This week, the Venezuelan government announced a series of manufacturing and infrastructure investments from China that could ultimately amount to up to $20 billion in ten years, though China only agreed to an initial $5 billion in “development” funds this Sunday.

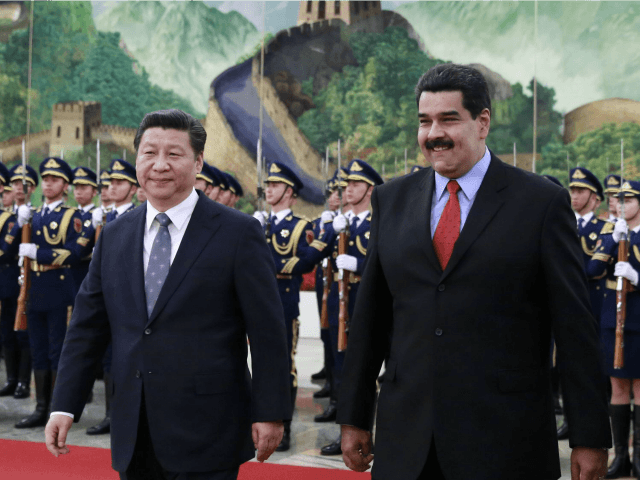

Venezuelan President Nicolás Maduro announced the new plans on Sunday, claiming that the $5 billion is half the promised sum to be invested in the following months. While he did not specify what kind of “development” the initial investment would be poured into, it is expected that the second half would go to maintaining the production of Venezuela’s oil fields.

“China wants to decisively back investments in areas like mature oil fields so that PDVSA can rapidly increase its production,” an anonymous source told Reuters of the investment. The money will replenish the coffers of the Joint Chinese-Venezuelan Fund. Reuters notes that “Venezuelan bonds rose following the news,” despite the vagueness of the projects’ announcement.

The Chinese government has been equally vague about details of the deal. “China will, on the basis of equality and mutual interest, continue to develop the cooperative relationship, including economic programs,” said Chinese Foreign Ministry spokesman Hong Lei.

The BBC notes that the project follows a visit to China in January by the Venezuelan head of state, who at the time claimed he had secured a $20 billion investment in Venezuela. He did not mention on Sunday whether the recent sum was part of the greater package promised in January.

In addition to Maduro’s statements on Sunday, Venezuelan Minister of Industry José David Cabello tweeted photos Monday of a meeting between himself and representatives of the Chinese manufacturing corporation Sany Heavy Industry Co. Ltd.

Venezuelan newspaper El Universal reports that Sany will begin a manufacturing program to last between 2015-2016 and that the project is part of a larger program China intends to implement that will reportedly result in $250 billion invested in Latin America within the next decade.

China’s lifeline to Venezuela could not come a moment too soon for the destitute OPEC nation. As the BBC notes, Venezuelan oil prices dropped in one year from $97 a barrel in April 2014 to $50 now. Venezuela has begun cutting free shipments of oil to allied countries in the Caribbean in an attempt to curb losses, including cutting in half shipments to its prime ally, Cuba. Inflation is also expected to boom within the next year as Venezuela tries to limit losses to its economy.

COMMENTS

Please let us know if you're having issues with commenting.