The stunning collapse of Baltimore’s Francis Scott Key Bridge is diverting shipping and trucking around one of the busiest ports on America’s East Coast, creating delays and raising costs in the latest disruption to global supply chains.

After the container ship Dali hit the bridge and brought it down early Tuesday, ship traffic entering and leaving the Port of Baltimore was suspended indefinitely. That will require rerouting vessels or their cargo to other ports, potentially causing congestion and delays for importers, said Judah Levine, head of research for the global freight booking platform Freightos.

“People right now are figuring out where are they going and what are their options,’’ Ami Daniel, CEO of the maritime intelligence company Windward in Tel Aviv, Israel, said.

The Dali was the only container vessel in the port at the time of the collision, but seven others had been scheduled to arrive in Baltimore through Saturday, Levine said. Six people, part of a crew that had been filling potholes on the bridge, were missing after the span came down, and their company said they were presumed dead.

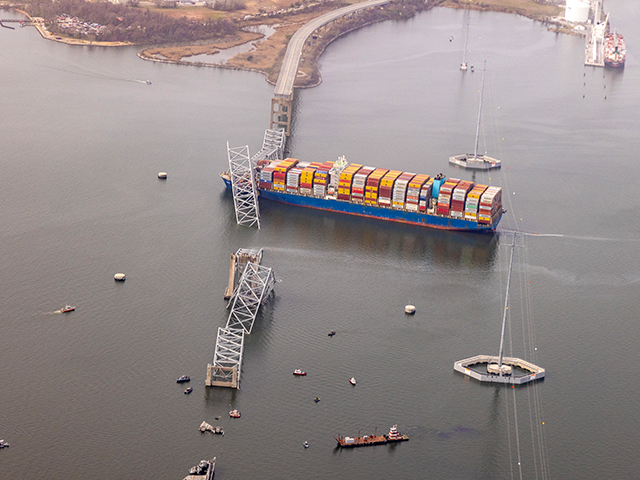

In an aerial view, the cargo ship Dali sits in the water after running into and collapsing the Francis Scott Key Bridge on March 26, 2024, in Baltimore, Maryland. According to reports, rescuers are still searching for multiple people, while two survivors have been pulled from the Patapsco River. A work crew was fixing potholes on the bridge, which is used by roughly 30,000 people each day, when the ship struck at around 1:30am on Tuesday morning. The accident has temporarily closed the Port of Baltimore, one of the largest and busiest on the East Coast of the U.S. (Tasos Katopodis/Getty)

“Aside from the obvious tragedy, this incident will have significant and long-lasting impacts on the region,” American Trucking Associations spokesperson Jessica Gail said, calling Key Bridge and Baltimore’s port “critical components” of the nation’s infrastructure.

Gail noted that 1.3 million trucks cross the bridge every year — 3,600 a day. Trucks that carry hazardous materials will now have to make 30 miles of detours around Baltimore because they are prohibited from using the city’s tunnels, she said, adding to delays and increasing fuel costs.

“Timewise, it’s going to hurt us a lot,” said Russell Brehm, the terminal manager in Baltimore for Lee Transport, which trucks hazardous materials such as petroleum products and chemicals. The loss of the bridge will double to two hours the time it takes Lee to get loads from its terminal in Baltimore’s Curtis Bay to the BJ’s gasoline station in the waterfront neighborhood of Canton, he estimated.

The accident comes as global shipping has largely adjusted to disruptions from Houthi rebel attacks on vessels in the Red Sea. The attacks, which started amid the Israel-Hamas war, have forced ships to take the longer route around the Cape of Good Hope at the southern tip of Africa and required more ships to sail more often.

The diversions have pushed freight rates from Asia to the U.S. to roughly double what they were before the war, though they prices recently declined some to $5,284 per 40-foot container, Levine at Freightos said.

Baltimore’s port has become increasingly important to U.S. retailers and manufacturers seeking to diversify their supply networks and bring goods closer to customers, said Jonathan Gold, vice president of supply chain and customs policy at the National Retail Federation.

Small boats surround a cargo ship after the ship ran into and collapsed the Francis Scott Key Bridge on March 26, 2024, in Baltimore, Maryland. (Win McNamee/Getty Images)

“Everybody is trying to figure out the impact of the supply chain” from the loss of the bridge, said Gold who spoke with big and small retailers Tuesday. “What they had going into the port or what is currently at the port destined for somewhere else.”

Gold added that it’s too early to tell how long shipments might be delayed.

Americans should expect shortages, said Ryan Petersen, CEO of the supply chain management company Flexport. He said the accident would have significant repercussions for ocean container shipping and East Coast trucking logistics.

“It’s not just the port of Baltimore that’s going to be impacted,” he said.

Petersen was working with his team Tuesday to reroute about 800 shipping containers currently making their way to the Port of Baltimore. Flexport had two containers onboard the Dali; one was filled with a donated playground headed to Zambia.

“It’s a scramble because each of those containers has now a new journey to clear customs. You’ve got to get a different truck to pick it up at a different port. It creates a whole lot of downstream work,” he said.

Petersen said the attacks on cargo ships in the Red Sea already forced traffic away from the Suez Canal and increased congestion in the Panama Canal. With U.S. importers increasingly shifting to West Coast ports that in turn may experience their own backups, “you get this vicious feedback loop,” he said.

The use of trucks as an alternative to shipping goods will also cause traffic backups on U.S. thoroughfares, Petersen predicted. “The East Coast I-95 corridor is going to be a real disaster,” he said.

In an aerial view, cargo ship Dali is seen after running into and collapsing the Francis Scott Key Bridge on March 26, 2024 in Baltimore, Maryland. (Tasos Katopodis/Getty Images)

Still, Levine thinks the bridge collapse is unlikely to have a big impact on global trade, certainly nothing like the disruptions caused by the COVID-19 pandemic. First, Baltimore is not a major port for container vessels. And second, shipping traffic from Asia is in the annual lull following China’s Lunar New Year holiday.

While shipments are pushed forward to get things out ahead of the holiday in early February, the period afterwards “is the slow season for ocean freight,” he said.

The century-old Domino sugar refinery, an iconic Baltimore institution located at the port, expects “no short-term impact” to its operations in the city. Marianne Martinez, a spokeswoman for Domino parent ASR Group, said the refinery has six to eight weeks of raw sugar supplies on hand.

The bridge collapse nevertheless is likely to have an outsize impact on the regional economy around Baltimore and on businesses that rely on shipments of steel and cars that come through the port.

In the Baltimore area, “if you’re in the construction business and you haven’t piled up enough steel because of (high) interest rates, then there’s a good chance you’re going to run out of steel,’’ Windward’s Daniel said. “If you’re in the shipbuilding or construction business, it can slow down your project.’’

The Port of Baltimore is one of the largest vehicle handling ports in the U.S., and a lengthy closure could disrupt the supply of new vehicles. In 2022, Baltimore ranked No. 1 with more than 750,000 vehicles going through the port, 70% of them imports, according to the publication Automotive Logistics.

However, supply chain experts say the Port of Los Angeles and others may have overtaken it last year based on the value of autos passing through.

And since most vehicles purchased in the U.S. are made in North America and don’t come by sea, experts do not expect big problems. Car dealers currently have sizable inventories, and ships carrying cars also can divert to other ports.

“Depending on the length of the disruption, we could see inventories drawn down,” Jason Miller, interim chair of the supply chain management department at Michigan State University. said.

Most of the auto imports to Baltimore come from Germany, Mexico, Japan and the United Kingdom, Miller said.

About 20% of U.S. coal exports pass through Baltimore en route to India, the Netherlands, Japan and other countries; that is second only to Norfolk, Virginia, according to the U.S. Energy Information Administration.

Thomas Goldsby, a professor of supply chain management at the University of Tennessee, predicted “some degree of confusion and bottlenecking” for a time. But he said that shipping companies have become accustomed to taking detours to other ports in the past few years due to conflicts along the Suez Canal or low water levels in the Panama Canal.

“These steamship lines are having to be agile to the circumstances,” Goldsby said. “The other ports are ready to receive. What is a challenge for Baltimore is an opportunity up and down the coast.”

___

McHugh reported from Frankfurt, Germany; D’Innocenzio from New York; Wiseman from Washington, and Krisher from Detroit. Martha Mendoza in Santa Cruz, California, also contributed.

COMMENTS

Please let us know if you're having issues with commenting.