A decade ago, former Federal Reserve Board Chairman Alan Greenspan and his colleagues on the Federal Open Market Committee were presiding over the lowest interest rates since WWII. The terrorist attack on September of 2001 had spurred the central bank to reverse course and ease tighter policy put in place to cool the financial bubble in technology stocks. The reason for this change in interest rate policy was to arrest any negative economic response from the dastardly act on 9/11.

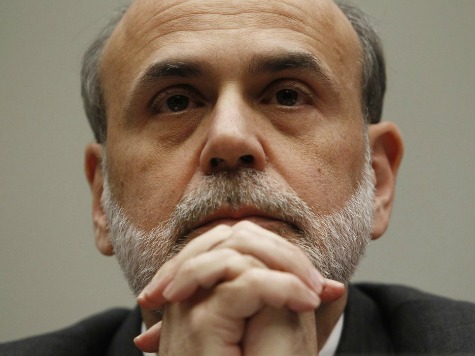

But the long-term negative impact of that decision by the Fed continues to color our economic life even today. No matter your good intentions as a central banker, attempting to fine tune the economy is a dangerous act of folly. In my last comment, “Bernanke’s Housing Bubble is Unsustainable,” we talked about why the Fed’s policies have created an unsustainable situation in the housing sector. The impending problems stemming from the latest round of Fed interest rate ease have begun to emerge in the past week, with financial markets showing more volatility than has been seen in years. But the chief problem facing financial markets is the total lack of independence from the White House of the Bernanke Fed.

“If Bernanke had put even a modest tightening in place at his first FIMC meeting at the end of January 2006, he would have had board support and would have established his Independence,” notes a veteran Republican staffer on Capitol Hill who’s followed Fed policy for three decades. “He didn’t and the market’s had its spurs into him ever since.”

The 2006 timeframe is crucial to understanding why current Fed policy is likely to end in tears. By the middle of that year, banks like Countrywide and Washington Mutual were already showing visible signs of distress. But Ben Bernanke and his Republican-appointed colleagues on the FOMC did nothing, turning aside warnings from credible Wall Street observers that the subprime debt market was about to collapse. But Bernanke’s FOMC kept interest rates low until the start of 2008, a critical mistake.

Since it is assumed that Chairman Bernanke is leaving the Fed at the end of his term next July, the natural expectation is for the outgoing chairman to keep the froth up. Greenspan did the same, to his discredit, and Bernanke will too because the entire FOMC, who are mostly left-of-center Obama appointees, is on board for endless interest rate ease. This fact is what is really driving fears in the financial markets.

Had Bernanke raised interest rates even a smidgen in 2006, the subprime crisis would have been far less serious. Much of the worst subprime loan production came after 2006, let us recall, but to his credit, Bernanke has accepted responsibility for this error. Yet he is doing the very same thing again as we all watch. The collegial Bernanke is too worried about his public image and transparency that he has forgotten that part of this job is to say “no” occasionally to the White House and Congress.

The failure of Bernanke’s FOMC to pull back on low interest rate policy is already causing turmoil in the financial markets. Over the past several weeks, yields on Treasury debt have risen more than a half a point and bond prices have fallen proportionately. In the mortgage market, the current coupon for agency securities has risen almost a point in the past month, so that the on-the-run coupon for GNMA securities is almost three percent. Home loan rates for consumers are rising rapidly as a result.

The public REITs, commercial banks, and exchange traded funds which own debt securities using leverage and fund themselves in the short-term markets are under growing stress. Again, had Bernanke slowed Fed interest rate ease several years ago, we would not today be looking at bubbles in the debt and equity markets alike. Instead we now face a replay of the 2007 market liquidity crisis as smaller, more limited short term debt markets are tested. As and when the Fed does eventually shift policy in a formal sense, there could be a significant market retreat. Indeed, it seemingly is already underway.

COMMENTS

Please let us know if you're having issues with commenting.