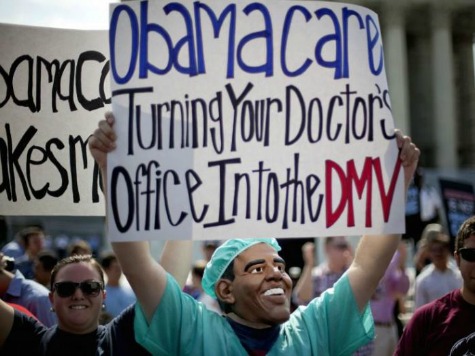

(AP) New health insurance markets: Not like Travelocity

By RICARDO ALONSO-ZALDIVAR

Associated Press

WASHINGTON

You may have heard that shopping for health insurance under President Barack Obama’s health care overhaul will be like using Travelocity or Amazon.

But many people will end up with something more mundane than online shopping, like a call to the help desk.

Struggling with a deadline crunch, some states are delaying online tools that could make it easier for consumers to find the right plan when the markets go live on Oct. 1.

Ahead of open enrollment for millions of uninsured Americans, the feds and the states are investing in massive call centers.

When the markets first open, Hencoski said, “there will be a significant amount of manual processing of things that will later be automated.” Translation: emails, phone calls, faxes.

The Obama administration, which will be running the markets or taking the lead in 35 states, has yet to demonstrate the technology platform that will help consumers get financial help with their premiums and pick a plan.

Officials say they always envisioned people would be able to apply in a variety of ways, from online to the mail. About 7 million are expected to enroll in the marketplaces by next year, and the administration says consumers will be pleased with the experience.

Also known as exchanges, the markets are supposed to transform the way individuals and small businesses buy private health insurance by increasing transparency and competition, bolstering government oversight of insurers, and injecting hundreds of billions of dollars in taxpayer subsidies.

The experience will be more like buying a new car than snapping up airline tickets on Travelocity or electronics on Amazon.

It’s a complicated transaction with different components, including arranging financing and picking the right product, each with its own choices and trade-offs. You may need a glossary of health insurance terms.

And there’s another layer.

One part of the process involves applying for federal benefits _ with consequences if you lie to the government, or maybe just make a mistake.

Another involves using your federal subsidy to pick the right insurance plan from among competing carriers and four coverage levels: bronze, silver, gold or platinum.

You’ll log on to the marketplace in your state, or the federally run exchange, and set up a personal account. You’ll enter information about yourself and your family, including Social Security numbers and household income. The exchange will shoot your data to something called the “federal data services hub,” an electronic clearinghouse that pings Social Security, Homeland Security and the Internal Revenue Service to verify your personal details.

The IRS will calculate the maximum health insurance subsidy that you’re entitled to. It’s set up as a tax credit, so the taxman can come back to collect if you claim too much. Discrepancies between the information you submit and what’s in government records will take time to straighten out.

Once you’ve got your subsidy nailed down, then you’re ready to pick a plan. Once you do that, the U.S. Treasury will send your insurer a payment on your behalf, and you’ll pay any difference. Coverage begins Jan 1.

Experts say the technology to facilitate online shopping among health plans is difficult to engineer. Some online tools are getting pared back and the refusal of congressional Republicans to provide more implementation funds for “Obamacare” probably isn’t helping. Some examples:

_ The Rhode Island marketplace will postpone a feature that allows consumers to enter the names of their doctors and instantly find out what insurance plans they accept. Consumer advocates say such a tool is important to help winnow choices. Instead, shoppers will be steered to the doctor directories of individual plans. The federally run marketplaces will also lack “all-plan” doctor directories.

_ The marketplace in Washington state is delaying its online-chat capability, as well mobile device features that would enable consumers to check their enrollment status. “These are some of the top items that we will focus on for the next version,” said spokesman Michael Marchand.

_ The Minnesota exchange is delaying a feature that would allow consumers to update their coverage to reflect life events such as the birth of a baby because that information won’t be needed right when sign-up begins.

_ It’s unclear how sophisticated online calculators will be at helping consumers pick the best-value plan. For the federally run exchanges, officials said the calculator will automatically subtract the consumer’s tax credit from plan premiums _ a help. But it won’t provide an estimate of likely out-of-pocket costs that the plan doesn’t cover, a feature consumer advocates say is closer to the true bottom line.

State officials say things will improve as the new program takes root.

With time, “it’s going to get a lot more user friendly and effective,” said Ferguson, the Rhode Island director. “Were there things I would have liked to see delivered on Oct. 1 that are going to be delayed? Yes. But is that something that I think is horrible? No.”

___

Associated Press writers Rachel LaCorte in Olympia, Wash., and Steve Karnowski in Minneapolis contributed to this report.

New Health Insurance Markets Not as Easy as Hoped

COMMENTS

Please let us know if you're having issues with commenting.