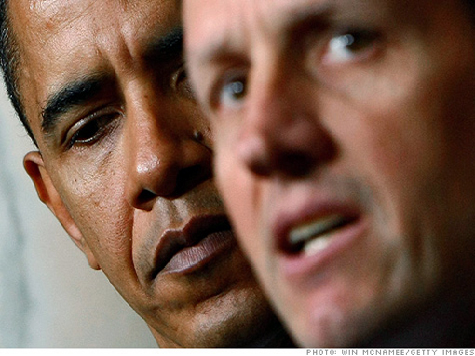

In response to a question Wednesday morning in Europe, Treasury Secretary Timothy Geithner said that Congress should be taking advantage of low interest rates and increase investment (spending) to bolster growth. He said that the low rates on U.S. debt indicate confidence in the American economy. “We pay about 1.5% for a 10-Year Treasury now, to borrow long term now, because fundamentally people have faith in the ability of the U.S. to solve its problems.” Either Mr. Geithner is ignorant or lying. We know he is intelligent. He must be lying.

Treasury prices (and therefore rates) are not being set by the market. They are being set by the Federal Reserve. Typically, according to Bill Gross of PIMCO, the Federal Reserve buys 10% of Treasuries issued. Last year, the Fed bought 61% of all the government debt issued by the U.S. Treasury. Net issuance last year, according to the Wall Street Journal, amounted to 8.6% of GDP, or about $1.3 trillion. Before the crisis, net issuance ran about 5% of GDP. Fed intervention makes demand seem higher than it really is, and, therefore, interest rates lower. Where the rate on the 10-Year would be without the Fed’s intervention no one knows, but it would be higher than 1.5 percent.

In 2007, just before the crisis, total Federal debt amounted to $9.0 trillion. Today, it is $15.9 trillion. Five years ago the Fed’s balance sheet was $870 billion. Today, it is $2.9 trillion. In other words, the Fed now owns approximately 18% of all Federal debt. In 2007 it owned 9.7 percent. Should the Administration continue to increase spending, as Mr. Geithner is suggesting, it places the Federal Reserve in a difficult predicament. If they do not go along with QE3, what happens to interest rates? If they do go along, how do they eventually unwind an even larger position?

As the Wall Street Journal put it in a lead editorial on Wednesday, “Sooner or later we’ll discover that their [central bankers] money illusion can’t save our economy from its more fundamental problems.” What is needed is tax reform and regulatory simplification.

Thus far, all the heavy lifting, in terms of effective economic policy, has been done by the Federal Reserve. The Administration attempted a heavy dose of Keynesian economics in 2009-2010 with the ill-fated, and now infamous, stimulus. There was a moment when it appeared bi-partisanship might work, when the President, in early 2009, appointed a debt-deficit commission. But when he ignored their findings, any hope for bi-partisanship dissipated. Following the interim elections, when Republicans took control of the House, Washington became deadlocked. So the Fed has been the only game in town. Neither the President nor the Congress has taken responsibility. Blame has been tossed every which way. There have been no mea culpas. The losers have been the American people, especially the middle class.

Nobody knows where interest rates will go when the Fed vacates the scene, which they will do at some point. The only thing we do know is that they will go up. Interest rates have been declining for thirty years. Would the bull market in bonds have come to an end without the Fed? Nobody knows. How long will this trend continue? Again, no one knows. What we do know is that the Federal Reserve kept short rates too low for too long beginning in the mid 2000s, encouraging subprime borrowers, speculators in financial markets and helping to overheat the housing market, all of which were instrumental in causing the credit crisis of 2008.

It is fair to assume that without the Fed’s intervention, interest rates today would be higher, but again we cannot know by how much. But the Treasury Secretary is being deceptive when he tells us that our low interest costs are due to the demand and faith of investors. If only that were the case. When he blithely calls on Congress for more stimuli, he risks raising the costs substantially for future generations, in order to satisfy his one short term goal – the reelection of his boss.

The Administration is playing a dangerous game. They persist in the pursuit of a Keynesian answer, with government playing a leading role in markets, whether it is with General Motors and the Volt, wind and solar farms, or with the nationalization of student loans and the expansion of the Community Reinvestment Act. With a focus on the short term, they have lowered predictability and confidence, damaging to both job creators and consumers. At the same time, they are imposing enormous burdens on future generations, while limiting the ability of free markets to regenerate.

The only policy that has been deployed over the past three and a half years has been monetary. Yet, in each successive intervention, the yields have produced diminishing returns. Among the losers are savers and the retired with interest rates on commercial paper, for example, of 0.20% versus 5% four years ago. Also, losers include low and moderate income families who have seen spikes in food and energy prices, as too-low interest rates have encouraged commodity speculation.

Franklin Roosevelt once offered some good advice, but unfortunately never took it himself: “Do something. If it works, do more of it. If it doesn’t, do something else.” President Obama, in almost perfect imitation, said the same thing in Ohio a couple of weeks ago. Yet he and his Administration persist in interventionist policies, which have kept unemployment high and produced mediocre economic results. He has relied on the Fed to keep rates low and his Czars to implement executive-ordered mandatory regulatory change. Instead of heeding his own words or those of his predecessor, the President and his Administration more closely fit Albert Einstein’s definition of insanity: “Doing the same thing over and over again and expecting different results.”

The American people are intelligent. Duping them, as Mr. Geithner attempted to do earlier this week in London, is neither good economics, nor good politics. The title of this piece stems from the poem “Liar”, written by William Blake in 1810, which is somewhat more elegant than the playground taunt, but the meaning is still the same:

Deceiver, dissembler

Your trousers are alight

From what pole or gallows

Do they dangle in the night?

COMMENTS

Please let us know if you're having issues with commenting.