Climate activists reacted with equal measures of anger and despair Sunday at the news oil giant Saudi Aramco achieved record profits totalling $161.1 billion last year as global demand for fossil fuels shows no sign of abating anytime soon.

AFP reports the mostly state-owned oil supplier, the world’s second most valuable company behind Apple, said in a filing with the Saudi stock market net income for 2022 was up 46 percent from $110 billion in 2021.

The results — the strongest since Aramco, also known as the Saudi Arabian Oil Co., became a listed company in 2019 — were “predominantly due to the impact of higher crude oil prices and volumes sold, and stronger refining margins,” it said.

Global energy prices surged after Russia invaded Ukraine in February 2022, as Breitbart News reported, with some government regulators looking to impose punitive taxes on companies that profit from selling oil products.

Agnes Callamard, secretary-general of Amnesty International, issued a statement in response to the profits castigating the company for profiting from global demand for its product:

It is shocking for a company to make a profit of more than $161 billion in a single year through the sale of fossil fuel –- the single largest driver of the climate crisis.

It is all the more shocking because this surplus was amassed during a global cost-of-living crisis and aided by the increase in energy prices resulting from Russia’s war of aggression against Ukraine.

Amnesty further described Aramco’s profits as “the most ever disclosed by a company in a single year” and said they “should be used to fund a human rights-based transition to renewable energy.”

Aramco’s gains are consistent with record profits for 2022 reported by the five oil majors Shell, Chevron, ExxonMobil, BP and TotalEnergies, which in total surpassed $150 billion and would have been closer to $200 billion without costly withdrawals from Russia.

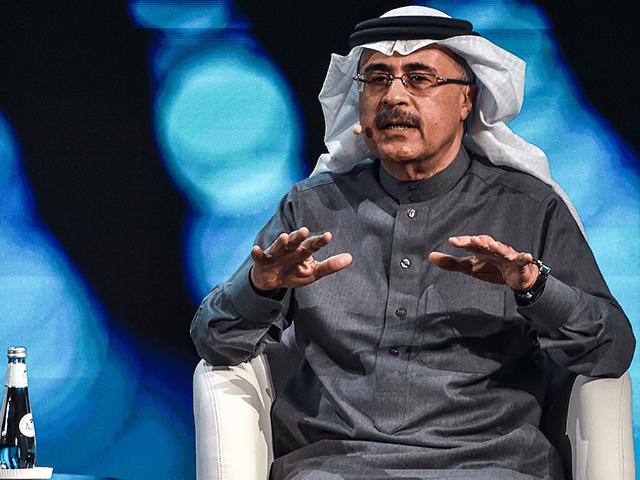

Amin Nasser, chief executive officer of Saudi Aramco, right, speaks during a panel session on day two of the Future Investment Initiative (FII) conference in Riyadh, Saudi Arabia, on Wednesday, Oct. 26, 2022. (Tasneem Alsultan/Bloomberg via Getty)

“Aramco rode the wave of high energy prices in 2022. It’s what the company is geared to do,” said Robert Mogielnicki, of the Arab Gulf States Institute in Washington.

“It would have been difficult for Aramco not to perform strongly in 2022.”

In a statement on Sunday, Aramco said the company results were “underpinned by stronger crude oil prices, higher volumes sold and improved margins for refined products.”

Aramco’s President and CEO Amin Nasser said global oil demand remains strong and shows no sign of abating anytime soon, despite the protestations of green activists.

“Given that we anticipate oil and gas will remain essential for the foreseeable future, the risks of underinvestment in our industry are real – including contributing to higher energy prices,” he said.

Saudi Arabia is the largest producer in the oil cartel OPEC (Organization of the Petroleum Exporting Countries).

COMMENTS

Please let us know if you're having issues with commenting.