“You thought socialism was dead, other than in miserable countries such as North Korea and Cuba? Think again. It’s alive and well at the Federal Reserve, and we and the world are paying a price for it.” — Steve Forbes, February 12, 2012, “Ben Bernanke: Supreme Socialist”

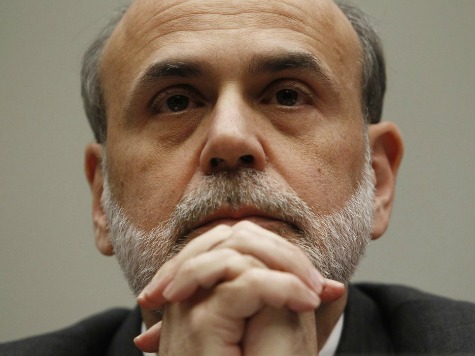

Federal Reserve Board Chairman Ben Bernanke is having a bad week. The fun started on Monday on PBS with Charlie Rose, when President Barack Obama said Chairman Bernanke has stayed in his post “longer than he wanted,” effectively firing the central bank chief on national television.

Then on Wednesday, after the Fed’s two days of deliberations regarding Monday policy, Bernanke’s held his now routine press conference and proceeded to drop several bombs on the financial markets. The Dow Jones Industrial Average ended up down 200 points in a resounding thumbs down from investors. Treasury bond yields are at the highest rates since 2011, all thanks to Ben Bernanke’s best efforts.

The first of Bernanke’s mistakes is trying to be clear and transparent. Markets don’t really like to hear clear, direct statements from central bankers. By trying to be more transparent and open with monetary policy, Chairman Bernanke is actually making the financial markets more volatile. His “hypothetical” example of how the Fed might stop buying $85 billion per month in Treasury bonds and agency paper stampeded Wall Street’s bulls.

But the second mistake made by Bernanke is to continue printing money even as the private sector is showing signs of a modest real recovery. As CNBC’s Rick Santelli asked after the press conference: “The one question I want to ask Ben is, ‘Ben, what are you afraid of?'”

CNBC, all the channels that cover business, we have person after person after person, buy side, sell side, upside, downside, how is the economy? The economy is great. What about stocks? You got to buy them. What if they break? You have to buy the dips. What’s wrong with the economy? I don’t hear these people saying anything is wrong with the economy. So what’s wrong, Ben? Why can’t we get out of crisis management mode?

The sad truth is that Bernanke is caught up in a key fallacy of the Keynesian-socialist tendency led by Nobel laureate Paul Krugman, namely that you can use “a little inflation” to grow jobs. In fact, as former Fed Chairman Paul Volcker noted in our last comment, there is no tradeoff between jobs and inflation. The whole idea of being able to use inflation to grow real jobs is false.

“The unemployment rate is not going down because people are not getting jobs,” Santelli ranted further. “I think that the Fed has the tiger by the tail, as much as they think that they have figured this out.”

Nobody at the Fed is ready to admit that the extreme monetary policies now being followed are not really effective in terms of creating jobs above current modest levels of growth. This is the new normal, folks. But now that the Fed has explicitly tied zero interest rate policy to a lower unemployment rate, the prospect is for years more of the Fed running the monetary printing presses.

Former Presidential candidate Steve Forbes stated flatly that “Bernanke has failed” when it comes to fixing the US economy. “It is going to be good for the markets when the Fed tapers off, less distortion for the credit markets,” Forbes told Maria Bartiromo of CNBC. “This whole premise that the Fed is helping the economy… needs to be closely reexamined.”

Noting that the Fed Chairman talked about fiscal policy being a drag on the economy, Forbes flatly stated that “when you fail you blame somebody else. After the crisis of 2008, the Fed has hurt the economy and not helped it.” Forbes particularly blames the Fed and easy money for channeling credit to the largest banks and companies at the expense of small businesses, which he notes are the single biggest source of new jobs in the US economy.

Look at the pace of the recovery. After every sharp downturn, including the Great Depression, at least initially you get a sharp upturn. Then the question becomes can you sustain it. We never got a sharp upturn. In 2010, 2011, 2012, we’ve been piddling around at 1.5% growth. That’s never happened… This is a punk recovery.

Bottom line is that Ben Bernanke got fired by Barack Obama at the start of the week because he can’t get the economy back to the level of jobs prior to 2008. The task is impossible. He looks to be ending the week as the least credible Fed Chairman in the history of the institution. The only real question now is whether Bernanke can stay in office to finish his full term, which ends in January 2014.

COMMENTS

Please let us know if you're having issues with commenting.