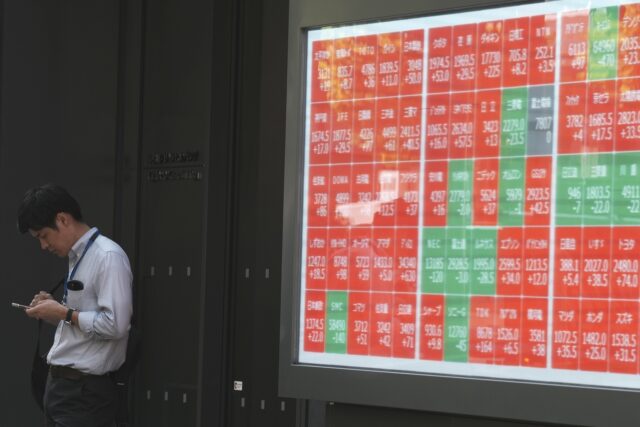

Asian shares are mostly declining amid uncertainty ahead of the U.S. election next Tuesday

Stock market today: Asia shares mostly decline as investors await earnings, US electionsBy YURI KAGEYAMAAP Business WriterThe Associated PressTOKYO

TOKYO (AP) — Asian shares mostly declined Thursday as investors grappled with uncertainty ahead of the U.S. election next Tuesday.

Japan’s benchmark Nikkei 225 dipped 0.5% to 39,081.25. Australia’s S&P/ASX 200 slipped 0.3% to 8,160.00. Hong Kong’s Hang Seng rose 0.4% to 20,451.69, while the Shanghai Composite added 0.5% to 3,282.13.

South Korea’s Kospi dropped 1.2% to 2,563.14, after North Korea’s test-launch of a new intercontinental ballistic missile that is designed to hit the U.S. mainland in a move that was likely meant to grab America’s attention ahead of Election Day.

Markets also were watching the Bank of Japan, which kept its benchmark rate unchanged at 0.25%. Japan is also facing political uncertainty after the ruling party, tainted by campaign financing scandals, lost its majority in the lower house of parliament, at elections last weekend.

Upcoming earnings releases in Asia, as well as the rest of the world, also added to the wait-and-see mood.

On Wall Street, the S&P 500 slipped 0.3% to 5,813.67 after drifting between small gains and losses several times, though it’s still near its all-time high set earlier in October.

The Dow Jones Industrial Average edged down 0.2% to 42,141.54, while the Nasdaq composite slipped 0.6% to 18,607.93, from its own record set the day before.

Alphabet climbed 2.8% after beating analysts’ forecasts for profit in the latest quarter, thanks largely to the performance of its Google business. It’s the latest of the highly influential group of stocks known as the “Magnificent Seven” to top high expectations for growth.

Computer chip companies have been some of the biggest winners of the artificial intelligence rush, but Advanced Micro Devices helped drag down stocks across the industry after reporting profit for the latest quarter that only matched analysts’ expectations.

Nvidia, a chip giant that’s rocketed to become one of Wall Street’s largest most influential stocks, fell 1.4% and was one of the heaviest weights on the S&P 500.

One of the few stocks to hurt the index nearly as much was Eli Lilly, which sank 6.3% amid concerns about two of the drugmaker’s blockbuster products: diabetes treatment Mounjaro and weight loss counterpart Zepbound.

Also falling was Trump Media & Technology Group, the company behind former Donald Trump’s Truth Social platform. It dropped 22.3% for the worst loss since taking its place on the Nasdaq stock market following a merger with another company in March. The stock is notoriously volatile, and it had been rallying strongly over the past month, up to $40 from roughly $12.

In the bond market, yields edged higher following the latest readings on the U.S. economy. Growth for the overall economy slowed during the summer from the spring, according to a preliminary estimate by the U.S. government. But the performance was slightly better than economists expected.

A report Wednesday suggested employers outside the government accelerated their hiring in October, when economists were forecasting a slowdown. It could raise optimism for Friday’s more comprehensive jobs report coming from the U.S. government.

A slowing economy is no surprise after the Federal Reserve hiked interest rates sharply in hopes of braking enough on the economy to get inflation under control. The question is whether the Fed can help keep the economy out of a recession, now that it’s begun cutting interest rates to keep the job market humming.

Traders are largely expecting the Fed to cut its federal funds rate by a quarter of a percentage point at its next meeting next week, according to data from CME Group.

The yield on the 10-year Treasury rose to 4.28% from 4.26% late Tuesday and just 3.60% in the middle of September.

In energy trading, benchmark U.S. crude rose 46 cents to $69.07 a barrel. Brent crude, the international standard, added 44 cents to $72.99 a barrel.

In currency trading, the U.S. dollar edged down to 152.80 Japanese yen from 153.31 yen. The euro cost $1.0854, inching down from $1.0858.

___

AP Business Writer Stan Choe contributed.

___

Yuri Kageyama is on X: https://x.com/yurikageyama

COMMENTS

Please let us know if you're having issues with commenting.