Tesla Motors stock tanked by 15 percent Tuesday night after the company announced a $2.8 billion deal to buy SolarCity — a deal that will give Elon Musk and his relatives another $700 million in Tesla stock.

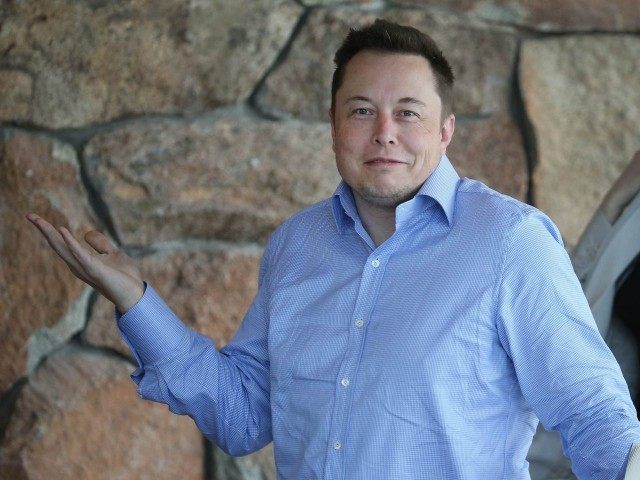

Musk is Tesla’s CEO and largest shareholder with over 27.8 million shares, or 20.8 percent of the company. But he is also Chairman of SolarCity and personally owns 22 percent of SolarCity, or 22.2 million shares. So if the transaction is completed, Musk would pick up another $587 million to $632 million of Tesla’s stock.

SolarCity’s CEO Lyndon Rive and CTO and Peter Rive are Elon Musk’s cousins. They each own about 2.3 million shares of SolarCity and are positioned to pick up $130 million in Tesla stock.

Because of the glaring conflicts of interest, Musk says that he is recusing himself from both the acquisition negotiations and decisions between Tesla and SolarCity Board of Directors.

But that did not stop Musk from hyping the deal as a “no-brainer” with “blindingly obvious” benefits that will bring his two companies closer together in an effort to transition the planet to sustainable and renewable energy future.

The definitive acquisition has yet to be approved by shareholders, but Tesla’s Board of Directors has offered to swap shares in SolarCity’s for Tesla stock at a value of around $26.50 to $28.50 a share.

But the deal to buy a solar panel company cost Tesla shareholders about $4.8 billion in market value as Wall Street analysts and big institutional shareholders showed their disdain for the transaction buy dumping the Tesla shares in overnight trading. The stock recovered about a third of the loss by the opening of OTC trading on June 22.

SolarCity’s stock initially leaped by 20 percent, or about $500 million in market value. But by the opening of OTC trading on June 22, SolarCity stock was down by 9 percent, or about 180 million in market value.

Analysts worry that SolarCity is a highly leveraged company with a debt-to-equity ratio of 3.492, as of March 2016. But Tesla is not far behind, with a debt-to-equity ratio of 3.215. That compares to a debt-for-equity ratio for General Motors of just 1.7.

Michael Morosi of the investment bank firm Avondale Partners told TechCrunch that the acquisition of SolarCity will hurt Tesla’s “GAP” earnings from an accounting perspective, because SolarCity can only report a small portion of cash flow as profit.

Breitbart News reported that despite Tesla Motors Inc. never meeting any unit production targets or making a profit in the last five years, CEO Elon Musk told shareholders in early June that through the magic of physics, he will revolutionize the auto industry to increase production profitably by 1,100 percent over the next two years to roll out the company’s “affordable” Model 3.

Musk has always expressed huge confidence in the disruptive and transformative leadership he brings to Tesla. But Breitbart News warned at the end of 2015 that Tesla was losing $19,810 on each car it sells, and hemorrhaging $51,344 in negative cash flow on each vehicle delivered, because of failing to meet production targets.

COMMENTS

Please let us know if you're having issues with commenting.