We were severely criticized last week by the left and the right for publishing “CALIFORNIA DEFAULT RISK TURNS BROWN INTO A CAPITALIST.” The report highlighted that California Governor Jerry Brown is steam-rolling environmentalists and regulators to generate more state tax revenue by expediting approval of pro-business infrastructure. But our detractors were stunned to learn from State Controller John Chaing that California’s July sales tax revenue was down 33.5% from the budget approved in late June. Even more ominously, the state’s $9.6 billion cash deficit that was rolled over from the June 30th fiscal year has catapulted to $18 billion last month.

The state has avoided default by temporarily borrowing from state trust funds, but those accounts will soon need their cash back to continue operating. Today California quickly began trying to sell $10 billion in municipal bonds to fund the record $28 billion they need to keep the lights on. With tax revenue plummeting and the state already the second lowest rated credit in the country, if the independent credit rating agencies downgrade the state to “junk bond”, California will be short up to $18 billion and default.

Governor Brown used his line-item veto authority to strike $128.9 million in spending from the $91.3 billion California general fund before signing the state budget. Brown’s cuts surprisingly hit Democrat priorities, such as spending for child care and preschool for low-income children, and closing 30 state parks. But Republican Senator Tom Berryhill warned Brown: “This budget is a slow-motion train wreck, and you’re driving the bus.” Berryhill criticized Democrats for failing to reign in public pensions, regulatory terrorism and cap state spending that Republicans say are all needed to rescue state government. But by agreeing to sign the budget before the June 30th end of the fiscal year, Brown spared all the California legislators from losing their paychecks under a voter-approved initiative that blocks their pay if a budget is late.

The governor justified signing the budget based on the twin assumption that the California economy was expanding and the voters would approve his tax initiative that would raise $8.5 billion. Many analysts doubted the voters willingness to vote to raise sales tax on themselves, but we were virtually alone in warning California’s shallow economic recovery had peaked and the state was at risk for a double dip recession.

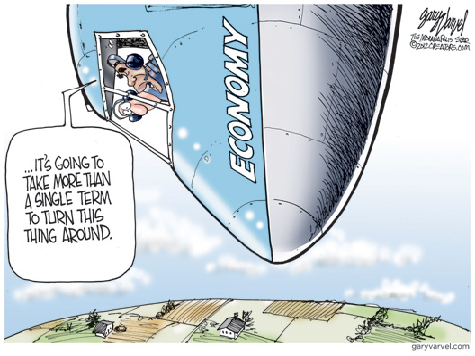

State Controller John Chiang tried to rationalize that even though California revenues were “disappointingly” down $475 million in July: “However, because spending appears to be tracking and the funds that the State depends on for liquidity are performing well, California’s cash outlook remains stable.” This is sort of like the pilot of a jumbo jet announcing to the passengers that as a safety precaution they may want to cross your arms over your calves and grab your ankles and to brace yourself for possible impact.

Chriss Street will be in Studio with Paul Preston on

“The American Exceptionalism Radio Talk Show”

Streaming Live Monday through Friday at 7-10 PM

Click here to listen: http://www.mysytv.net/kmyclive.html

COMMENTS

Please let us know if you're having issues with commenting.