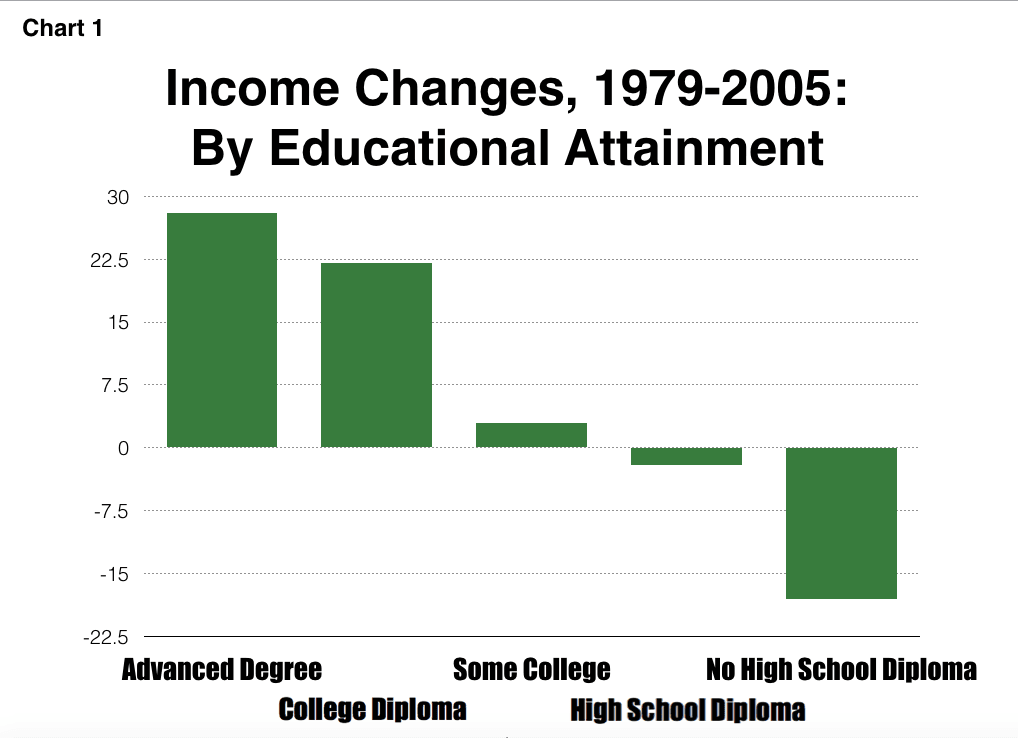

Between 1979 and 2005, the average real hourly wage for those with a college degree went up 22 percent and for those with advanced degrees, 28 percent. In contrast, average wages for those with only some college went up a mere 3 percent, actually fell 2 percent for those with a high school diploma, and for high school dropouts, declined a stunning 18 percent.

The meaning is clear: In this globalized economy, the economic reward goes to the well-educated, and the economic punishment goes to the less-educated.

We might add that these differentials aren’t the result of some inexorable law of economics. Instead, they were the deliberate consequence of government-negotiated trade deals and other government economic policies, which have elevated certain American sectors, such as finance and tech, while degrading others, such as manufacturing.

So we’ve read the numbers. Now, to reinforce the impression, we can see the same data in a chart:

We might note that a little less than a third of American adults have a college degree, and a little more than a tenth have an advanced degree.

So to sum it up, we can observe that the roughly six in ten American workers with less educational attainment have, in recent decades, been coming out behind. That’s a lot of loss. So it’s easy, therefore, to see where the angry populist energy of the Trump and Sanders campaigns is coming from.

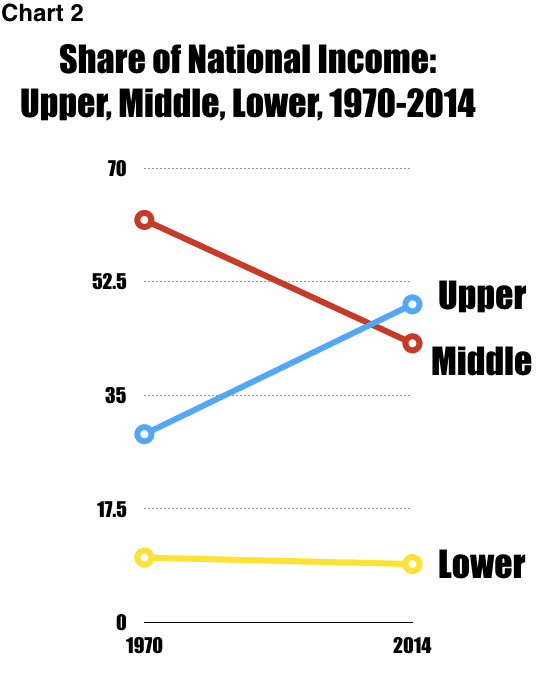

We might further note that the above data isn’t some statistical fluke. Other findings, too, attest to the hollowing out of the middle class. Last year, the Pew Center found that in 1970, the middle class received 62 percent of the national income; yet in 2014, that percentage had fallen to 43 percent. Meanwhile, the upper class’s share of national income, during those same four decades, rose from 29 percent to 49 percent. And as for the poor, their percentage barely budged, from 10 to 9.

We can sum up these data in another chart:

Thus again, we see the impact of the financialist globalization that has dominated the economy this past half-century. As a result, American investors and knowledge-workers have flourished mightily, while American laborers and wage-earners have suffered mightily. Meanwhile, below the middle class, the economic standing of the lower class — mostly the beneficiaries of entitlement programs and the welfare system — has stayed about the same. Why? Because while the floor underneath the middle class has been demolished by globalization, the floor under the poor has been maintained by government

So we might ask: How did all this happen? Why has wealth shifted the way it has?

2. The Cycle of Reckless Capital: Concentration, Accumulation, Stagnation

We are all familiar with the general outlines of globalization: During the Cold War, America turned a blind eye to the impact of imports from countries such as Japan and West Germany; the thinking in Washington DC was that it was more important to keep those exporting countries snugly within the Western alliance than to protect American manufacturing.

Yet curiously, this lenient Cold War-era trade strategy persisted even after the end of the Cold War.

Indeed, in the 1990s, free trade took on a life of its own; it was no longer seen as a means to an end — the end being to firm up our alliances — but rather, as an end in itself. And so we extended free trade to enemies, or at least potential enemies, such as China.

Yes, pure free trade, at all times and for all countries, became the shared ideology of both Republican and Democratic elites. And so the U.S. “negotiated”trade deals with Mexico, Africa, Central America, China, and, in the form of the World Trade Organization, the entire planet — although, in fact, there wasn’t much actual negotiation; it was mostly gleeful concession, as the Americans surrendered to their newfound ideology of utopian globalism.

As they say, ideas have consequences: The American middle class has been gutted. We can observe that workers’ wages are always in part a function of the prevailing wages in the market-area; it’s a matter of competition. Only nowadays, the market-area is the whole wide world. That is, American workers must be mindful of the wage-rates in competitive countries, and if they aren’t mindful, their employers — most recently, Ford, which is investing more than $4 billion in new plants in Mexico — are there to remind them. Incidentally, Trump has labeled the outsourcing as an “absolute disgrace,” even as most other American political figures are silent. In other words, every American worker is standing atop a trapdoor of globalism.

This economically bent reality was the backdrop for that. As noted, the magazine has long been libertarian in its outlook, and so if it sees trouble with the free market, well, it’s likely that there is indeed trouble. As the piece explained, in recent decades, profits and power have been piling up for the upper echelon of corporate America, thereby enervating the rest of the economy:

Our analysis of census data suggests that two-thirds of the economy’s 900-odd industries have become more concentrated since 1997. A tenth of the economy is at the mercy of a handful of firms — from dog food and batteries to airlines, telecoms and credit cards. A $10 trillion wave of mergers since 2008 has raised levels of concentration further. American firms involved in such deals have promised to cut costs by $150 billion or more, which would add a tenth to overall profits. Few plan to pass the gains on to consumers.

We might pause to marvel, again, at the dimensions of this admission of policy failure; for years, The Economist and other champions of free trade have told us that globalization policies would expand prosperity, not contract it. Of course, The Economist, still being the doctrinaire free-market publication that is, has no real solutions — the article is just 1000 words of despair.

Indeed, we have discovered something else, too — something not very nice: Beyond the declining wages of workers, free trade even isn’t good for the overall economy. And why is that? It’s because the globalization of capital brings with it bubbles, and bubbles are always followed by panics — and crashes. And each bubble, panic, and crash leaves the economy weaker than it was before.

And so it is the case that the U.S. economy has never really recovered from the 2008 meltdown. As the Heritage Foundation’s Steve Moore has observed, this is the weakest economic recovery since World War Two. And the jarring key word in a recent CNBC headline lays it out: “Stagflation.” That is, stagnant growth plus rising prices — inflation.

It’s easy to see why this is happening: The Obama administration has unleashed an unprecedented regulatory onslaught, and that red-tape tide has hurt the ability of companies to compete. So real incomes for workers, as well as job growth, are further flattened.

Yet at the same time, because of the Federal Reserve’s “Quantitative Easing” program, which has pumped paper trillions into the economy, it’s to be expected that we would see inflationary pressures. As Breitbart’s Chriss W. Street observes, the two-thirds decline in oil prices, thanks to the miracle of fracking in recent years, has masked our underlying economic weakness. (Needless to say, the Obama Greens are doing their utmost to squelch the surge in energy production, in the name of combating “climate change.”)

Next, to our list of stagflationary factors, we can add the rise of financial transactionalism. How’s that? Financial transactions, day-trading by individuals or by companies, is inherently zero-sum. The idea of making money in the price-marketplace — of buying low and selling high — is as old as human nature, and for most of human history, civilizations have nevertheless remained poor. So we can see: It takes something extra, something new beyond mere haggling, to generate productivity gains. Yes, all the blather about the added-value of “financial innovation” is just that — blather.

By contrast, technological development isn’t transactional, it’s transformational. If an inventor builds a better mousetrap that catches more mice, that’s transformation. Yes, only imagining and tinkering, followed by sustained new production, can generate quantum wealth transformations.

Indeed, the key innovations of industry are relatively recent, coming with the Industrial Revolution. Samuel Arkwright developed reliable factory machinery for spinning cotton only in the mid-18th century; James Watt developed a reliable steam engine a few years later. In the 19th century, Friedrich Bayer was among several Germans who pioneered the synthesis of aniline dye derived from coal; these dyes, in turn, were the precursors to plastic. In the early 20th century, Henry Ford perfected the assembly line. And in the 21st century, new geniuses have figured out ways to squeeze more oil and natural gas out of “dead” fields.

Technology, based on brains and hard work, is still the closest thing to a free lunch that we’ll ever see.

Yet the recent triumph of fracking notwithstanding, technological exuberance, according to many measures, has been declining in recent decades; the best efforts of a relatively few high-profile Silicon Valley “app” developers can’t change that baleful nationwide reality.

Other factors, too, have worked to undercut wage growth in the U.S.: Breitbart readers are well versed, of course, in the deleterious impact of immigration.

Yet we should never underestimate the imaginative determination of globalization advocates. Thanks to whatever combination of subsidy and ideology that might float their own personal noodle, open-borders advocates are nothing if not relentless.

For example, speaking for the corporate-courtier-propagandist wing of the Republican Party, the Cato Institute’s Scott Lincicome wrote recently in National Review that the problem America faces on trade is that the American labor force lacks “dynamism.” We might note that “dynamism” is lobbyist-speak for workers being willing to take pay cuts and suffer other job-indignities. Lincicome disdains American labor’s “distressing lack of dynamism” as “a problem exposed, though certainly not caused, by free trade.”

Translation: Free trade is a positive good, because it shows up the defects of the American work force.

With unintentional hilarity, Lincicome then turns to the “expertise” of the Wall Street firm of Goldman Sachs — a company that has expertly financed more corporate liquidations and relocations than any other — to provide more detail as to this “distressing lack of dynamism”:

The Goldman Sachs Labor Market Dynamism Tracker, which synthesizes various labor reports, shows that, after remaining positive through the 1980s and ’90s, U.S. labor dynamism — the natural, beneficial replacement of old jobs with new ones, owing in part to the willingness of workers to seek new jobs and their ability to obtain them — dove into negative territory in 2001 and has remained there ever since.

Warming to his slime-the-workers theme, Lincicome continues on, adding that the Goldman experts identified specific negative variables, notably, employment-protection laws, which, he laments, “suppress labor market flows, sometimes to a powerful extent.”

In other words, in the view of Cato and Goldman, there’s nothing wrong with the American workforce that repealing the last century of labor-market protections couldn’t solve. Got that? Any more questions?

Meanwhile, other “conservatives” are brimming with radical new tactics to put yet more downward pressure on wages.

Here, for instance, is Reihan Salam, executive editor of National Review, who has just written a guest-piece in Slate.com, praising Virtual Reality “holoportation,” as in hologram teleportation. Such holoportation, Salam enthuses, is, in effect, “virtual immigration,” and to his way of thinking, it’s the next big thing — at least for employers. As he explains, Virtual Reality will allow countries and companies to “enjoy all of the benefits associated with a low-wage immigrant workforce,” without the bother of physically bringing them to America. In other words, the ordinary working stiff could lose his job to a hologram.

Salam concedes that this Virtual Reality holoportation would depress U.S. wages:

Naturally, the advent of what we might call “virtual immigration” will put pressure on workers competing with these virtual immigrants, just as automation and the offshoring of manufacturing has put pressure on domestic manufacturing workers, and just as non-virtual immigration puts pressure on native and foreign-born U.S. workers.

Yes, just as Salam says, lots of different forces are conspiring to undercut U.S. wages. Moreover, he has a point when he argues that the technology “is advancing at breakneck speed,” and so we have to be ready for it.

It’s true: We can’t hide from technological change. Yet at the same, we can develop a realistic plan for accommodating both economic progress and the maintenance of the American middle class. As the great conservative Edmund Burke once said, the task of the statesman is to channel the tides of change through what are nevertheless the canals of custom.

Unfortunately, occasional bursts of rhetoric notwithstanding, the Obama administration, like the Bush and Clinton administrations before it, has had no interest in protecting the middle class.

Yes, it’s been a long time since the presidency of Theodore Roosevelt, who had a far different idea: He thought that all of America would do fine if the American middle did fine. Back in 1901, he told Congress:

No one matter is of such vital moment to our whole people as the welfare of the wage workers. If the farmer and the wage-worker are well off, it is absolutely certain that all others will be well off too… Every effort… should be [made] to secure the permanency of this condition… and its improvement wherever possible.

Continuing, TR added that Americans were all in this together:

The fundamental rule in our national life… is that, on the whole, and in the long run, we shall go up or down together… A period of good times means that all share more or less in them, and in a period of hard times, all feel the stress to a greater or less degree.

I guess there’s a reason — actually, a lot of them — that TR is on Mt. Rushmore. He understood that the Burkean tides of change were always going to be with us, and so America needed, always, to be evolving. As he declared, such forward-looking pragmatism is “the highest form of conservatism.”

Today, absent Roosevelt’s positively conserving influence, the country is moving substantially to the left — and that’s something TR never wanted to see happen.

3. The Leftward Lurch

The signs of the leftward lunge are everywhere:

We can start with the national activism over the minimum wage: New York and California have both enacted a $15 minimum, and many other states will follow.

Meanwhile, young people eagerly embrace socialism, and the socialist magazine, Jacobin — named after the most radical leaders of the French Revolution, the ones who guillotined so many heads — has emerged as the hottest new publication in the country today. Indeed, as Bloomberg View notes, the entire economics profession seems to be moving to the left.

And most recently, we see the epic leak of the Panama Papers, which reveal rampant tax-cheating worldwide. As British Labour Party leader Jeremy Corbyn jibes, “There’s one rule for the rich and one rule for everybody else.” Indeed, one needn’t be a socialist to agree with that statement.

Of course, the most spectacular evidence of the leftward lurch is in the U.S. presidential campaign. There’s Bernie Sanders, of course, declaring, every day, that “the system is rigged.” And then there’s Hillary Clinton. All her career, she and Bill have been system-riggers, but at least for the purposes of her campaign to fend off Sanders, she is posing as just another soldier, if not for socialism, then at least for social democracy.

However, when it comes to whipping up enthusiasm for left-wing, class-warfare politics, the Democrats have a problem: Namely, the trendy new thinking of left-wingers is a far cry from the redistributionism of the old days. Oh sure, Sanders might be a self-declared “socialist,” but he is also a champion of newer causes, such as gender-fluidity, #BlackLivesMatter, open borders, and, of course, Green Malthusianism.

Indeed, because of Green influence, it’s hard to find a Democrat who will make a full-throated case for economic growth, no matter how equally allocated, because growth inevitably kicks up more carbon dioxide, thus provoking the dreaded “climate change.” It seems that, given a choice between workers’ incomes and penguins, the Democrats will always choose penguins.

So by default, the cause of looking out for workers’ wellbeing has shifted to the Republicans — if, that is, Republicans are interested.

Some Republicans are most definitely interested in making a non-Green pitch to the blue collars, in hopes of making them into red-staters. One such GOPer is University of Maryland economist Peter Morici. For years, Morici has been urging the GOP to pick up the blue-collar mantle. And he has had some success, especially as he explains the job-killing impact of blind, rote, free trade. Here he is, writing at Breitbart:

U.S. imports exceed exports by some $500 billion a year, directly eliminating about 4 million American jobs. Factoring in negative impacts on research-and-development spending and lost spending by trade-displaced workers, U.S. GDP growth is sliced 1 to 2 percentage points a year and 7 million jobs are lost overall.

No surprise, 7 million men between the ages of 25 and 54 are neither employed nor looking for work — too discouraged by the twin effects of trade and illegal immigration on the wages they could earn.

Of course, the big “get” for Republican trade hawks has been Donald Trump. Indeed, his ideological heterodoxies on a number of economic issues — including taxes and spending as well — are all well known.

As an aside, we might ask: Where was the media when all this populist fire was heating up, fueled by economic trends that have been visible for decades? The answer, of course, is that most reporters were clueless. Howard Kurtz, a veteran of the Main Stream Media now writing for Fox News, was startlingly candid when he chronicled how the media missed it:

News organizations, for the most part, were either oblivious or uninterested in the growing disconnect between the political parties and working-class voters. That’s because they were suffering from the very same gap.

Yet the MSM is now starting to catch up and catch on. Nicholas Confessore, writing for the New York Times, has zeroed in on the chasm between the GOP hierarchs and the Trump insurgents. He describes

…a party elite that abandoned its most faithful voters, blue-collar white Americans, who faced economic pain and uncertainty over the past decade as the party’s donors, lawmakers and lobbyists prospered.

That’s a damning portrait, to be sure. And who’s to say he’s wrong? Continuing, Confessore adds further points about the yawning gap between the thinking of rank-and-filers and the thinking of their DC-based betters:

While wages declined and workers grew anxious about retirement, Republicans offered an economic program still centered on tax cuts for the affluent and the curtailing of popular entitlements like Medicare and Social Security. And where working-class voters saw immigrants filling their schools and competing against them for jobs, Republican leaders saw an emerging pool of voters to court.

And it was out of this social cleft, Confessore adds, the Trump rebellion emerged:

From mobile home parks in Florida and factory towns in Michigan, to Virginia’s coal country, where as many as one in five adults live on Social Security disability payments, disenchanted Republican voters lost faith in the agenda of their party’s leaders.

Confessor also quotes Foster Friess, the Republican philanthropist and donor who helped finance Rick Santorum’s blue-collar-themed campaigns, as noting that the GOP establishment neglected “the people who truly make our country work — the truck drivers, farmers, welders, hospitality workers.” But now, under new popular pressure, Friess added, the Party “is being dramatically transformed.”

Indeed. Even Ted Cruz has shifted away from elite orthodoxy. He has long been an antagonist of the “ruling class” and the “Washington cartel,” but only recently has he also challenged entrenched economic power. This Breitbart headline from March 31 tells the tale: “‘Fair Trade’: Ted Cruz Rejects GOP Orthodoxy, Joins Jeff Sessions Populist Revolt.”

Yet we must also observe that while populism is an understandable passion, it’s being set forth, by itself, it doesn’t often make for good policy.

In fact, we can see some ominous clues as to where American politics might be heading from the example of Latin America, where populism has long flared.

In other words, as American society Brazil-ifies, it only makes sense that our politics, too, will gain a south-of-the-border tinge. As a recent Trump-hostile Politico headline put it, summing up Latin politics:

Pinochet. Chavez. Trump? After decades of suffering under populist autocrats, Latin Americans have a message for the Gringos: Welcome to our world.

As noted, Trump may no longer be in our political future — at least not in ’16 — but the fact remains that in large part because of his efforts, the familiar political system is disintegrating; as Jeb Bush and others of his low-energy ilk discovered, the “normal” political class can no longer produce effective leaders. So if we can’t do better, we might end up, in the future, with counterproductive Latin-style populism.

4. The Future Dystopia Foreseen

So what happens if things fall apart? If, as Karl Marx once put it, all that is solid melts into air?

We all know that Marx prophesied that capitalism contains the seeds of its own destruction. In Marx’s telling, the accumulation of the capitalists would be accompanied by the immiseration of the workers — until, of course, the glorious day of the proletarian revolution.

And yet all of us — except for Bernie Sanders and a few million naive college kids — know that communism only makes things worse.

Yet anti-communism, while necessary, is not sufficient. We have to have our own positive vision of the future — a future that includes everyone.

Interestingly, as we look around for better models, we might be glad to know that there’s a substantial tradition on the right, too, that responsibly critiques runaway capitalism and globalism.

A century ago, in 1912 to be exact, Hilaire Belloc, a conservative Englishman of French extraction, published a book, The Servile State, in which he outlined a critique of laissez-faire capitalism that was remarkable, both for its comprehensive vigor and for its complete lack of Marxist influence.

Belloc’s argument can be stated simply: Capitalism would inevitably grind down workers’ wages, to levels below subsistence. And yet governments, for reasons of either altruistic compassion or counter-revolutionary calculation, would not let their populations starve. And so the state would step in with grants or wage-subsidies. The Speenhamland Plan of 1795, discussed here at Breitbart, was a short-lived example of this sort of policymaking.

Belloc did not want anyone to starve to death, but, he warned, the result of such government intervention would be to create a double-servility. That is, ordinary workers would be in the thrall of their employers, but at the same time, if the government was chipping in, they would also be in the thrall of the state. In other words, in Belloc’s grim scenario, both the capitalists and the bureaucrats would be vital to the workers’ survival — and thus would jointly have dominion over them.

We can stipulate here, once again, that Belloc was no leftist. He was an ardent Catholic; in fact, he credited Christianity with the abolition of slavery, which he abhorred. Indeed, it was because Belloc so loathed slavery that he was so exercised about contemporary conditions; he feared that slavery, at least wage-slavery, was making a comeback in the guise of free-market capitalism.

So that was the servile state, according to Belloc: the toiling masses under two thumbs — one private, and one public.

His alternative to the servile state was what he called the “distributed state” — that is, the widespread distribution of private property.

So once again we see that Belloc was anything but a leftist. Indeed, his conservative urgency was aimed at alleviating desperate conditions, thereby forestalling an enslaving socialist or communist revolution of the sort that overtook Russia just five years after The Servile State was published.

In fact, lest his message be misunderstood, on the title page of his book, Belloc emblazoned these warning words:

If we do not restore the institution of Property we cannot escape restoring the institution of Slavery; there is no third course.

That was Belloc’s mantra, repeated all through the book: Reform is needed to stave off bondage, either from revolution, or from counter-revolutionary crackdown.

In Belloc’s reckoning, the key to liberating conservative stability was ownership of what he called the “springs of life” — that is, private property.

In the distant past, such “springs” were mostly land; a farmer could usually always scratch out some sort of existence from the soil. But by Belloc’s time, in the modernized, mostly urbanized 20th century, the farmers had become workers; new forms of ownership had become the reality, or at least the goal. And in this new era, survival depended on access to tools, and steady work — and perhaps also some sort of shared ownership of an enterprise.

Belloc recalled that during the High Middle Ages — that is, the 12th and 13th centuries, when Europe had emerged from the Dark Ages, darkened by the fall of the Roman Empire — much property was held communally, or jointly. This was the system from the past that gave Belloc a mental model for the future.

In the rural areas of olden times, the folk had enjoyed access to forests and meadows — the commons — the places where they could hunt for game and graze their animals. (Virgil wrote about the destruction of the commons, beginning in the 17th century, here and here for Breitbart.)

And in medieval cities and towns, economic activity, such as trading, blacksmithing, and tailoring, was often organized by guilds — a sort of combination of a chamber of commerce and a labor union.

Yet the guilds lost power in the middle of the second millennium, displaced by the rising nation-state and, later, by the Industrial Revolution. The surge of manufacturing, of course, empowered factories that could outproduce, and outcompete, any artisanal guild.

Yet centuries after they had mostly disappeared, Belloc wanted to revive the guilds and their sense of participatory, cottage-industry capitalism. Once again, his key idea was widespread property ownership; only private property could guarantee freedom.

From his perspective in 1912, Belloc despaired at what he called the “dreadful moral anarchy” of wide-scale industrial capitalism. As he wrote, “Capitalism means that control is vested in the hands of the few, while political freedom is the appanage [birthright] of all.” And so the only answer, he continued, was that “the mass of citizens should severally [each separately] own the means of production.”

Yet for all his humanity and erudition, Belloc was vague about how this property-ownership shift — from big capitalist combines to human-scale guilds — would actually be achieved. He was no Bolshevik; he was not thinking about violent revolution. So he wrote his earnest book, and that was about it.

And unfortunately for his cause, Belloc did not examine the one country where the property-diversification he extolled had actually been achieved, and with great success: The United States.

Here in America, the widespread distribution of property was a concept near and dear to such American leaders as Thomas Jefferson and Abraham Lincoln. The Homestead Act of 1862, empowering small farmers to work, and thereby own, their land, was the supreme realization of the Jeffersonian-Lincolnian Dream.

We can note, for instance, that Uncle Sam could have made real money by selling off to speculators, for example, the territory of the Louisiana Purchase. But such sales would have created a population of serfs and squatters; the American government, in its wisdom, wanted, instead, sturdy land-owners. And so, over time, the American working class evolved into the American middle class.

In other words, it has been possible to achieve Belloc’s distributive dream, at least some of the time.

Meanwhile, during the 20th century, in many parts of the world, numerous countries sank back, just as Belloc feared they would, into slavery, including Soviet Russia, Nazi Germany, and Maoist China.

Yet thanks in no small part to the heroic military and strategic efforts of the newly bourgeois citizens of the United States, the world has enjoyed more freedom, and more prosperity, in the last century than in all of human history.

So without a doubt, American capitalism has been a huge success. Yet today, in 2016, as we see it unraveling, we can take away a lesson or two. That is, we can see that crucial elements of our success were based on variables that were not always guaranteed to be in place — and that we can’t afford to be without.

Specifically, we can see that our prosperity was a function of our mostly closed border — closed both to imports and to immigration. In the 20th century, American entrepreneurs built their businesses, and as they looked around for workers to make their wares, they inevitably hired — Americans.

And at the same time, the U.S. military mostly defended — America.

It takes nothing away from American workers to observe that it’s easier to get hired when you’re the only kind of worker in town — when the employer has no choice but to hire Americans.

And it takes nothing away from the genius of inventors and investors to say that it’s easier to make money when one’s factory is not under foreign assault.

These points, about the comprehensive value of making and hiring in America, and about the equally great value of defending America, might seem so elementary that they are barely worth writing down.

And yet, as we have seen in recent decades, neither point — make in America, defend America — is in any way, any longer, guaranteed.

That is, American capitalists no longer feel an obligation to hire Americans, and the American government and its military, are not only not defending the United States anymore, they are actively helping shepherd in immigrants who are avowed enemies of the American Way.

Yes indeed, these changes — no longer building and hiring in the USA and no longer defending it — are a big deal. They tell the story of how the United States, mostly because of its feckless government, has abandoned the model that made us both rich and powerful.

We can observe that free-market capitalism is a great economic and social system, perhaps the greatest ever, but it has to be a great system within the country — because otherwise, the benefits are dispersed throughout the world, leaving Americans with little. And at the same time, property and assets must be defended here at home; otherwise, capital will flee elsewhere.

As we have seen, Hilaire Belloc developed his distributive theory because of his abhorrence for slavery — he did not want to see the workers re-enslaved by capital.

Yet today, a century later, as Kevin Kearns of the U.S. Business and Industry Council argues, American capitalism, through outsourcing, has essentially figured out how to evade the 13th Amendment to the Constitution, which banned slavery in America. That is, U.S. companies can hire workers in China, or Vietnam, or in many other countries, who must work at near-slave wages.

The 13th Amendment, that noble constitutional provision of 1865, is typically seen as an ethical and compassionate advancement for civil rights. And so it was. Yet at the time of its enactment and ratification, it was often seen as an economic advancement as well: a commitment by the Lincoln Republicans that slave labor would never again be allowed to underbid free labor. And that, we can observe, is how a country builds a middle class: by creating conditions that put a floor under wages.

Yet today, that wage-floor is gone; an American company can say to its employees, “Work for less, or we’ll relocate this plant to one of a hundred countries around the world.” That’s a gun to the head of wages if there ever was one.

Apple workers in China, for example, ought to be able to be organize, even strike, for higher wages — but they can’t. And so, as a practical matter, American workers, directly pitted as they are against Chinese workers, can’t strike, either. So all workers lose, and all capitalists win.

Moreover, as we have learned to our horror, the elite leadership in both political parties is quietly supportive of this labor-crushing process: Democrats, under the influence of Big Green, are eager to see America “restored” to its pre-industrial pastoral purity — that is, to the point where Green plutocrats can look out from their balconies and poolsides and enjoy vistas unsullied by the riffraff. Meanwhile, Republicans, under the influence of the US Chamber of Commerce and other corporate tools, want desperately to see the lowest possible wages for workers — and they know that imports, as well as immigration, can help make that happen.

And so today we see the results: headline from McClatchy News: “Blue collar voters: Trade is killing us.” Or this headline, from the Portland Press Herald: “Trade deals costly in key election states: In Wisconsin and across the industrial Midwest, economic angst is coupled with a sense of betrayal.” Such headlines, of course, have massive political, as well as economic, consequences.

Now back to Belloc: One needn’t agree with all of his ideas on the distributed state to see, nonetheless, that he was on to something when he argued for local control of the means of production. It is, as we have seen, vital to national prosperity that we maintain factories, and factory employment, here, inside our own country. If we take away nothing from Belloc beside that basic point, he, and we, will have done well.

5. Jubilee

As we have seen so far, much of the challenge in statecraft is dealing with the braided political impulses of justice and envy. That is, the feeling people have that they are being treated fairly — or unfairly. Even dictators must be mindful of the popular will; there’s hardly been a regime in history that hasn’t felt threatened by internal unrest, even civil war. And so, once again applying that Edmund Burke quote, the wise leader seeks to harness both populist impulses and the need for change, utilizing the resultant energies for some desired end, be it winning a war or building a bridge.

And of all the things that ordinary people typically have wanted to see changed, financial burdens, in the form of both taxes and also debt-payments, have been high on the list. Even the least compassionate leader must consider the impact of taxation and interest payments on his people, lest the subject population revolt, flee, or simply sink into a fatalistic stupor. Any of those outcomes, we can readily see, undermine the power of a government — and its ruler.

Interestingly, the politics of debt reach back to the origins of our Judeo-Christian civilization. In the Bible, “jubilee” isn’t a fun party, it’s a serious injunction for political leaders.

In the Book of Leviticus, God speaks to the Israelites through Moses, telling them the rules by which they should live. Specifically, in Leviticus 25: 9-17, God ordains that every 50 years, the Hebrews should

…proclaim liberty throughout all the land unto all the inhabitants thereof: it shall be a jubilee unto you; and ye shall return every man unto his possession… Ye shall not therefore oppress one another.

Over the years, these words have been interpreted to mean debt-forgiveness — emancipation from financial peonage. Of course, as with most most Bible teachings, the jubilee idea hasn’t actually been practiced much, but still, it’s possible to see the germ of wisdom in that Godly admonition.

Yet now we come to today, when financial players seek to climb the Forbes 400 list, building their paper fortunes — mostly because, well, they can.

But we don’t need the Bible to tell us that if financial accumulation becomes just the mindless pursuit of another zero at the end of an already-long string of zeroes — that is, if getting ever richer becomes a new kind of arms race, punctuated occasionally by some spasm of conspicuous consumption — then public loyalty to the capitalist system will inevitably decay.

The political-science term for such loyalty is “legitimacy”: the ruling system must be seen as legitimate. We can note that even the most tyrannical dictator needs at least some smidgen of legitimacy; his henchmen, jailers, and executioners will follow orders only if they see a basic logic to the system, however cruel.

And as for capitalist democracies, well, the feeling of legitimacy must be widely shared for the system to remain intact. As Teddy Roosevelt back in Belloc’s era, said as he surveyed the ascendant wealth of the Gilded Age, “We grudge no man a fortune in civil life if it is honorably obtained and well used.”

And what if, in the opinion of the many, the fortune is not honorably obtained and well used? Well, say hello to Donald and Bernie.

As noted, both of these populist insurgents may fall short in their quests for their respective party nominations, but their impact on politics, as they both would say in their New Yawk accents, has been “yuge.”

Indeed, as we think about the cycle of reckless capital, described in Part Two, we can recall that it was in three phases: concentration, accumulation, and stagnation. But in reality, the cycle has a fourth part: revolution. That is, the masses will put up with only so much, before they rise up.

The positive experience of the American Revolution shouldn’t give us false hope about future insurrections. Not every violent revolution is virtuous; most are not — and most end badly, with just more repression. Yet we can see that sometimes, there’s simply no alternative: The grievances get to be too much.

We can also see that if the rich make themselves into a fat target, well, they’re a fat target.

For example, in the Middle Ages, the Catholic Church grew enormously wealthy, at least relative to the general population. The Church did much good, caring for the poor and the sick, providing at least some education to many and a high-quality education to the meritocratic few headed for the priesthood. Yet at the same time, there was much abuse. As they say, absolute power corrupts absolutely.

The result, in the 16th century, was the Reformation. And one key “plank” in the Reformation platform was the seizure of church lands and property, which might have represented 10 percent or more of the wealth in northern Europe.

This “Dissolution of the Monasteries,” as it was called in England, was a violent and brutal process; in some cases, libraries were seized, and in other cases, they were destroyed. And yet in a way, it was inevitable: The Catholic Church in England found itself owning more property than it had public support. So the land-title “choices” made in centuries past were no longer sustainable — and so they were no longer sustained.

Belloc, being the devout Catholic that he was, found himself appalled by this history, and, as he pointed out, the land seized by the Protestants was not distributed to the landless; it was typically just transferred from clerical control to aristocratic control.

On the other hand, some economic good did come from the Dissolution. The legal term mortmain (“dead hand”) refers to the unproductive use of land, to be followed, typically, by its its subsequent shift to the productive economy, and some of that shifting occurred during the Reformation.

The enduring lesson, though, is that concentrated wealth needs a bodyguard of legitimacy — otherwise, it will not survive.

In other words, if wealth is seen as illegitimate, its owners will inevitably be stripped of their possessions. Thus it was that in the 18th and 19th centuries, the Church was shorn of its lands in southern Europe, too, even though they remained Catholic.

We might note that this process of Dissolution is always ongoing, somehow. The Catholic Church today has little political power, and yet it still faces a challenge to its legitimacy, insofar as there are fewer practicing Catholics; this is especially true, ironically enough, in Italy. And so its remaining property is at risk.

So today, even after centuries of shrinkage, the Church is still land-rich, albeit people-poor. As the London Review of Books noted recently, citing the case of just a single Vatican bureaucracy, the Church is still a wealthy landlord and cites one egregious case, namely,

…the organisation Propaganda Fide, instituted to evangelise the world, that spends relatively little on this mission while owning almost a thousand valuable properties in and around Rome, many of them rented way below market price to friends and favourites.

We can quickly see, in other words, that this status quo is not stable: More Dissolutions are in the Church’s future.

Today, we can also observe the same dynamic at work here in the United States, in various sectors.

We can see the jubilee impulse, for example, in the housing sector. The city of San Francisco has been notoriously hostile to new housing construction; in the midst of that city’s seemingly perpetual tech boom, a combination of Green-ism, NIMBY-ism, and also, yes, the cynical desire of current homeowners to see the value of their homes rise rapidly has led to policies that have drastically constricted new housing, causing prices to skyrocket. And this, in turn, has led to a new kind of protest movement, a movement in favor of building more housing — new housing construction is a jubilee-ish protest against housing strangulation. It is also, we might add, a protest against the left; that is, it’s a protest-movement in which supposed “progressives” now find themselves cast as reactionaries. The New York Times does a nice job of getting inside the minds of this newest tranche of protestors, the pro-housing-production activists:

They view San Francisco progressives as, in fact, fundamentally conservative. That is because, to the group members at least, progressive positions on housing seem less about building the city and more about keeping people like them out.

Some might argue that strictly speaking, the pro-housing movement in San Francisco is not a jubilee, since it doesn’t involve the renunciation of debt. However, it does involve the distribution of wealth — in seizing the near-monopoly power away from existing homeowners, it is, in fact, transferring wealth to newbies; that is, their right to own a piece of the American dream. Of course, that’s what freedom does: It enables new people to make money, too.

We can also see a kind of jubilee process going on other sectors, too:

For instance, and perhaps most fatefully, education. The early indicators of a jubilee for Big Education are everywhere: Just on April 13, the Obama administration announced a forgiveness on the student loans of some 400,000 students with disabilities; meanwhile, some 40 million more Americans owe more than a trillion dollars. For better or for worse, it’s a safe bet that most of that debt will never be repaid.

Moreover, revenue-hungry jurisdictions are taking the fight, beyond debt, to the actual wealth of private schools.

Under the headline, “As Budget Woes Grow, Some Want To Tax Yale’s Endowment,” the Hartford Courant noted that Connecticut is facing a $266 million deficit this year and a projected $900 million deficit next year.

So some Nutmeg State lawmakers have proposed a seven-percent tax on the investment profits of Yale University’s $25.6 billion endowment, which earned $2.6 billion last year. Seven percent of that $2.6 billion, we might note, is $182 million; it’s not necessary to approve of the idea of taxing non-profits to see the political temptation.

In the dry words of Connecticut State Representative Roland Lemar, “Perhaps the original intent of providing a tax-exempt status to a small, ministerial training college 300 years ago isn’t the same thing that we’re seeing now.” And Lemar’s words gained added oomph from State Senate President Pro Tem Martin Looney, who declared, “It is our hope that these rich schools can use their wealth to create job opportunities, rather than simply to get richer.” So it’s probably only a matter of time before Connecticut enjoys a jubilee — at Yale’s expense.

Lemar and Looney are Democrats, along with most of Connecticut’s government.

Yet some Republicans, too, are moving in a similar direction. Down in Washington DC, a GOP Congressman, Tom Reed of New York, a member of the tax-writing House Ways and Means Committee, has a different, but still jubilee-ish, idea: He is readying legislation that would require colleges with endowments over $1 billion or more to spend at least 25 percent of their endowment earnings on their students.

What a concept: colleges spending their money on their students! Of course, that would make for a culture-shift at some hulking academic institutions: The joke about Harvard — endowment: $37.6 billion — is that it is a hedge fund with a school attached.

Indeed, it seems fair to assert that university presidents seeking bigger endowments have fallen into the same rat-race trap as those who seek to climb the Forbes 400: they measure themselves by their ability to add zeroes to their already massive dollar-totals.

In such an atmosphere, as annual tuitions reach $50,000 or more, it’s easy for critics to make the case that rich schools have lost sight of their teaching mission.

And so schools are sitting ducks for the likes of Bernie Sanders, who offers his own form of jubilee: His campaign website proclaims, “It’s Time to Make College Tuition Free and Debt Free.”

Meanwhile, the modern-day jubilee movement continues to spread. Under the headline, “It’s On, Non-Profits,” Politico writes:

Do you get the sense that cities and states are essentially looking under the couch cushions for every spare dime of revenue they can find?

And the answer, of course, is “yes.” As Politico continues:

Whether it’s a hospital in Illinois, Ivy League colleges in New England or a religious day camp in Pennsylvania, nonprofits are facing a multi-pronged assault on their tax breaks in the courts, state legislatures and city councils.

Other concentrations of wealth, too, are subject to scrutiny — and perhaps seizure.

For instance, there’s the trillion or more dollars that American corporations have stashed overseas. That cash pile — hovering somewhere in between, perhaps, Ireland, the British Virgin Islands, and Panama — has been floating for too long, just accumulating interest, and so now international tax collectors are increasingly emboldened to go after it.

As the Financial Times explains, the European Union is in the process of changing its rules with an eye toward — you guessed it — gleaning more revenue. Under EU rules, tax breaks for companies are permitted, but state aid to companies is not permitted. And so the EU is redefining “tax breaks” as “aid.” And presto! Big tax bill.

American companies, of course, have lobbied furiously against this change, but they are losing. In the words of the FT:

Politically, the fight cuts to the heart of discontent about the size of America’s offshore cash pile, and who will ultimately tax it. According to Moody’s, a credit-rating agency, the offshore balance for all US companies has ballooned to $1.1tn, with the largest shares belonging to Apple, Microsoft, Google, Cisco and Oracle.

We can ask: What European country — or the Union as a whole — wouldn’t be eager to grab some of that wealth? If nature abhors a vacuum, then politics abhors unspent money.

So we can see: Anywhere in the world, if the accumulation of wealth loses its legitimacy and seems excessive, there will be a backlash — and quite possibly, a Dissolution.

And that’s why, from the point of view of defending private property — to say nothing of promoting the long-term survival of the human species — it was so refreshing to see the report about the new space venture from the tycoons Yuri Milner and Mark Zuckerberg, joined by the famous physicist Stephen Hawking: They have in mind a mission to send an unmanned probe Alpha Centauri, the star closest to earth. We might note that “close” means 4.37 light years, which would necessitate about 20 years’ travel time, barring some huge technological breakthrough. Which is to say, this is a long-time-horizon undertaking.

Moreover, the visionary trio is thinking about much more than just unmanned probes. As Hawking explained, “Earth is a beautiful place, but it might not last forever. Sooner or later we must look to the stars.”

Hawking is correct, of course: For the long-term survival of our kind, we will have to learn to migrate, not just to other planets in this solar system, but to other solar systems altogether. And in a way, we might add, space exploration offers the prospect of new wealth; that is, just as land in the New World of America offered wealth to Europeans willing to risk everything work hard , so, too, land in the Newer Worlds of space will offer wealth to risk-taking, hard-working Americans.

We can observe that the sort of bold altruism of these space pioneers is the sort of bright vision that keeps the Dissolutionists and redistributionists at bay, because all of us, or at least our descendants, stand to gain if Milner, Zuckerberg, and Hawking succeed. By contrast, simply repeating rote apologetics about the sanctity of private property will not suffice in this Sanders-ized era.

In the meantime, back here on earth, if governments really want money, they can look to dissolving their own real-estate empires. As Virgil wrote in 2014, Uncle Sam is sitting on $128 trillion in oil and natural gas wealth — and that wealth does not include coal, as well as other minerals. Such an American jubilee would enrage the Greens and the NIMBYs, but give it time. In the historical sweep of things, the current policy of Malthusian mortmain is indefensible, and it is doomed.

6. The Solution: Shining America, United

On the night of April 5, night, in the wake of Trump’s defeat in the Wisconsin primary, Fox News pundit Tucker Carlson was wistful. Carlson, who has been supportive of Trump, or at least of Trumpian ideas, surveyed the mogul’s campaign, seeming stalled, and sighed: at least Trump has advanced the cause of “moderate nationalism.” That is, for all of Trump’s bloviation and bluster, his policy agenda was actually rather focused on American renewal: He has had a compelling vision of America, once again, the shining city on a hill.

And of course, in the weeks since, Trump’s campaign has revived — Trump’s “moderate nationalism” has been vindicated.

Or as Pat Buchanan — whose presidential candidacies in the 90s anticipated many Trumpian themes — wrote on April 4:

Whatever his stumbles of the last two weeks, Trump has helped to unleash the mightiest force of the 21st century: nationalism.

Yes, nationalism, also known as patriotism. America: apple pie, baseball, and eight-lane highways. And oh yes, the Declaration of Independence, the Gettysburg Address, and patriot graves. Our country, right or wrong. Deal with it.

Yet nationalism can’t just be patriotic rah-rah, it needs to be connected to a serious plan for advancing the nationalist interest. Otherwise, it’s just tee-shirt wearing and empty “USA!” chanting.

So if we want Old Glory to always be waving over our fruited plains and alabaster cities, we need a practical vision: As President Theodore Roosevelt said, “We are not building this country of ours for a day. It is to last through the ages.”

If we agree with TR, then we can see, in front of us, the work that needs to be done — work that transcends Trump. We must pull this country together — and we must pull it back from the abyss.

So how to start? Where do we begin?

Let’s start with trade, which is perhaps the hottest unresolved issue of Campaign 2016. To be sure, there are other hot issues, too, such as immigration. But today, in the wake of Brussels, the elites at least pretend to be on the side of border-security.

But trade is still a raging debate: Wall Street sees it one way, and Main Street sees it the other way.

Thus trade makes for a good test of the new populist energy in the country: Who will prevail? The globalists? Or the nationalists? We know that the globalists have been winning for decades, but could that change, and could American greatness be restored?

Specifically, should trade be “free”? Or should it be “fair,” as Trump insists, now joined by Cruz? And what do we mean, anyway, by those terms?

Let’s start with “free trade”: It’s an economic theory — a theory based on another theory, “comparative advantage.” In fact, both theories were cooked up by economists in the 18th and 19th centuries, when travel, cargo-shipping, and communication were all slow — traveling at the speed of horses and sailing ships.

Yet “free trade” has always been more than a theory describing economic processes — it’s also been an idealistic philosophy of human potential: It’s about the transcendent dream of international brotherhood and universal peace.

As one of the leading free traders of the 19th century, Richard Cobden, declared in 1846:

I see in the Free-trade principle that which shall act on the moral world as the principle of gravitation in the universe, — drawing men together, thrusting aside the antagonism of race, and creed, and language, and uniting us in the bonds of eternal peace.

Two centuries later, even though the world has changed — and even though free-trading nations have fought many wars against each other, in contravention of Cobden’s fond dream — “free trade” is still treasured in ivory-tower circles, it is preserved, one might say, under glass.

And so, for example, if Japan, Mexico, or China wipe out American industries by manipulating their currency and/or using slave or near-slave labor, well, that’s a small price for somebody — somebody else — to pay. What really matters is the preservation of the precious theory.

Yes, unfortunately for American workers, while “free traders” are conjuring up their dream-palaces of one-world fantasy, the actual damaging consequences of free-trade theory are secondary, at best, in the minds of these proponents.

Of course, not every free trader is an intellectual bubble-head. Some are hard-nosed financiers, who see economic gain for themselves under the guise of “free trade.” For example, if a Wall Street firm can make a profit financing the outsourcing of an American plant to another country — well, that firm, and its hired-gun propagandists will call that “free trade.”

By contrast, “fair trade” starts out with the presumption of the national interest.

That is, flesh-and-blood citizens are held to be more important than an abstract theory. And we might add: That’s where the votes are, which is why Trump and Cruz have both come out against the Trans-Pacific Partnership, the latest free-trade deal.

Republicans are at last learning that trade deficits do matter, that free trade is not free. The cost comes in dead factories, lost jobs, dying towns and the rising rage of an abandoned Middle America whose country this is and whose wages have stagnated for decades.

Buchanan, always a man of big-picture perspective, continues:

Economists who swoon over figures on consumption forget what America’s 19th-century meteoric rise to self-sufficiency teaches, and what all four presidents on Mount Rushmore understood.

Production comes before consumption. Who owns the orchard is more essential than who eats the apples. We have exported the economic independence Hamilton taught was indispensable to our political independence. We have forgotten what made us great.

Actually, we haven’t all forgotten: Hence the insurgencies of 2016.

We can add a simple economic observation derived from Buchanan’s point about orchards, above: The capacity to produce is more important than the capacity to consume.

That is, it’s better to know how to make an automobile than merely to own an automobile. Yes, the technological know-how of manufacture is more valuable than just driving a car around.

We can immediately observe that this point is a variant on the old adage about fish and fishing: “Give a man a fish and he’ll eat for a day. Teach a man to fish and he’ll eat for a lifetime.”

But there’s more to a responsible fair-trade policy than economic justice and prosperity: There’s also the issue of national survival.

Once again, our authority can be Teddy Roosevelt, who declared, in the run-up to World War One:

If a free government cannot organize and maintain armies and navies which can and will fight as well as those of an autocracy or despotism, it will not survive.

Yes indeed. that’s true, and it has always been true. Every few decades, throughout the course of US history, America has faced a mortal threat to its existence from somewhere. Whether it’s fighting the British at Fort McHenry in 1814, or fighting ISIS in San Bernardino in 2015, we have always needed to maintain our vigilance and our strength.

Thus we need to see trade and industry through the prism of national security as well, because production for wealth is also production for defense.

History tells us that a strong industrial base is vital in wartime; after Pearl Harbor, we couldn’t count on Japan for anything.

To further illustrate this point, we might recall a scene in Clint Eastwood’s 2006 movie, Letters From Iwo Jima, the World War II film told from the Japanese point of view — the lesser known companion film to Flags of Our Fathers. In the film, before the US landing on Iwo, the Japanese commander explains to his top officers that the defending forces will, of course, fight bravely. But just as certainly, he continues, they are doomed to defeat. He is asked, “Why?” Because, he answers, Japan is fighting a nation that makes five million cars a year. The eyes of the Japanese subordinates grow wide as they all look at each other and agree, yes, that’s a clincher of an argument. And, of course, although the Japanese fight bravely, nearly all of them are soon killed, buried under an avalanche of American steel.

Yes, the domestic manufacture of defense wares is vital: During World War Two, for example, America earned its title, “The Arsenal of Democracy.”

Ford’s Willow Run, Michigan, plant, for example, could make one bomber an hour. There was no thought by Ford, then, of making things in Mexico.

Destroyers were built in Boston, battleships in Philadelphia, P-51 Mustangs in Inglewood, California, and tank wiring in Warren, Ohio.

In all, during World War Two, we produced ten battleships, 27 aircraft carriers, 211 submarines, 907 cruisers and destroyers, 41,000 artillery pieces, 61,000 tanks, 82,000 landing craft, 303,000 aircraft, 12.5 million rifles and carbines, and 41 billion rounds of ammunition.

That’s how we won the war with “only” 400,000 deaths. The Japanese, by contrast, suffered perhaps 3 million, Germany around 8 million, and the Soviet Union as much as 26 million.

And, oh, by the way, here in the U.S., the unemployment rate fell from 14 percent in 1940 to one percent in 1945. Yes, to be frank, it was the Good War.

Yet since World War Two, the global situation has changed. It’s not an accident that, in the decades since 1945, Japan has set about building the sort of industrial plants that Henry Ford would have admired.

And it so happens that during those same seven decades, America’s share of world auto production has fallen from 90 percent to less than 10 percent. Is that militarily significant? We’ll find out in the next big war.

It could be argued, of course, that bending steel is less important than funneling electrons. And that might well be the case. But if so, we’d still be in trouble if we found ourselves in a confrontation with our main rival, China.

If it’s true, as ZDNet reports, that the Chinese have built “backdoors” into 80 percent of our cell phones, then maybe Trump has been right — maybe we shouldn’t be relying on China to make our iPhones.

That’s the bad news: We are a nation at risk. Yet the good news is that in the conscious restoration of American self-sufficiency, we could see not only security, but also a renewed national prosperity.

Indeed, these are the fundaments of a strongly nationalistic trade policy, as well as a healthy nationalism itself.

Produce here, protect here. Both points seem obvious to most Americans.

So now we must ask: Is it possible that we can persuade the political class to agree? Can Donald Trump’s leadership make a difference? The nation must wait and wonder.

COMMENTS

Please let us know if you're having issues with commenting.