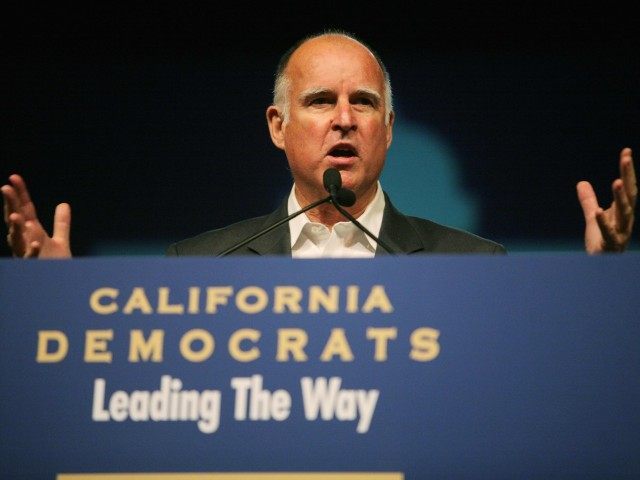

What a difference three weeks make: three weeks ago, California Gov. Jerry Brown, proposing a tax in his new budget that would tax all health plans, boasted, “We need the [managed care organization] tax now — this month. We’re going to get it. We’ve got to get it.”

But now, prospects for Brown’s proposal seem dim, as GOP legislators and even some Democrats are balking at raising taxes, according to the Los Angeles Times.

Assembly GOP leader Chad Mayes of Yucca Valley stated, “We will not support a tax that hurts consumers.” Democratic Sen. Cathleen Galgiani, said she would not back a tax unless it was approved by voters.

The state will lose over $1 billion in federal dollars for Medi-Cal if it doesn’t ensure all health plans are taxed, according to the Obama administration. Brown’s plan would extend the current tax on managed care organizations that serve Medi-Cal patients to all managed care organizations

The Times reports that the tax rates would increase or decrease depending on how many Medi-Cal enrollees and non-Medi-Cal beneficiaries were covered in any given plan. The managed care plans would benefit from an elimination of their corporation and insurance taxes.

Brown asserted in his State of the State address, “This is not a tax increase, no matter what anyone tells you.” He released a statement in which he said, “The package provides a net reduction in taxes paid by the private health care industry, secures funding for General Fund Medi-Cal expenses and provides an opportunity for targeted rate increases for developmental disability services.”

COMMENTS

Please let us know if you're having issues with commenting.