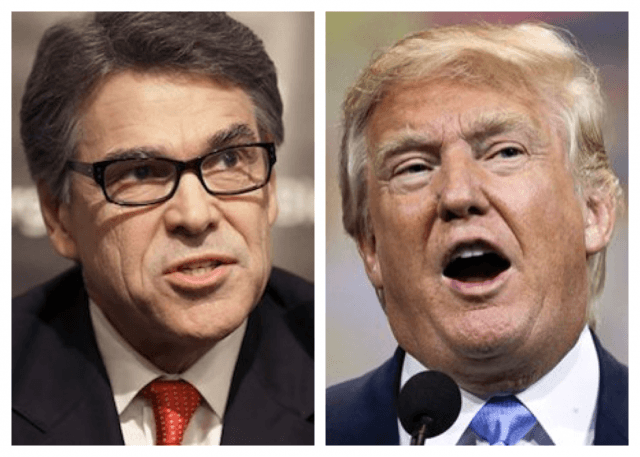

Showcasing some of that trademark Texas swagger, Republican presidential candidate and former Texas Gov. Rick Perry unveiled his plan for reforming Wall Street, and then challenged Donald Trump to a pull-up contest.

As Breitbart News has reported, Perry and Trump have been engaged in a rhetorical battle for weeks. In the latest example of why this 2016 election cycle is incredibly entertaining to cover, the real estate mogul had said that Perry lacked the “energy,” the “brainpower,” and the “toughness” needed for a successful presidential campaign.

At the end of Perry’s speech Wednesday at the Yale Club in New York City, he was questioned about Trump’s remarks. Grinning as he listened to the question, Perry quipped, “Let’s get a pull-up bar out there and see who can do more pull-ups,” as the audience roared with cheers.

Trump has not yet accepted Perry’s invitation.

The speech Perry delivered on Wednesday was noteworthy on its own, separate from any pull-up challenges that were issued afterwards. The event was sponsored by the Committee to Unleash Prosperity, a fiscal conservative group founded by Steve Forbes, Larry Kudlow, Art Laffer and Steven Moore, and Perry’s remarks included a detailed discussion of the role that former President Bill Clinton’s policies played in the housing crisis, as well as several proposals for reforming Wall Street.

Perry began his remarks by describing the events that led up to the recent housing crisis, highlighting some of the bad decisions that preceded it. “Banks made a lot of mistakes regarding risk management leading up to the crisis,” he said. “Some financiers intentionally misled investors and customers. They pushed people into deceptive financial products.”

Worse, he explained, was how instead of the banks and Wall Street being punished for their poor choices it was “average Americans who paid a tremendous price.”

“To be quite frank, they were screwed,” continued Perry. “They were not bailed out. They lost jobs, homes and savings. And they have every right to still be angry about it.”

However, added Perry, Wall Street was not completely at fault. “I am tired of politicians bashing Wall Street while ignoring the sins of Washington, D.C.,” said Perry. “It was Washington regulators who fell asleep at the switch. It was Washington politicians who changed laws that created the housing crisis.”

Perry then described how former President Bill Clinton had enacted a policy that reshaped how Fannie Mae and Freddie Mac invested in mortgages, significantly increasing the percentage of mortgages from low- and moderate-income borrowers sponsored by the two federally-backed mortgage giants. This disastrous policy was also pursued under the Bush administration, and the effects would ripple throughout the American economy:

This set in motion catastrophic events. Lower-income Americans started taking out mortgages that, in many cases, they couldn’t really afford. And upper-income Americans started taking advantage of the relaxed standards to buy even larger homes than the ones they already had.

Prior to 1992, nearly all mortgages held by Fannie and Freddie had been purchased by Americans with good credit, who had paid at least 10-20 percent down – what bankers call prime mortgages.

But by 2008, half of the mortgages in the country – 31 million of them – failed to meet the prime standard, thanks to the new Clinton regulations. And three-quarters of those non-prime mortgages were held by government agencies or government-backed entities like Fannie Mae.

Not only were Americans buying homes with little or no money down, but they had no documentation of their income or assets. The banks looked away. The regulators looked away. Everyone pretended the good times would never end…

As Americans began to borrow more money to buy bigger houses, demand went up and prices went up. A whole ecosystem of lobbyists emerged to block reform, and ensure that the party could go on. People started saying that housing prices would never go down again. And then the music stopped.

Perry points fingers of blame directly at not just former President Clinton, but also retired Democratic Sen. Chris Dodd and Rep. Barney Frank, whose names are on the Dodd-Frank bill that “misdiagnosed the problem, passed the wrong remedy, and actually made things worse.”

As for Clinton, now that his wife, former Secretary of State Hillary Clinton, seeks to follow his path to the White House, Perry says that she must answer for her husband’s policies, and her support of the Obama administration, which had expanded them:

If Secretary Clinton wants to take credit for the “Clinton economy,” then she must defend the destructive homeownership policies advocated by her husband that pushed shoddy loans to people who couldn’t afford them, and the economic chaos that followed…

If you thought the financial crisis of 2008 was bad, wait until the next serious economic downturn.

The fact is the Obama Administration is pursuing some of the same reckless policies that caused the housing crash of 2007 and 2008. Fannie and Freddie are still pushing relaxed credit standards, and down payments on homes that are too low.

One detrimental effect of Dodd-Frank pointed out by Perry was how it was a disproportionate burden on community banks.

Over 1,300 community banks have closed [since Dodd-Frank passed], making life for small businesses much more difficult. Yet the big banks are bigger than ever. Three decades ago, the six largest U.S. banks held assets amounting to 14 percent of our GDP. Today, it’s 61 percent…

Dodd-Frank took aim at Wall Street and ended up harming Main Street. And today, community banks are spending more time and money on legal compliance than ever before. We should exempt community banks, banks run as partnerships, and asset management firms from Dodd-Frank’s onerous and excessive regulations.

The solution, according to Perry, is “to restore market forces to banking, where failure is not rewarded or bailed out.” This would necessarily end the practice of “too big to fail,” and Perry vowed that, if he is elected President, “we will not bail out a single bank on Wall Street.” Fannie Mae and Freddie Mac’s share of the market would also need to be dialed down.

Leveling the playing field between small banks and big banks is critical, continued Perry. One way to do this would be to increase the capital cushion that must be maintained by larger and more complex banks. Reforming the bankruptcy code to create clear procedures for banks to follow would be another positive change. He also expressed support for reducing regulatory barriers to digital currencies like bitcoin.

Perry also touted how Texas had been able to almost completely avoid the housing crash. Nationally, during the recession, housing prices fell by 20 percent; in Texas, housing fell by less than one percent. Texas also had a far smaller percentage of mortgages end up underwater (where borrowers owed more than their home was worth).

Part of the reason for Texas’ success, said Perry, was the state’s flexible zoning laws and land use regulations, allowing cities to expand their housing supplies as millions of people moved to Texas. In previous speeches, Perry has pointed out how overly restrictive housing laws end up hurting low-income Americans the most.

Another crucial regulation passed in Texas limited the amount of cash that homeowners could borrow against the value of their homes. In Texas, cash-out refinancings are limited to 80 percent of the home’s value. It’s noteworthy that in most cases, Perry supports lowering regulations that interfere with the free market, but this was one area where a broad consumer protective measure was prudent. When the housing bubble burst, more Texans avoided being underwater on their mortgages because they had not been able to borrow the full value of their homes.

Read Gov. Perry’s full remarks, as prepared for delivery, here.

Follow Sarah Rumpf on Twitter: @rumpfshaker.

COMMENTS

Please let us know if you're having issues with commenting.