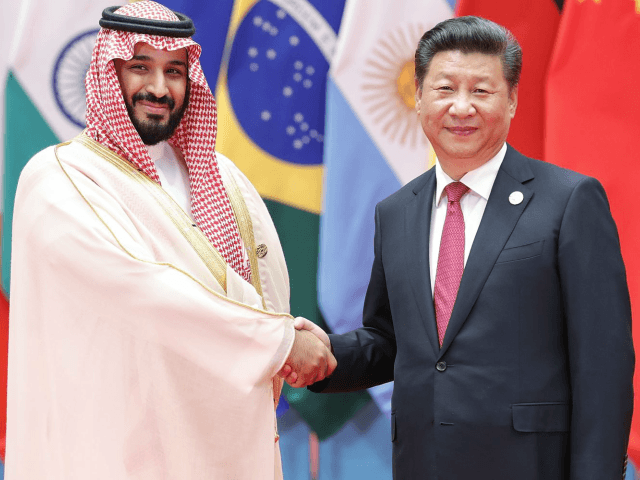

Genocidal Chinese dictator Xi Jinping reiterated his commitment to cooperation with Saudi Arabia in a phone call to Saudi Crown Prince Mohammed bin Salman on Tuesday, following multiple announcements from Saudi state oil company Aramco of major investments in China this weekend.

Aramco announced on Sunday and Monday that it would use some of its record 2022 profits to build a new refinery complex in northern Liaoning, China, and acquire major percentages of one of China’s largest petrochemical companies.

Aramco had already announced a plan in December to build a new refinery in southeast Fujian, China, but appears to have planned even more investment in the Chinese economy after losing the title of China’s top oil supplier to Russia in the first two months of this year.

Crown Prince Mohammed bin Salman, commonly known by his initials MBS, has dedicated much of the past two years to reconfiguring his nation’s relationship with China, expanding ties, and seeking entry into Beijing’s inner circle.

Part of that plan, according to multiple reports throughout the past year, is to advocate for Saudi entry into the BRICS coalition, a primarily economic union bringing together Brazil, Russia, India, China, and South Africa. The president of South Africa, Cyril Ramaphosa, told reporters in October that MBS had expressed interest in joining BRICS during the former’s visit to Riyadh that month.

Also expressing interest in joining BRICS is Iran, Saudi Arabia’s top geopolitical rival with which it has been embroiled in a proxy war in Yemen for over half a decade. Riyadh’s pursuit of proximity to China coinciding with a similar policy in Tehran led Beijing to negotiate an agreement announced this month to normalize diplomatic relations, including the posting of ambassadors in each other’s capitals.

Saudi Arabia withdrew its diplomatic representation from Tehran in 2016 after a Shiite mob firebombed the Saudi embassy in the capital, an attack to which the Iranian government responded with little law enforcement action.

Xi and MBS addressed the reconstruction of the Iran-Saudi Arabia relationship in their call on Tuesday, according to the Saudi Ministry of Foreign Affairs.

“HRH the Crown Prince expressed Saudi Arabia’s appreciation for the Chinese initiative to support the development of good neighborly relations between Saudi Arabia and Iran,” the ministry said in a statement confirming the conversation. “For his part, the Chinese President praised Saudi Arabia’s role in promoting the development of his country’s relations with the countries of the Gulf Cooperation Council (GCC) and the Middle East.”

“Aspects of the partnership between Saudi Arabia and China and joint coordination efforts to enhance cooperation between the two countries in various fields were also reviewed,” the statement concluded, without elaborating.

The Chinese government, through the state news agency Xinhua, reported that Xi used the opportunity of the phone call to commit to helping “firmly support” Saudi Arabia when its interests align with China. Xi reportedly proposed working to “expand practical cooperation and people-to-people exchanges with Saudi Arabia, and push for greater development of China-Saudi Arabia comprehensive strategic partnership.”

Neither statement discussed the announcements by Aramco this week revealing plans for significant Saudi investment in the Chinese oil and petrochemical industries.

This weekend, the Saudi state oil company committed to investing in building an oil refinery in Liaoning, in China’s industrial northeast, and acquiring a ten-percent share in the Chinese company Rongsheng Petrochemical Co. Ltd., which would grant Aramco greater access to the chemicals necessary to refine and otherwise process its product.

The Rongsheng deal is Aramco’s largest foreign acquisition ever, according to Bloomberg. The Liaoning complex is expected to allow Aramco to ship 210,000 barrels of crude oil per day to Liaoning for refining and is expected to cost $12 billion.

“This announcement demonstrates Aramco’s long-term commitment to China and belief in the fundamentals of the Chinese petrochemicals sector,” Aramco Executive Vice President Mohammed Al Qahtani said in a statement quoted by Voice of America. “It also promises to secure a reliable supply of essential crude to one of China’s most important refiners.”

Aramco announced its investment in a refinery in Fujian, China, in December, working alongside the state-owned China Petroleum and Chemical Corporation (Sinopec).

“These projects represent an opportunity to contribute to a modern, efficient, and integrated downstream sector in both China and Saudi Arabia,” Mohammed Y. Al Qahtani, Aramco senior vice president of Downstream, said at the time. “They also underpin our long-term commitment to remain a reliable supplier of energy and chemicals to Asia’s largest economy.”

The sudden spree of project announcements by Aramco in China follows news this month that Russia overtook Saudi Arabia as China’s largest oil supplier in January and February. Saudi Arabia dominated the Chinese oil market in 2022 and has traditionally been a top petroleum product supplier.

Russia has become a large-scale oil supplier for China, India, and Saudi Arabia itself in the past year as Western sanctions, in response to Russia’s invasion of Ukraine, have resulted in dramatic cuts to Russian oil prices. Saudi Arabia, like India and China, reportedly purchases cheap Russian oil for domestic consumption.

Unlike the other two countries, Saudi Arabia reportedly uses those purchases to open up supplies of more expensive Saudi domestic oil products, which are then shipped out to the world for a profit while keeping oil prices at home cheap for the country’s citizens.

In the face of increased oil demand following the end of Wuhan coronavirus pandemic protocols and sanctions on the Russian oil industry, Aramco posted a record $ 161.1 billion profit in 2022.

COMMENTS

Please let us know if you're having issues with commenting.