The financial reform bill is finally in its home stretch in the Senate, but Americans have yet to fully engage on the issue. In fact, in recent weeks as I’ve worked with various grassroots leaders across the country to discuss the bill, its impacts on our economy and on us as American citizens, I must admit, it’s probably the first time I’ve ever found myself frustrated at the progress of activism.

It’s a complex issue, and let’s face it, not exactly an exciting one either. But that’s precisely what the left is counting on. So, whenever I find myself feeling frustrated that others might not share my same level of fervor on the issue, I remind myself of its complexity and lackluster appeal. And then, I proceed directly to the source – the bill itself.

I hone in on a few key points in three categories that resonate with most activists I know: Big Labor, Big Government, and Big Brother. Put those together in the context of Big Banks, and they spell out big disaster.

As the left goes on demonizing Wall Street and big bankers on one hand, Democratic lawmakers on the other hand are busy making sweetheart backroom deals with them up on Capitol Hill, promoting their legislation to the public as “consumer protection.” But really, such measures are nothing more than payback to the likes of three-way mortgage entitlement partnership stronghold of the Bank of America, Center for Responsible Lending and Fannie Mae.

Meanwhile Democrats and Obama allies like Organizing for America are also using the issue as a shameless fund-raising opportunity.

The banks actually SUPPORT this bill – so don’t let that “Main Street Not Wall Street” message fool you, no matter which side of this issue you’re on.

Once many people learn about some of what’s in the bill, their reaction of immediate remorse followed by outrage is completely understandable. Remorse – for some – for not having engaged their grassroots groups earlier. Outrage over just how much this bill would push the country head first toward socialism. That’s right, I said the “s” word. Let’s stop pretending and just call it for what it is, shall we? Even old school Democrats I talk to feel the same outrage and see the “s” word coming as the result of this bill. Facing down the inevitable is the only way we’re going to be able to tackle what the radical left has snuck into this thing. All the while, they have been counting on the apathy of average citizens on BOTH sides, and on the burnout of Tea Party and other patriot group activists.

The reality is this: If we sit back and allow this bill to pass the Senate in its current form, then we deserve the destruction of our privacy, our liberties and of our free market system that will follow. WE will be the only ones to blame. Because as bad as we all thought the Health Care bill was for our freedoms, the Financial Reform bill makes Health Care pale in comparison. No level of remorse could suffice if we failed to engage every last patriot, every last Paul Revere and Sam Adams , during these final days of the legislation.

I’ve found that one way to help other activists digest this bill has been to put all of the actual financial details aside and focus solely on some of the parts of the bill that demonstrate the erosion of our personal liberties and the free market system as we know it.

Big Labor: Dismantling the Free Market System

Under the American Financial Stability Act of 2010 (S 3217), several provisions tucked away in the bill will give labor bosses unprecedented powers that, especially if abused, could threaten the very structure of our free market system.

- Financial institutions and other covered businesses could be required by law to give labor unions “Proxy Access”, enabling union bosses to potentially abuse the system to force unrelated agenda items, like unionizing the firm’s employees, before the shareholders

- New regulations will control how board of director elections are conducted – at private corporations!

- Similar rules will also determine whether an individual may serve as both the CEO and Chairman of the Board – at a private corporation!

- Government and labor unions will have “say on pay” for the annual salaries and bonus compensation of executives and other employees. Essentially, like Obama himself, they can determine at what point “someone has made enough money”

I don’t think anyone’s against shareholders having their proper say and representation in the corporate management process. But that’s not really what’s behind these pieces of the legislation. We’ve seen how today’s labor bosses are abusing their powers and using the shareholder resolution as a hostage weapon to bully corporations into unionization and special union concessions. Just read my prior post, “SEIU’s Secret Weapon: If Obama’s Plan Fails, Brandish the Shareholder Resolution” for a taste of that tactic.

It’s been known for some time that labor bosses are now organizing on a global scale, and as such, have taken to the Participative Management style common in European workplaces. In the U.S., private corporations might typically achieve a similar democratic process of employee participatory management when the company enters into a direct employee ownership plan. The difference here however is that we’re talking about companies that do not belong to the labor unions – these are companies in which the union might have a pension fund investment, or perhaps some of its workers unionized on premise. These are private companies that the unions attempt to overtake through such smaller connections to earn a place on the board, and then change it from the inside out until a Participative Management environment is achieved. If that achievement were to occur, US corporations would quickly fold and restructure under a more socialist model. Eventually, the free market system would erode away as labor unions take over the boards of once privately owned corporations.

For weeks now, Ive been searching for the resources to help me describe this threat in simple terms, and just as fate would have it, my friend Peter List over at LaborUnionReport and RedState pens the perfect post describing this with clarity and precision, in his post titled “Changing America Forever: Behind the AFL-CIO’s Push for Financial Reform.”

Big Government: Power, Control and Everlasting Entitlements

- A new agency, the Consumer Financial Protection Agency, or CFPA, would serve as massive bureaucracy that would control everything from defining the types of loans consumers may be permitted to purchase, to expanding redlining provisions and subsequent mortgage entitlement programs. (And let’s not forget that the head of this agency would be Eric Stein, who ran the Center for Responsible Lending, and before that worked at Fannie Mae)

- The CFPA’s authority goes far beyond banks or financial institutions. This new bureaucracy would have the power to regulate hundreds of thousands of businesses. Examples of small businesses that would be subject to CFPA oversight (as outlined by the US Chamber of Commerce):

- A nonprofit organization that provides financial literacy education

- A software company that creates products to help consumers manage their money

- An advertising company that provides services relating to financial products

- Utilities companies, retailers and even doctors that extend credit to their customers.

- The Consumer Financial Protection Agency, or CFPA, created in the bill would be housed within the Federal Reserve, an already secretive and unchecked force of power in our financial system that insists on going unaudited

- A government agency will have unlimited executive bailout authority, including the power to pick and choose which companies are saved and which are left to fail. This creates serious potential for abuse, as private corporations could literally live or die based upon political decisions

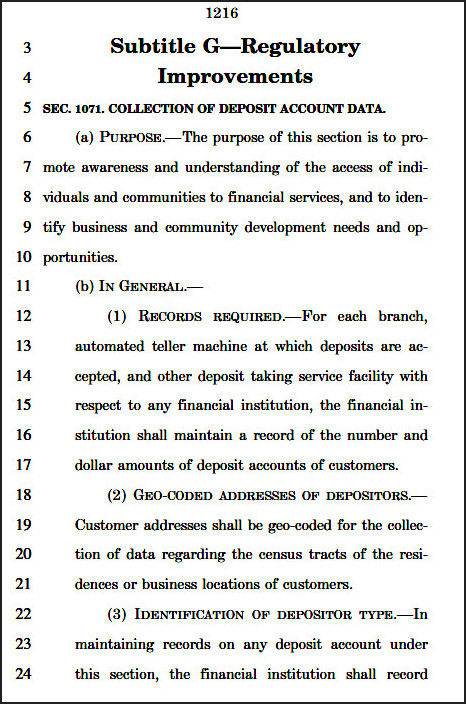

- This bill contains the same language used by groups like the Center for Responsible Lending in the redlining laws and changes to the Community Reinvestment Act in 1995 for special research centers and programs “that promote awareness and understanding of the access of individuals and communities to financial services, and to identify business and community development needs and opportunities”

And we all know what happened as the result of those redlining laws and subsequent CRA changes in 1995.

Big Banks: Empowered by Big Government, Become Big Brother

Finally, in order to justify all these entitlement programs, all this forced unionization, all this takeover of private companies’ boards of directors, the government needs research. Not to worry, the bill creates vehicles for that, like the “Office of Financial Research” and a national database for the collection of your personal bank account and loan information, and various deposit account data.

Fannie Mae and Bank of America will be so thrilled when this passes the Senate (as will ACORN and SEIU). Thanks, of course, to years of lobbying by organizations like the Center for Responsible Lending. After all, they pioneered the use of banking research to mandate mortgage entitlements. Just imagine all the new entitlements that will be created once they can analyze all of that *new* banking information and data on what we’re purchasing. Someone will find some injustice somewhere in there. You can count on that.

If you haven’t been as interested in all the complex language about things like financial derivatives and credit default swaps in this bill, then all of this above should be plenty for you to be concerned about.

COMMENTS

Please let us know if you're having issues with commenting.