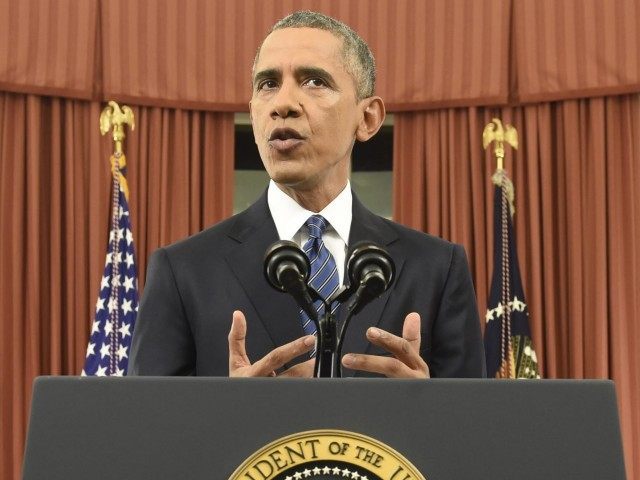

Although President Barack Obama likes to snarl about the unfairness of income inequality, under his administration, the 400 top earning American families now pay about one-third less of their income in taxes than under President Ronald Reagan.

The IRS each year tabulates the effective tax rates paid by 400 individual income tax returns that report the nation’s largest adjusted gross incomes. As just reported, with about 146 million returns filed for 2012 as the latest study period, the top 400 earners took home an average of about $336 million.

The average tax rate paid in 2012 by what is referred to as the “Fortunate 400” was 17 percent, despite the statutory top marginal income tax rate of 39.6 percent. This compares to an average income tax rate of 27 percent under President Reagan; 26 percent under George H.W. Bush; 25 percent under Bill Clinton; and 20 percent under George W. Bush.

United States primarily financed the cost of government for its first 130 years through tariffs. But Woodrow Wilson ran and won the presidency in 1912 on a campaign to tax the incomes of the 400 highest income earners in America.

With Democrats capturing both houses of Congress for the first time in 18 years, Congress passed the income-tax law in 1913. The bill created an income tax on families earning over $4,000, supposedly in exchange for cutting the nation’s basic tariff rates from 40 percent to 25 percent. The income tax originally hit about 1 percent of American families. The rate began at 1 percent and progressively rose in steps to 7 percent for incomes of $500,000 or more.

The income tax was marketed as supposedly only impacting the wealthy. But three years later, the Democrats passed the Revenue Act of 1916 that expanded the income tax to cover all Americans with a minimum 2 percent on incomes up to $20,000. The Democrats tried to deflect criticism of bait and switch by adding an excess profits tax, an estate tax and raising the top progressive marginal tax rate to 15 percent.

The high income tax rates encouraged the rich to pursue tax avoidance strategies—such as borrowing out profits instead of selling assets, and generation transfers to help them reduce their income tax payments. By 1918, the Fortunate 400 were only paying a small fraction of the income tax and the middle class was stuck paying the majority.

The public was so angry at the Democrats for heavily taxing “working people” that Republican Calvin Coolidge was elected in 1920 by a 26.2 percentage-point victory (60.3 percent to 34.1 percent). The triumph remains the largest margin of victory in a contested presidential election. His “coattails” also gave both Houses of Congress to Republicans.

The Republicans cut tax rates throughout the 1920s and revenue collection from the richest 10 percent of Americans boomed to 50 percent of all taxes paid. But with Democrats gaining control in the Great Depression, President Franklin D. Roosevelt raised marginal tax rates on Americans earning over $100,000 from 25 to 62 percent. As a result, the wealthy went on strike and their share of all U.S. taxes paid fell from 50 to 27 percent. Once again, the middle class paid a much higher share of taxes.

President Reagan radically cut the highest marginal income tax rate from 70 percent when he came in office in 1980 to only 28 percent when he left office in 1988. But rather than the wealthiest Americans paying fewer taxes, the richest 10 percent of Americans went from paying $177 billion in federal income taxes in 1980 to $237 billion in 1988.

Progressives cheered President Obama when he raised the top marginal tax rate to 39.6 percent in 2013, the highest rate since 1986. But the average tax rate paid by the Fortunate 400 fell to a record low of 17 percent, down from 19.04 percent from his first year in office.

The main reason that the wealthiest are paying a lower percentages of taxes on income than Reagan is that Obama’s current federal tax code at 74,608-pages is about three times larger than the 26,300-pages under Reagan.

Shrouded in legalese, post-Reagan Democrats and Republicans have conveniently legislated an awesome array of tax deferral strategies: Wall Street trusts that convert twice as much income into lower taxed capital gains, sophisticated derivative borrowing schemes, and multi-generational asset transfers options that allow the Fortunate 400 to be much more fortunate.

COMMENTS

Please let us know if you're having issues with commenting.