Major insurers in some states are proposing up to 51 percent premium increases for health plans sold under the Affordable Healthcare and Patient Protection Act, commonly referred to as Obamacare. Despite single digit increases for 2015, insurance companies are seeing their costs jump and are demanding to be compensated with dramatically higher rates.

When Insurance plans proposed 2015 rates last summer, they had only a little information about the health of the new customers they expected to sign up during the fall Obamacare expansion. Big insurers tended to ask for increases of less than 10%, while some smaller insurers tried to under-cut pricing by the major’s to take market share, according to the Wall Street Journal.

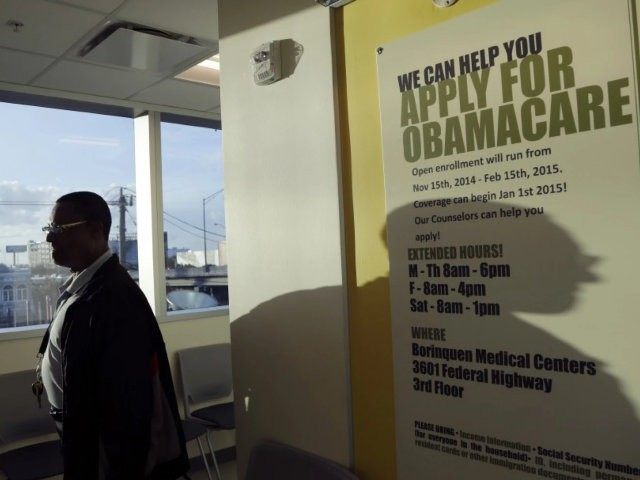

Under Obamacare, insurers must file proposed premium rates with their local state regulator and the federal government by June. But some states have already started publicly disclosing the premium requests. Due to the high utilization costs from people newly enrolled under Obamacare, the 2016 insurance premiums are about to skyrocket.

According to states that have released rate requests, New Mexico’s market leader Health Care Service Corp. is asking for an average premium spike of 51.6 percent; Tennessee’s top insurer BlueCross BlueShield of Tennessee wants an average spike of 36.3%; Maryland’s market leader CareFirst BlueCross BlueShield is requesting an average spike of 30.4%; and Oregon’s top insurer, Moda Health, is seeking a 25% spike.

The Obama Administration’s only legal power regarding healthcare premiums is the right to ask insurers seeking increases of 10% or more to explain themselves. There is no federal power to force rate cuts. State insurance regulators can force carriers to scale back requests they believe are not justified, but the carriers can drop coverage and cause a crisis.

Obamacare supposedly sought to fix two problems: coverage and cost. To extend coverage, the law made it compulsory for Americans to have health insurance, or pay a fine. It also offered subsidies for those who could not afford it and barred insurance firms from charging people more if they have “pre-existing conditions.” Before the exchanges arrived in 2013, some 41.3 million Americans lacked health insurance. That number fell to 30 million, but only because 48% of Obamacare subscribers received “premium assistance.”

President Obama claimed he compromised the design of Obamacare in 2010 to achieve fiscal neutrality over a 10 year projection to avoid increasing the deficit spending. But to achieve that mirage, the implementation was delayed for three years and the premium cost increases were ramped up over the next three years.

(My own insurer, Aetna, left the “individual market” rather than participate in the Covered California exchange. I was forced to purchase a 2014 Blue Shield policy on the state exchange. The premium for my wife and I, who have no major health issues, almost doubled from $740 per month with Aetna to $1,340 under Covered California.)

Although the inflation rate was only +.8 percent last year, national health spending grew by +5.0 percent. The 2014 health spending share of national GDP came in at 17.8%, up from 16.0% when President Obama took office. Prescription drugs were the fastest growing healthcare expenditure last year, rising by at a +13.0 percent rate.

The Affordable Care Act was rushed into law and implemented with what now appears to have been grossly defective actuarial assumptions regarding costs. The same consumer groups that fought for Obamacare are already demanding federal and state officials put premiums under the microscope to curb some increases.

But with healthcare inflation running far ahead of inflation and insurers saying their huge proposed rates only reflect the revenue they need to pay claims, Obamacare seems destined to loom as a financial and political crisis this summer.