The City of San Diego had been on a path to financial sustainability after 66 percent of voters passed Proposition B pension restructuring to save $1.6 billion, but Governor Brown appointed Public Employment Relations Board just ruled that the unions can nullify an initiative.

The San Diego City Employees’ Retirement System, like most California defined benefit pensions, had been the victim of the union controlled politicians on the City Council spiking pension benefits, while decreasing funding. Facing a cash flow crisis in 2002, the City Council reduced money going into the retirement fund, increased money going out of it, and paid for the irresponsible move by selling $500 million in municipal bonds.

A Securities and Exchange Commission investigation led to a national scandal that caused the City Auditor, City Manager, City Treasurer to resign and the newly reelected mayor to be recalled and replaced in a special election by the conservative former police chief Jerry Sanders, and a pension reform advocate elected city attorney.

Despite the union controlled City Council being forced to vote for big spending cuts following a SEC 2006 ruling that San Diego committed securities fraud by failing to disclose extreme pension and retiree health care obligations, the Great Financial Crisis that began in 2008 left the city again on the verge of bankruptcy in 2012.

Unable to get any further concessions from the City Council, Mayor Sanders and two Councilmen filed an initiative to save $1.6 billion by converting the city’s pension plan for new employees from a defined contribution plan to a defined contribution plan, similar to the 401Ks most voters have.

The unions scoffed at the effort, until the idea became viral and the required 116,000 registered voters signed a petition to place this initiative in the November 2012 ballot. After three unsuccessful legal challenges by union from across the country, voters passed the initiative by a two to one margin in 2012.

After the vote to public reform pensions, the city has economically boomed. Unemployment at 4.8 percent is fraction of California’s 6.3 percent. Having suspended the city’s credit rating in 2004 during the SEC investigation, Standard & Poor’s credit rating agencies raised the San Diego’s solvency to a top tier “AA.”

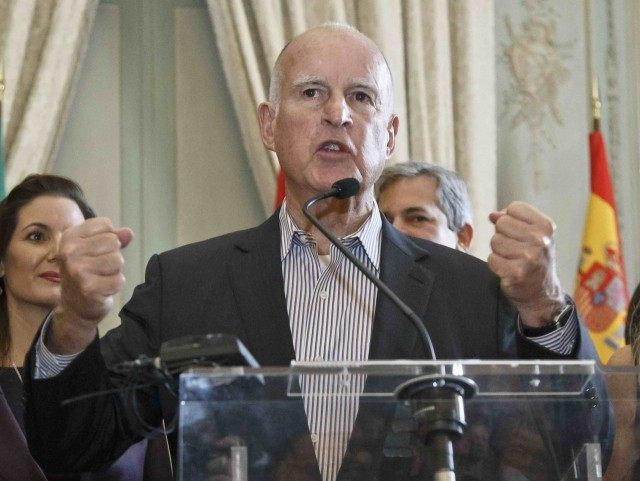

But this good news could be in big trouble after the quasi-legal Administrative Law Judge for the Public Employment Relations Board appointed by Governor Jerry Brown ruled that the voter approved initiative was nullified, because the City of San Diego did not conform to the state law requirement that the city “meet and confer” with the unions before considering any pension adjustments. The PERB ruled that San Diego must return to the status quo that existed before its passage of Proposition B and pay 2,000 new hires 7 percent interest as a penalty and cover the unions’ attorney fees.

San Diego City Attorney Jan Goldsmith estimated the city would have to spend about $100 million to create retroactive pensions for roughly about 2,000 employees to comply with PREB. But she also warned that the cost could be up to $500 million.

Goldsmith hopes to get the City Council to approve an appeal to state appellate courts, which she believes will nullify the PREB ruling and vindicate the pension cutbacks.

The San Diego Union Tribune’s chief political reporter Steven Greenhut does not view the ruling as unsurprising, despite the fact that union-controlled San Diego City Council refused to support the initiative and the signatures for the initiative were gathered independently. He points out that “A majority of board members previously did work for the California Teachers Association and the Service Employees International Union.”

COMMENTS

Please let us know if you're having issues with commenting.