Kenya’s request this week for a $740 million loan from the World Bank, of which American taxpayers remain the largest stakeholders, has sparked outrage as the African country continues to deny its financial woes and accept gigantic sums of money from China to fuel its role in Beijing’s ambitious Belt and Road Initiative (BRI).

The loan request also comes after the country, which maintains it is not nearing bankruptcy, already borrowed $2.1 billion in another Eurobond, the Daily Nation reported Wednesday.

Despite claims that African country is solvent, the Central Bank of Kenya (CBK) indicated that the public debt was $50.4 billion. The country’s treasury secretary conceded most of the money cannot be accounted for, likely due to rampant corruption.

“How long will this reckless borrowing without accountability go on? The Jubilee government and their partners must now tell Kenyans the true level of their country’s indebtedness and the detailed terms and conditions around each debt. Kenyans have a right to know,” Amani Musalia Mudavadi, the leader of the National Congress opposition party, said.

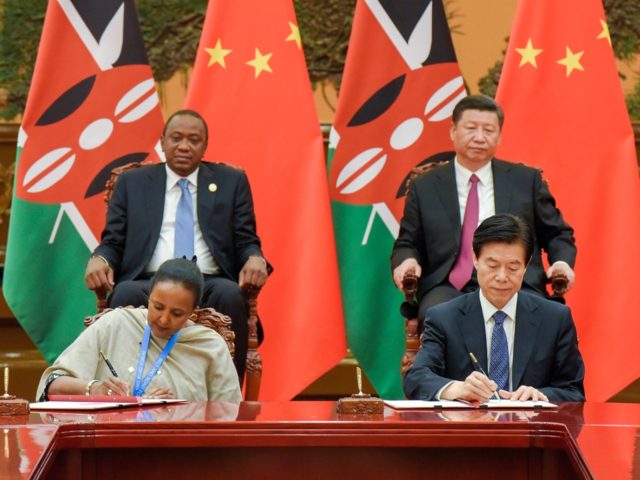

In September 2018, Breitbart News acknowledged that BRI signatory “Kenya is one of the most heavily indebted countries, but President Uhuru Kenyatta” still traveled to Beijing to reaffirm his commitment to the multi-trillion-dollar BRI that has drowned several countries in debt to the benefit of China, which is cashing in on the natural resources and strategic assets used as loan collaterals.

BRI is actively allowing Beijing to expand its financial clout and military ambitions across African and beyond.

Now, arguing that it is not broke, Kenya is turning to the World Bank for assistance following in the footsteps of cash-strapped Pakistan who is also reeling from its BRI participation.

U.S. President Donald Trump’s administration has accused China of using its BRI as an instrument to disseminate “predatory lending practices” or “debt traps” across Africa to undermine borrowing countries’ sovereignty with loans collateralized with natural resources or strategic asset collaterals.

Following Sri Lanka, where China already seized a strategic port over its inability to repay, Kenya has surfaced as another poster child for Beijing’s debt trap diplomacy.

A leaked report that came to light at the end of last year revealed that Kenya promised China parts of its Mombasa Port as collateral for financing a $3 billion railway the African country built from the port to Nairobi.

The governments of both China and Kenya deny the report’s claims.

Kenyan Treasury Cabinet Secretary Henry Rotich told the Daily Nation that the World Bank has yet to make a decision on the African country’s request of $740 million.

The secretary reportedly claimed that the funds will be used to pay for agriculture, universal healthcare, manufacturing, and housing sectors.

Kenya’s World Bank loan request reportedly comes days after Kenya borrowed [$2.1 billion] in another Eurobond.

Treasury Secretary Rotich declared:

This is a development policy operation by the World Bank. It is being given to many countries. Yes, it is a budgetary support but we have had to sacrifice our own projects so as to turn it into a budgetary support.

It doesn’t add to debt because we canceled some projects. If a project is slow moving and say there are other challenges, instead of losing the money, let us convert them into budgetary support and implement.

Kenya’s World Bank loan request is similar to one solicited from the International Monetary Fund (IMF) by cash-strapped Pakistan this year. American taxpayers are the top IMF contributors.

Some U.S. lawmakers expressed concerns the Pakistani loans would be used to repay debts to China incurred through the BRI, prompting

Some Kenyan areas are accusing China’s Belt and Road Initiative of mainly relying on tens of thousands of Chinese workers, cheap imports undercutting local companies, Chinese companies exploiting natural resources and strategic assets, and projects benefiting elites more than local population who will ultimately have to foot bill.

Once borrowing countries are unable to pay, China can take over some of the collateral, increasing its economic and potentially military posture to the detriment of U.S. interests.

COMMENTS

Please let us know if you're having issues with commenting.