In a controversial 2010 deal, ARMZ, a wholly-owned subsidiary of Rosatom, the Russian government-owned nuclear energy conglomerate, obtained a controlling 51 percent interest in Uranium One. That’s the Canadian company at the center of the Clinton Foundation donor scandals. The deal appears to have been approved by the Committee on Foreign Investment in the United States (CFIUS), an inter-agency committee of the federal government, 52 days after Uranium One’s shareholders signed off on the takeover.

Uranium One’s shareholders approved ARMZ’s acquisition of controlling interest in the company on August 31, 2010. While neither CFIUS nor Uranium One have publicly stated the date the ARMZ-Uranium One transaction (CFIUS Case No. 10-40) received CFIUS approval, Breitbart News believes the most likely date that took place was October 22, 2010, 52 days later.

The CFIUS review and approval process, as established by law and regulation, takes 75 days from the time the parties involved in a “covered transaction” with national security implications where the acquiring company is wholly owned by a foreign government, as was the case in this transaction.

CFIUS is an inter-agency committee of the federal government, first established by an Executive Order from President Ford in 1975. Congress strengthened its mandate when it passed the Foreign Investment and National Security Act of 2007 (FINSA). As amended by a 2008 Presidential Executive Order, FINSA requires that all foreign acquisitions of American assets considered to be central to American national security require the review and approval of CFIUS.

The CFIUS board consists of seven cabinet members, including the Secretary of State and the Secretary of Treasury, and two additional high ranking federal executives. Typically, cabinet members designate representatives to serve on CFIUS.

In 2010, the State Department’s representative was former Assistant Secretary of State for Economic, Energy and Business Affairs Jose W. Fernandez, now a partner with the prestigious Gibson Dunn law firm. The Treasury Department was represented by Marisa Lago, Assistant Secretary of Treasury for International Markets and Development.

The speedy approval of the ARMZ-Uranium One transaction (CFIUS Case No. 10-40) raises the possibility that the deal may have received expedited treatment, though the management of Canadian based Uranium One stated in a Management Information Circular/Notice to Shareholders published August 6, 2010 and dated August 3, 2010 that “Uranium One and ARMZ intend to submit a joint voluntary notice with CFIUS during the first week of August 2010.”

The 2008 CFIUS regulations promulgated by the Department of Treasury state that “a party or parties to a proposed or completed transaction may file a voluntary notice of the transaction with the Committee.”

So Uranium One and ARMZ could have jointly filed such a notification with CFIUS some time in August prior to the August 31, 2010 approval of the takeover by Uranium One shareholders.

However, the 75-day clock does not begin the day the Staff Chairperson receives the notification.

The Staff Chairperson must first “inspect such notice for completeness.” Given the lengthy list of required information found in Section 800.402 of the regulations, this may take some time. Only after the Staff Chairperson has confirmed the voluntary notice complies with Section 800.402 and “disseminated the notice to all members of the Committee” does the 30-day initial review, the precursor to the 45-day investigation, begin.

Breitbart News contacted Aimen Mir, currently the Acting Deputy Assistant Secretary of Treasury for Investment Security, but in 2010 the Staff Chairperson for CFIUS, the individual with the statutory and regulatory authority to initiate case files on “covered transactions,” to determine the date on which the initial 30-day review period for the ARMZ-Uranium One transaction began.

Breitbart News also asked Mir to confirm that the ARMZ-Uranium One transaction went through the mandatory second stage 45-day investigation phase required in cases where the acquiring company is owned by a foreign government, but has not received a response.

The language used in a Jan. 29, 2013 letter to the Nuclear Regulatory Commission (NRC) from Uranium One suggests that CFIUS completed its approval of Case No. 10-40 on or before October 22, 2010, and that the Secretary of the Treasury and the Secretary of the lead agency (possibly State, possibly another Department) may have “jointly determined that the transaction will not impair US national security.”

Note the key phrase “no unresolved national security concerns,” which appears in both the final CFIUS regulations promulgated by the Department of Treasury in November 2008, (Federal Register Vol. 73, No. 226, November 21, 2008, pages 70702-70728) and the January 29, 2013 letter to the NRC from Uranium One.

Here’s where the 2008 CFIUS regulations use the term:

To ensure accountability for CFIUS decisions, FINSA requires that a senior-level official of the Department of Treasury and of the lead agency certify to Congress, for any covered transaction on which CFIUS has concluded action under section 721, that CFIUS has determined that there are no unresolved security concerns. (emphasis added)

Here’s where that January 29, 2013 letter to the NRC from Uranium One uses the term:

On December 27, 2010, Ul Inc. [Uranium One] and ARMZ announced completion of the 2010 Transaction. . .

In addition, in August 2010, Ul Inc.[Uranium One] and ARMZ jointly filed a notification with the Committee on Foreign Investment in the United States (“CFIUS”) regarding the 2010 Transaction in CFIUS Case No. 10-40.

By a letter dated October 22, 2010, CFIUS informed Uranium One and ARMZ that there were no unresolved national security concerns regarding these transactions under Section 721 of the Defense Production Act of 1950, as amended. (emphasis added)

This strongly suggests CFIUS completed its review of CFIUS Case No. 10-40 and approved the covered transaction between ARMZ and Uranium One on October 22, 2010.

If ARMZ and Uranium One notified CFIUS of their covered transaction on August 6, 2010 (a Friday) and CFIUS Staff Chairperson Mir completed his review of the voluntary notification the very next business day (August 9), the earliest the 30-day review could have begun was August 10.

That review would have been completed on September 9. The 45-day review would have begun on September 10, and, by law, could have extended until October 24.

Such a timeline would be consistent with CFIUS review that followed the 75-day statutory timeline and delivered an approval on October 22.

However, the actual date in August when ARMZ and Uranium One submitted their notification to CFIUS is not known, nor is the amount of time it took the CFIUS Staff Chairperson to review the notification for completeness.

At the time of the transaction, Uranium One owned 20 percent of all uranium deposits in the United States. Uranium, of course, is a key strategic national security asset for the country, since it is the fuel used in nuclear power plants and nuclear weapons.

Hillary Clinton, then the Secretary of State, may need to do more than clarify the timeline for the CFIUS approval of the ARMZ-Uranium One deal.

She may also have to explain whether she failed to disclose to Assistant Secretary Fernandez, the State Department representative on CFIUS, that several executives at Uranium One made millions of dollars in contributions to the Clinton Foundation immediately before and after CFIUS reviewed and approved the ARMZ-Uranium One deal, CFIUS Case No. 10-40, in 2010.

Ian Telfer, Chairman of Uranium One, donated $2.3 million to the Clinton Foundation between 2009 and 2013 through his family controlled Fernwood Foundation. Other Uranium One executives and investors contributed between $1 million and $5 million during the same period.

“Mr. Telfer’s undisclosed donations [of $2.3 million through his family foundation] came in addition to between $1.3 million and $5.6 million in contributions, which were reported, from a constellation of people with ties to Uranium One or UrAsia, the company that originally acquired Uranium One’s most valuable asset: the Kazakh mines,” the New York Times reported.

When the 2010 transaction closed, ARMZ gave Uranium One $610 million in cash and controlling interest in two uranium mines in Kazhakstan in return for the issuance of 360 million new shares in the company. Combined with the estimated 109 million shares it already owned (a year earlier, it had purchased 17 percent of the company), the additional shares gave ARMZ ownership of an estimated 469 million shares, or 51 percent of the company’s outstanding 920 million shares.

Owners of the remaining 451 million shares, of whom Chairman Ian Telfer was one of the largest, received a one-time dividend of $1.06 per share, for a total of $479 million.

The Uranium One press release announcing the August 31, 2010 shareholder approval stated, “[a]s previously announced, as part of the Akbastau and Zarechnoye transaction ARMZ will also contribute US $610 million in cash to Uranium One, of which approximately US $479 million will be paid directly to shareholders (other than ARMZ) as a change of control premium after closing, by way of a special dividend of US $1.06 per share”

The company’s Management Information Circular dated April 13, 2010, a solicitation of proxies in advance of the company’s 2010 annual meeting, showed Chairman Telfer owned 800,000 shares personally and had options on an additional 675,000 shares. If those options were exercised, Telfer would have received at least $1.5 million in a one-time preferred dividend from the transaction.

Significantly, the company document acknowledges this reporting is totally reliant upon the transparency of Telfer: “The information as to common shares beneficially owned or over which control or direction is exercised (not being within the knowledge of the Corporation) has been furnished by the respective nominees individually.”

The ties between Uranium One executives and the Clinton Foundation may be stronger than has been previously reported.

Uranium One is the successor company to UrAsia Energy, the Canadian company founded in 2005 by Frank Giustra, who donated $31 million to the Clinton Foundation in 2006 and a year later established the Clinton Giustra Enterprise Partnership (CGEP), a Canadian non-profit that has raised $30 million and donated $25 million to the Clinton Foundation.

Giustra has stated that he sold all his shares in Uranium One in 2007, but he remains a close business associate with Uranium One Chairman Ian Telfer, who also serves as Chairman of Goldcorp, one of the largest gold mining companies in the world. Before he established UrAsia Energy, Giustra made huge profits on his earlier investment in Goldcorp while Telfer was at the helm there.

CGEP has refused to disclose the names of its 1,100 donors, a lack of transparency that is seen as a violation of the 2008 Memorandum of Understanding between Hillary Clinton and the Obama administration.

We may never know if Uranium One executives made even more hidden donations to the Clinton Foundation through CGEP.

According to the company’s 2010 annual report, Uranium One executives exercised options on more than 13 million shares of common stock that year. As a result of these stock options, as a group Uranium One executives received a one-time dividend in excess of $14 million.

That dividend was a very sweet financial incentive for Uranium One executives and shareholders alike.

As Market Watch reported at the time, Uranium One “[s]hareholders would receive a special dividend of $1.06 per share to compensate for the change of control whenever the transaction closes, likely by the end of the year. With Uranium One shares trading at between $2.20 and $2.60 lately, the dividend equates to 41% to 48% of recent share value.”

ARMZ acquired the remaining 49 percent of Uranium One through its ARMZ subsidiary in 2013 for $1.3 billion, or $2.86 per share. Telfer remained on the company’s board until February 2015.

If Secretary Clinton failed to disclose the ties between Uranium One executives and the Clinton Foundation to Fernandez and other representatives on CFIUS, she may have violated the terms of the 2008 Memorandum of Understanding she signed with the Obama administration that was designed to prevent conflicts of interests between her decisions as Secretary of State and donations to the Clinton Foundation, headed by her husband, former President Bill Clinton.

She may also have violated governmental rules regarding ethical conduct and recusal of government executives, and possibly the law and regulations governing CFIUS.

In a statement released by the Clinton campaign last week, former Assistant Secretary Fernandez said, “Mrs. Clinton never intervened with me on any CFIUS matter.”

Notably, Fernandez did not definitively say that Mrs. Clinton did not communicate with him about the case. Nor did he say that anyone on her staff, or his immediate superiors who reported to Mrs. Clinton at the time — Under Secretary of State for Economic Growth, Energy, and the Environment Robert D. Hormats, Deputy Secretary of State for Resources and Management and Resources Jack Lew, Deputy Secretrary of State James B. Steinberg.

While the 2010 transaction proved to be a financial boon to Telfer and other Uranium One executives, at least five members of Congress said at the time that the transfer of control over 20 percent of America’s uranium supply to a company owned by the Russian government threatened American national security.

As the New York Times reported:

Senator John Barrasso, a Republican from Wyoming, where Uranium One’s largest American operation was, wrote to President Obama, saying the deal “would give the Russian government control over a sizable portion of America’s uranium production capacity.”

“Equally alarming,” Mr. Barrasso added, “this sale gives ARMZ a significant stake in uranium mines in Kazakhstan.”

ARMZ and Uranium One had gone through the CFIUS review and approval practice a year earlier in 2009, when ARMZ announced that it was acquiring a 17 percent interest in Uranium One. That deal was consider a “covered transaction” under FINSA, and was reviewed and approved by CFIUS in 2009. Surprisingly the 2009 Annual Report submitted to Congress by CFIUS inaccurately described this approved transaction by stating the company acquiring a minority interest was Canadian rather than Russian.

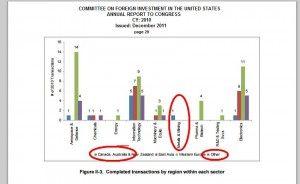

As it did in its 2009 Annual Report to Congress, CFIUS misreported the nature of the approved transaction (Case No-40) between ARMZ and Uranium One in its 2010 Annual Report to Congress. The chart on page 29 of that report shows only one approved mining transaction in 2010, and shows the acquiring company as Canadian, rather than Russian. (Highlights in red added.)

Breitbart News has asked representatives from the State Department and Treasury Department, as well as former Assistant Secretary of State Jose W. Fernandez, to provide details on the CFIUS approval of the ARMZ-Uranium One transaction. Specifically, we have asked to learn the date on which ARMZ and Uranium One jointly notified CFIUS of the 2010 “covered transaction,” and the date on which CFIUS opened Case No. 10-40 to review that transaction.

We also asked these three parties whether CFIUS Case No.10-40 was subjected to a statutorily required secondary 45-day investigation process or if the Secretary of Treasury and the Secretary of the lead agency jointly determined if such an investigation was required.

We also asked if the State Department was the lead agency on CFIUS Case No. 10-40.

Finally, we asked if Secretary Clinton disclosed to anyone involved in the CFIUS review and approval of CFIUS Case No. 10-40 that key executives and investors in Uranium One were significant financial supporters of the Clinton Foundation may have been significant financial supporters of the Clinton Giustra Enterprise Partnership.

“I will decline to comment,” a spokesperson for the Treasury Department told Breitbart News on Monday.

“By law, information filed with CFIUS may not be disclosed by CFIUS to the public. Accordingly, the Department does not comment on information relating to specific CFIUS cases, including whether or not certain parties have filed notices for review,” the spokesperson added.

A spokesperson for the State Department also responded to Breitbart News on Monday.

“By law, information filed with CFIUS may not be disclosed by CFIUS to the public. Accordingly, we cannot comment on specific transactions, including whether or not certain parties have filed notices for CFIUS review,” the spokesperson said.

On Sunday, Breitbart News asked the Clinton campaign for comment, but has received no response.

COMMENTS

Please let us know if you're having issues with commenting.