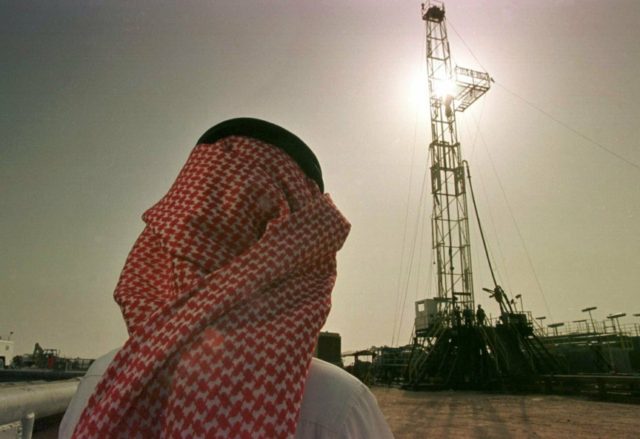

Although Saudi Arabia remains committed to production caps set by the Organization of Petroleum Exporting Countries (OPEC) in an effort to shore up global prices, the Saudis are spreading the word that they can meet all orders from former customers of Iran and are ready to take on even more of Iran’s business as U.S. sanctions choke out the Iranian oil industry.

A source in the Persian Gulf region “familiar with Saudi plans” told Bloomberg News on Wednesday that Saudi Arabia has received “moderate requests from customers for shipments next month, including from former buyers of Iran’s oil.”

The Saudis believe they can meet all of these requests without violating the production limits OPEC agreed to, which remain in effect until the end of next month. OPEC officials indicated they would review the limits if they see an oil shortage developing, but they did not anticipate such an emergency.

Bloomberg described the Saudis as unpleasantly surprised when the United States decided to grant waivers from oil sanctions to some of Iran’s biggest customers last year but was perhaps more pleasantly surprised when the Trump administration announced in early May that it would not review the waivers.

The trick for Saudi Arabia is to grab as much of Iran’s business as it can – delivering a blow to its adversaries in Tehran, pleasing the United States, and making a great deal of money all at once – without increasing production enough to disrupt OPEC unity, prompting other members to increase production as well, and triggering another oil glut that sinks prices.

That danger is somewhat ameliorated by an unexpected shortage from Russia, which had to shut down a crucial pipeline due to contamination in April. Supply disruptions from basket-case Venezuela and unstable Libya are also possible. OPEC strategists worry that if other producers step up production to make up for these shortfalls, it will be difficult to persuade them to cut back again once the disruptions are resolved.

Another major source of uncertainty is China, which may or may not respect U.S. sanctions and cancel purchases from Iran. Saudi Arabia’s report of “modest” orders from former Iranian customers suggests there has yet to be a stampede away from Iranian oil, but if China decides to stop buying it, the situation could change dramatically. The Chinese were clearly stockpiling Iranian oil before the sanctions waivers expired, which would suggest Beijing does not plan to completely ignore U.S. sanctions.

As always, everyone who is not worried about another oil glut and bargain-basement prices that would crash petroleum-based economies is worried about a price spike that would send global shipping and manufacturing into a tailspin. India, for example, is apprehensive about Iran sanctions causing an oil shortage that could strangle its economy.

The Saudi monarchy apparently had second thoughts about Crown Prince Mohammed bin Salman’s idea to transition away from an oil economy by selling stock in the titanic national oil company Aramco and using the proceeds to make game-changing investments around the world.

If the Saudis are going to keep relying on oil, they need high demand and high prices, which are difficult to sustain because of a wild card OPEC did not see coming: the astounding growth of American oil production. No matter what happens in Iran, its oil will not stay off the market forever. A spirited hunt for market share and strategic position is underway.

COMMENTS

Please let us know if you're having issues with commenting.