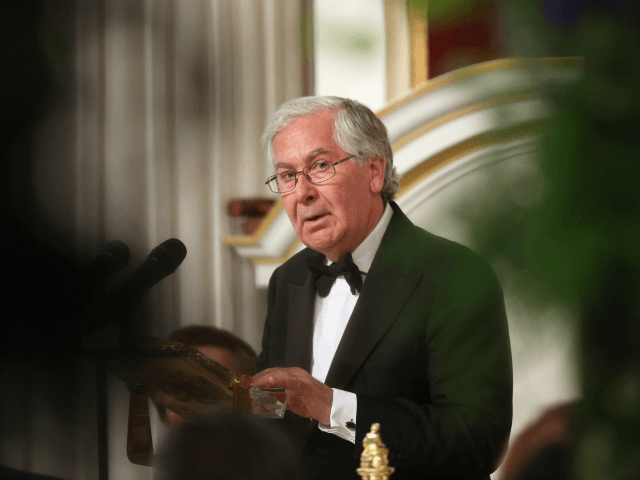

Britain should be “confident” and quit the Single Market when it leaves the European Union (EU), a former governor of the Bank of England has said.

Lord King said that while Brexit would not be a “bed of roses”, there will be “real opportunities” for the country if it ignores defeated Remain campaigners and leaves the European Single Market, adding that the UK should be more upbeat about its future.

Speaking to BBC Radio 4’s Today programme, Lord King said: “I think the challenges we face mean it’s not a bed of roses, no one should pretend that, but equally it is not the end of the world and there are some real opportunities that arise from the fact of Brexit we might take.

He described the EU as “pretty unsuccessful”, adding that Britain would benefit economically from being outside it.

“There are many opportunities and I think we should look at it in a much more self-confident way than either side is approaching it at present.

“Being out of what is a pretty unsuccessful European Union – particularly in the economic sense – gives us opportunities as well as obviously great political difficulties.”

Many defeated Remain campaigners have argued for a so-called ‘soft Brexit’, where the UK remains a member of the Single Market and thus is still subject to many EU regulations and cannot make its own free trade deals.

However, Lord King said this position does not make sense, and could potentially hold the country back.

“I don’t think it makes sense for us to pretend we should remain in the single market and I think there are real question marks about whether it makes sense to remain in the customs union.

“Clearly if we do that we cannot make our own trade deals with other countries.”

Lord King also said the EU was facing an existential crisis as richer nations in the north become increasingly reluctant to bail out the struggling economies in the south. Resentment could even become so high, he added, that Germany could quit the Eurozone.

“I think it’s impossible to put any timescale on [the collapse of euro] but they have simply not put in place the framework to make it a success,” he said.

“For a long period, they relied on the confidence the markets had in [European Central Bank President Mario] Draghi. The problem now is people in Germany and other countries in the north of the EU are deeply reluctant to pay for countries in the South.

“I think if you look at Italy, Portugal, even France now they are really struggling. As soon as German taxpayers see their money is being thrown away they will start to ask serious questions about whether they want to be part of it.”

COMMENTS

Please let us know if you're having issues with commenting.