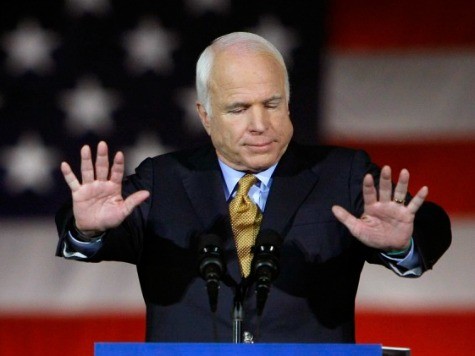

Massachusetts Democrat Elizabeth Warren and Arizona Republican John McCain have introduced legislation to separate commercial and investment banking a la the Depression era Glass-Steagall. The proposal is more of a political exercise since the legislation has little chance of approval, but it is important because the political attraction of beating on the largest banks has not diminished now five years after the start of the subprime crisis.

I spoke about the McCain-Warren proposal on CNBC Friday. One major point to make is that the current situation with respect to the largest banks and limits on their business activities is a problem. The Volcker Rule, named after former Fed Chairman Paul Volcker, restricts banks from trading for their own account. This restriction comes from the Dodd-Frank law and seeks to address a problem with principal trading that does not exist.

The 2007 subprime crisis was provoked by a sharp decline (disappearance really) of liquidity in private label mortgage securities and derivatives. When investors fled these assets, a liquidity run emerged that eventually engulfed Bear Stearns, Lehman Brothers and even Citigroup. Fears about the value of mortgage securities eventually caused the collapse of government-sponsored mortgage agencies Fannie Mae and Freddie Mac. Names like Countrywide and Merrill Lynch were acquired by Bank America. JPMorgan bought both Washington Mutual and Bear Stearns.

The interesting thing about McCain-Warren is that it would complete the evolution only partly accomplished by the Volcker Rule, namely that it would separate trading from banking, and allow the dealer to trade for its own account. As we discussed Friday on CNBC, the Volcker Rule limits the trading activities of banks for their own account and sequesters their capital from the financial markets. This change, which actually helped to reveal the London Whale trading scandal at JPMorgan, reduces the overall liquidity of the global debt and equity markets dramatically.

So ultimately we need to either repeal the Volcker Rule or go forward with something like a Glass-Steagall type legal separation of banking from investment activities to release this capital. In the latter case, the banks would function as depositories and fiduciaries, and they would become clients of the investment banks. The investment banks would need to have pretty substantial balance sheets to operate outside the umbrella of too-big-to-fail. But this would be a big improvement over the current very dangerous situation. I blame the Volcker Rule for the disorderly market retreat in June after Fed Charman Ben Bernanke’s comments (See my post in Zero Hedge).

Of note, the last several lines of the McCain-Warren proposal deletes some of the exemptions from the federal bankruptcy code for over-the-counter derivatives. This implies that the dealers which traffic in these ersatz financial instruments could indeed fail in bankruptcy. One of the chief reasons that former Treasury Secretaries Tim Geithner and Larry Summers have refused to support the breakup of the big banks or the prosecution of the top executives is because of fear of “financial contagion,” but McCain-Warren explicitly rejects that view.

The fact that Geithner and Summers don’t support a re-imposition of the Glass-Steagall style regime is no surprise. Lloyd Green writes in The Daily Beast, reviewing Neil Barofsky’s 2012 book “Bailout,” that “that Geithner ‘made the preservation of the largest banks, no matter the consequences, a top priority of the U.S. government,” blaming “perversion of the U.S. criminal justice system,’ for the hands-off approach toward prosecution of financial crimes under Obama. Barofsky, I should note, is a former federal prosecutor, a Democrat, and a contributor to the Obama 2008 campaign.”

Treasury Secretary Jack Lew is no friend of Glass-Steagall-type legislation either and has already dismissed the idea in congressional testimony. Robert Sheer wrote in the Huffington Post back in January:

“I suppose that he can’t be much worse than Timothy Geithner, but that should be scant cause for cheer over the news that the president has nominated Jack Lew as Treasury secretary. Both championed the financial deregulation craze of the Clinton administration, and both are acolytes of Robert Rubin, the former Clinton Treasury secretary who unfettered Wall Street greed and then took his own considerable cut of the action.”

Senators Warren and McCain should not expect any support for their crusade against the big banks, an epic struggle that is almost as old as the American Republic. It is worth noting that when FDR commanded that Congress pass Glass-Steagall in the dark days of 1932, attacking the big banks and Wall Street speculators was good politics. His cousin Theodore Roosevelt did similarly several decades earlier with his “trust busting” campaign against JPMorgan and the Money Trusts.

But today the banksters not the New Dealers run Washington, at least in large part, so odds are that McCain-Warren proposal will never be more than a convenient fund raising opportunity for deserving members of Congress. Suffice to say that during the earnings conference call today by JPMorgan, the bank’s spokesperson said that “they never think about” Glass-Steagall type business configuration and that their customers like doing business with the nation’s largest bank just as is. Nuff said.

COMMENTS

Please let us know if you're having issues with commenting.