A bill has been introduced in the California legislature to dump the infamous “space tax” that extended the state’s revenue collection frontier to 62 miles above the Earth.

Not satisfied with being the heaviest-taxed state in the nation, the clever folks at the California’s Franchise Tax Board (FTB) announced last May they would start taxing the “Apportionment and Allocation of Income of Space Transportation Companies” under a new addition to its state tax collection “Code of Regulations.”

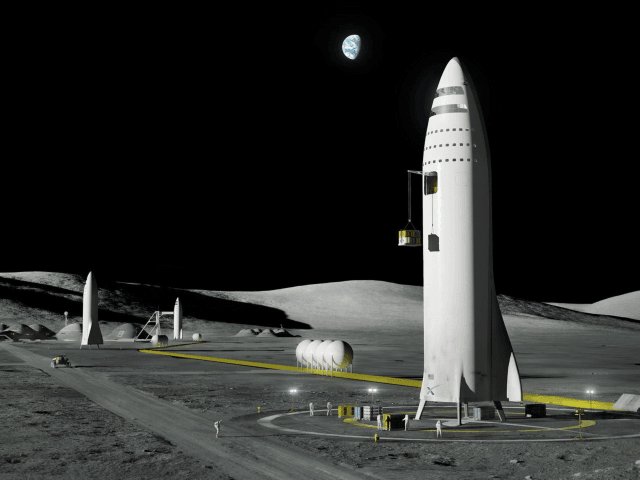

With companies like SpaceX, United Launch Alliance, and Northrup-Grumman gearing up for multi-billion-dollar missile launch businesses, the FTB was set to tax all movements or attempted movements of people or property — including, without limitation, launch vehicles, payloads, cargo, refuse, or any other property — to space.

The only California spaceport where the FAA allows large payloads to be launched into orbit is Vandenberg Air Force Base in northern Santa Barbara County. The launch site has not been as busy as Cape Canaveral in Florida, even though Vandenburg is the only facility in the continental U.S. where satellites can easily be launched into more favorable north-to-south polar orbits.

But the San Francisco Chronicle reported that Assemblyman Tom Lackey (R-Palmdale) is sponsoring AB 1878, which would make space transport tax-exempt in an effort to continue growing jobs and our economy. Lackey added:

“We are sending a terrible message by taxing an industry that is only in its infancy. Instead, California should continue to protect its role as an aerospace leader and offer an incentive for companies that choose to operate here.”

Lackey highlighted that Mountain View space mining start-up Moon Express had moved to Florida in 2016 to be closer to Cape Canaveral. He emphasized that rapidly growing companies like Virgin Galactic in his district may leave due to California’s being the first to tax space travel.

The FTB issued a technical report claiming that California was spurring the growth of space entrepreneurs by helping them better understand “the privilege of doing business in this state.”

The FTB even argued, under the subtopic “Benefits of Regulation”: “State of California has always prided itself on being in the technological forefront and the proposed tax regulation will provide concrete evidence that the state actively engages with industry to address emerging industries.”

Howard Jarvis Taxpayers Association President Jon Coupal told the Chronicle that California’s private space exploration industry could fundamentally change lives. But he added: “Government has no business excessively stifling this innovation economy with new taxes and regulations.”

COMMENTS

Please let us know if you're having issues with commenting.