On Tuesday, Intrade, the Irish based market predictions company, announced that “the report of Intrade’s death was premature.”

In a statement posted on its website, the company clarified its Monday announcement that it was closing the accounts of American customers. Although the company did not explicitly confirm it, Monday’s action was in response to a lawsuit filed by the Commodity Futures Trading Commission (CFTC) against Intrade and its parent company, Trade Exchange Network (TEN), that same day:

We understand yesterday’s announcement was met with surprise and disappointment by our US customers, but this in no way signals the end of Intrade in the US. In the near future we’ll announce plans for a new exchange model that will allow legal participation from all jurisdictions – including the US. We believe this new model will further enhance Intrade’s position as the leading prediction market platform for real time probabilities about future events.

In its initial statement on Monday, the company said:

We are sorry to announce that due to legal and regulatory pressures, Intrade can no longer allow US residents to participate in our real-money prediction markets.

Unfortunately this means that all US residents must begin the process of closing down their Intrade accounts. We strongly urge you to begin this process immediately. . .

We understand this announcement may come as a surprise and a disappointment, and we apologize for the short notice and haste required to deal with this. We would like to sincerely thank all US customers for their custom, support and loyalty over the years.

Back in 2005, the CFTC and TEN settled similar charges when TEN agreed to pay a modest civil penalty of $150,000:

The U.S. Commodity Futures Trading Commission (CFTC) today announced the filing and simultaneous settlement of charges under the Commodity Exchange Act (CEA) that Trade Exchange Network Limited (TEN), a limited liability company based in Dublin, Ireland, solicited and accepted orders from U.S. residents for commodity option contracts that were not excepted or exempted from the Commission’s ban on options. TEN owns and operates an Internet-based trading platform that facilitates trading through its websites www.Tradesports.com, www.Intrade.com, and www.TradebetX.com.

The CFTC’s 2005 complaint against TEN was handled quickly without the need for either lengthy litigation or the initiation of drastic protective action by TEN and Intrade, as the agency’s own press release confirmed:

TEN’s high level of cooperation during the underlying investigation resulted in a reduction of the civil monetary penalty to $150,000, which TEN agreed to pay. The order also calls for TEN to cease and desist from further violations of the CEA and comply with specific undertakings. In consenting to the entry of the CFTC’s order, TEN neither admitted nor denied the findings made in the order.

In its statement on Monday announcing the new litigation, the CFTC claimed that TEN and Intrade violated this 2005 consent order:

[T]he complaint alleges that TEN violated an order issued by the CFTC in 2005 that found that TEN had previously engaged in similar conduct and ordered TEN to cease and desist from violating the Commodity Exchange Act and CFTC regulations, as charged.

Bryan Caplan at the Library of Economics and Liberty writes that the CFTC’s motives in undertaking this new litigation against Intrade may not be entirely pure:

The CFTC’s real complaint is that consumers eagerly bet on Intrade because the company exemplifies market integrity: “I trust Intrade with my money because of their reputation, not government regulation.” Reputation: That’s the same mechanism, of course, that underlies eBay, Amazon Marketplace, and the whole cornucopia of internet commerce that the mainstream information economist of 1990 would have dismissed as free-market Fantasy Island.

If the CFTC really wants to protect market integrity, it should start by publicly admitting that if the CFTC ever served a useful function, that time has long since passed. Americans send money to Intrade because Intrade delivers the goods (and produces the positive externality of accurate forecasts in the process!).

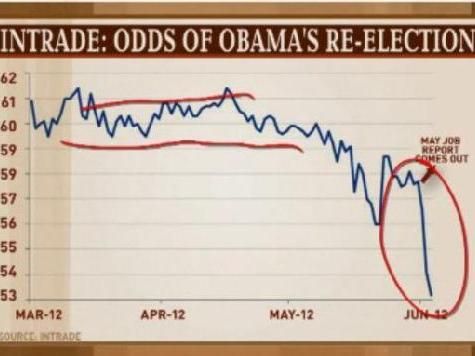

On learning of the CFTC lawsuit against Intrade and the company’s initial response on Monday, Nate Silver, the New York Times blogger who accurately predicted the re-election of President Obama, sent out the following tweet:

Out of all things the CFTC could be doing to protect consumers and investors, it chooses to sue Intrade?!? http://1.usa.gov/XWqzrC

Breitbart News posed the same question to officials at the CFTC on Tuesday. Why was suing Intrade and its parent company, TEN, such a high priority for an agency established by Congress to protect customers from fraudulent trading of the sort engaged in on a massive scale by companies like MF Global?

As of the time of publication, no one at the CFTC had responded to our inquiry.

It’s worth noting that no consumers appear to have come forward claiming they have been defrauded by TEN or Intrade. In contrast, consumers lost billions in Jon Corzine’s MF Global debacle, which was subject to CFTC regulations.

COMMENTS

Please let us know if you're having issues with commenting.