Tesla Motors stock fell to a 13-month low after the company announced the recall of about half of all the cars it ever produced Thursday, and after the company suffered a credit rating downgrade.

Tesla’s stock market capitalization fell by $10 billion over the last three months, and about $22 billion over the last six months. At $259.30 per share, it is trading at the lowest price since early 2017.

The company is producing 90 percent fewer Model 3 vehicles than forecast; its Chief Financial Officer resigned over fears the company is burning $2 billion of cash per year; and Tesla is now the subject of a federal probe over a death that occurred while a driver was using the car’s self-driving features.

All of that contributed to Moody’s Investors Service issuing a credit downgrade for Tesla, from B2 (non-investment grade) to B3 (highly speculative). Moody’s analysts commented that the company’s “significant shortfall in the production rate of the company’s Model 3 electric vehicle” had led to “liquidity pressures due to its large negative free cash flow and the pending maturities of convertible bonds.”

After trading closed on March 29, the Associated Press reported that Tesla Motors, Inc. (TSLA-NASDAQ) was recalling 123,000 cars, or almost half of the 276,000 vehicles the company has ever produced, to fix rusting bolts that hold its steering column.

Tesla’s website stated that bolts could corrode in winter conditions on all cars built before April 2016. The company stated that the chance of failure is just 0.02 percent, and blamed the issue on salt used on icy winter roads. Tesla claims, “If the bolts fail, the driver is still able to steer the car, but increased force is required due to loss or reduction of power assist.”

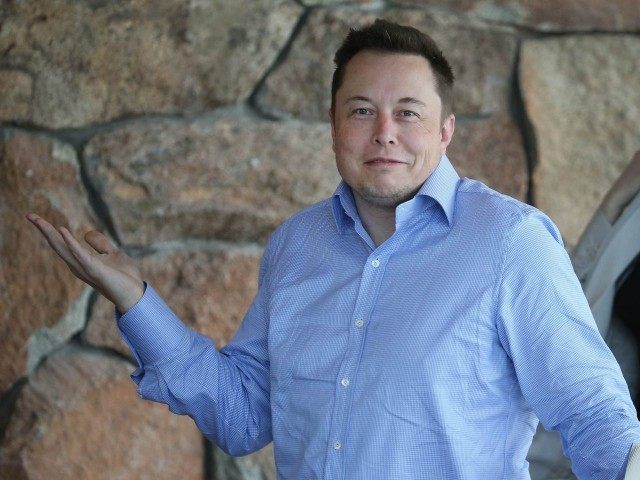

CEO Elon Musk gave a speech last weekend that many are calling is his equivalent of Sir Winston Churchill’s rallying of British boat owners to save the troops at Dunkirk. He showed up at Tesla’s Fremont, California, factory to encourage workers to disprove the “haters” that are shorting the company’s stock on the bet that Tesla cannot ramp up manufacturing by 1,000 percent to mass-produce on its Model 3.

Tesla Chief Engineer Doug Field told workers in a March 23 memo, “I find that personally insulting, and you should too” that Wall Street hedge funds think we will fail. “Let’s make them regret ever betting against us. You will prove a bunch of haters wrong.”

Tesla will celebrate the two-year anniversary of introducing its Model 3 — and quickly taking deposits for 500,000 potential customers — on Saturday. CEO Musk emphasized at the time that through “physics-first principles,” Tesla would shape a new mode of industrial production to improve efficiency by “factors of 10 or even 100 times.” Musk emphasized that Tesla’s key advantage in building all-electric vehicles would be limiting moving electric engine parts to 20, versus up to 10,000 for internal combustion engines.

Musk claimed that the company would be delivering 5,000 Model 3 vehicles per week in the last quarter of 2017 and 10,000 per week in the first quarter of 2018. But Doug Field stated in his weekend memo to Tesla workers that the company is currently producing about 1,000 cars per week, and that Tesla’s goal is to produce 1,500 a week by the end of the second quarter.

COMMENTS

Please let us know if you're having issues with commenting.