I’ve often written that as bad as America’s economy is, China’s economy is in much more trouble. And now, after a week of extremely bad economic news in U.S. housing, manufacturing, and unemployment, it appears that China’s economy is also showing signs of heading downward, with major consequences for the rest of the world.

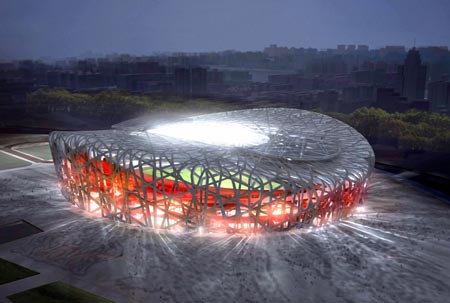

Bird’s Nest – Beijing Olympics stadium (Xinhua)

Bird’s Nest – Beijing Olympics stadium (Xinhua)

International commodities markets are “starting to look a lot like 2008,” according to Standard & Poors analyst Scott Sprinzen, quoted by Bloomberg.

Recall that China’s overheated economy was sucking up commodities early in 2008. But as the Beijing Olympics games approached in August, China’s economy sank and China’s commodities purchases fell. By the end of the year, trade and transportation had collapsed around the world, and the Baltic Dry Index (a measure of commodities shipping) had fallen an incredibly 95%. As I described it at the time, it was like the science fiction movie, “The Day the Earth Stood Still,” except that it wasn’t science fiction. (See “World wide transportation and trade sink farther into deep freeze.”)

A slowdown in China’s economy would have a similar effect today. Commodities prices could esily fall 25-40%, and might fall as much as 75%, according to Sprinzen.

And a slowdown IS occurring. Two surveys released Wednesday reveal that Chinese manufacturers expanded in May at their slowest pace in nine months, according to the Globe&Mail.

CBS Business News blogger Constantine von Hoffman has provided a list of some of the signs that China’s economy is melting down:

- We’ve reported on a major drought in China’s heartlands, and it’s taking its toll. Vegetable and rice prices have risen 16-20% in the last month, and prices of crab, shrimp and river fish have also surged up in the past week. As in the U.S., high food prices leave less money for consumers to spend on manufactured goods. MarketWatch

- The worst power shortage in seven years has caused China to raise electricity prices by about 3%, in an attempt to reduce demand. The drought is one cause of the shortage, while another cause is high costs of coal. Coal-fired power plans generate 80% of China’s electricity. Reuters

- China’s housing bubble is much worse than America’s ever was, with many ghost cities, and enough commercial real estate to give every man, woman and child in the 1.4 billion population country a 5×5 cubicle, all funded by massive bubble price rises. (See “5-Feb-10 News – China’s nationalism and real estate bubble grow.”) Now real estate prices are falling, and land prices have fallen 20-50% this year alone. This indicates the housing bubble is finally collapsing, with potentially devastating consequences. Market Watch

- As in the U.S., local and regional governments are heavily in debt, and threatened with bankruptcy. China’s regulators plan to pay off some $400 billion in local government debt, forcing the state-run banks to take some of the losses. Reuters

- For every yuan that China’s banks have loaned, there are many times more yuan loaned by informal or underground banks, totalling trillions of yuan. This has created a huge credit bubble similar to the credit bubble created by mortgage-backed CDOs a few years ago, and it makes the real estate bubble many times more lethal than it is anyway. FT Blog

America and China, two great civilizations that are almost completely foreign to one another, are now locked together, arm in arm, in a death spiral downward that will leave both countries, and all of their neighbors, completely devastated.

COMMENTS

Please let us know if you're having issues with commenting.