China’s state-run Global Times told readers to remain calm as the economy of Turkey teeters on the brink of collapse, but the real point of the editorial was to insist China is in far better shape than Turkey despite grappling with a currency crisis of its own.

“The Chinese people must be prepared for hardship and crisis, but they must not underestimate their capabilities and scare themselves,” the Global Times asserted.

The bulk of the editorial was devoted to explaining why China can deal with these hardships much better than Turkey:

Some Chinese internet users recently compared Turkey to China, suggesting China may be the next Turkey. The lira crisis has alerted most Chinese, which is not a bad thing. But a judgment of the situation must be made objectively, not ideologically. Those who seemingly curse the Chinese economy may be playing an ideological game. It is almost like predicting the US economy will be the next Italy or Spain.

It must be noted that there are more differences than similarities in the Chinese and Turkish economies. Both countries are latecomers to emerging markets and both have experienced an overheated economy. But there’s no comparison of their economic scale. China is the world’s second largest economy, the largest manufacturing nation and the largest trading nation. It takes much more to carry out an effective assault against China than bring Turkey to its knees.

China has the most competitive real economy in the world as well as the fastest-growing consumer market. It is not reliant on foreign trade as much as other emerging economies and such dependence has been constantly reduced in recent years. China is the world’s biggest holder of foreign currency reserve, which can protect China’s economic stability. Beijing has been taking a proactive but cautious approach to financial liberalization. When making relevant analyses, China’s political system is often mentioned, which is a crucial factor to prevent systematic risks due to its unique management, control and mobilization capabilities.

Interestingly, the Global Times sees the travails of both China and Turkey as the work of Donald J. Trump, who has gone from being the foolhardy American president picking a quixotic trade fight he could not win to a global bully shaking the bankers of Beijing and Ankara down for their lunch money:

In a bid to cement the US’ comparative advantage, Washington is unwilling to see smooth development of emerging countries and takes some actions, intentionally or not, to foster the crises that confront the latter. All developing countries have to stay alert to Washington’s role. The repeated economic upheaval in emerging countries reflects the twists and turns in their modernization. They have to make more efforts than one might expect in order to change their destiny.

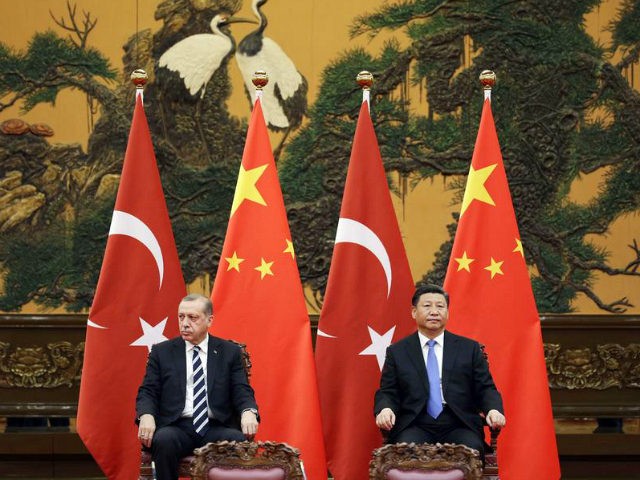

U.S. Treasury Secretary Steven Mnuchin warned on Thursday that more sanctions are coming Turkey’s way unless President Recep Tayyip Erdogan agrees to release hostage American pastor Andrew Brunson.

“We put sanctions on several of the Cabinet members. We have more that we’re planning to do if they don’t release him quickly,” Mnuchin said of Brunson’s plight.

Bloomberg News reports Erdogan spent Thursday attempting to rally investors in a conference call with his brother-in-law, Finance Minister Berat Albayrak, and talking with French President Emmanuel Macron.

A pledge of $15 billion in support from Qatar, offered in gratitude for Erdogan’s support in Qatar’s diplomatic standoff with the other Gulf states, will buy no more than temporary relief for the troubled Turkish economy. The Turkish lira has now lost a quarter of its value since the first round of U.S. sanctions were imposed.

Erdogan pleaded with German Chancellor Angela Merkel for help on Wednesday but got nowhere possibly because the Germans remember Erdogan and his top officials insulting them as Nazis during the Turkish president’s drive for expanded powers.

As for China, White House economic adviser Larry Kudlow said on Thursday their economy “looks terrible.”

“Their economy is just heading south. Business investment is just collapsing,” Kudlow reportedly said at a cabinet meeting.

“People are selling their currency,” he said of the nine percent drop in China’s currency value since April. “Investors are moving out of China because they don’t like the economy, and they’re coming to the USA because they like our economy.”

COMMENTS

Please let us know if you're having issues with commenting.