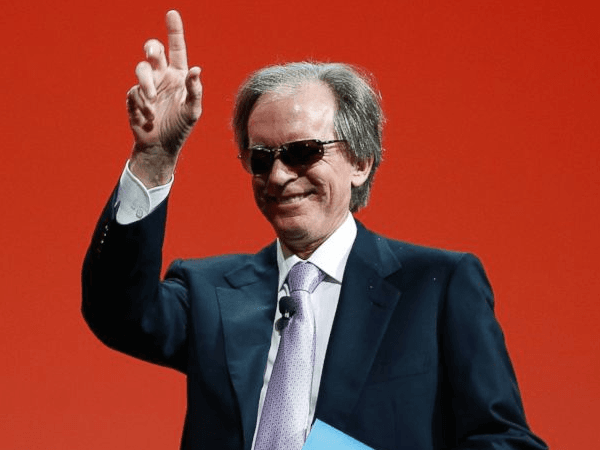

Former PIMCO boss Bill Gross has just filed a lawsuit against PIMCO seeking $200 million and claiming to be a victim–despite the company receiving a “Wells Notice” warning that the Securities and Exchange Commission (SEC) is investigating potential criminal violations in investment performance reporting during Gross’s tenure.

Gross credits his ability to build PIMCO’s investment management division from $12 million in assets under management in 1971 to $2 trillion at its peak in 2013 because of his skills learned as a psychology major and a professional blackjack player.

He liked to boast that the key investment strength he brought to bond investing was combining the type of intuitive probability analysis common among so-called mechanics of blackjack, and that he had a psychological student’s understanding of what drives the human emotions to engage in herd behavior, overreaction and despair.

But Gross charges in the lawsuit that he was victimized and robbed by PIMCO.

“Driven by a lust for power, greed, and a desire to improve their own financial position and reputation at the expense of investors and decency, a cabal of Pacific Investment Management Company LLC (“PIMCO”) managing directors plotted to drive founder Bill Gross out of PIMCO in order to take, without compensation, Gross’s percentage ownership in the profitability of PIMCO,” the legal complaint reads in its first paragraph, not holding back. “Their improper, dishonest, and unethical behavior must now be exposed.”

According to the complaint, he and PIMCO CEO Bill Thompson in 2007 had reached their 60’s and wanted to develop a succession plan for the firm. They then recruited Mohamad El-Erian from Harvard University Investment Management:

El-Erian received his first substantive exposure to a host of high-risk derivative asset classes while at Harvard. Through the use of these high-risk assets, El-Erian was able to witness a 23% return on investment in his only full year at Harvard growth that came during what would soon be recognized as the market “bubble” of the mid-2000s. From this experience, El-Erian became convinced of the attractiveness of such high-risk investments, especially since he had not yet been exposed to their downside during the “Great Recession” of 2007 that was soon to follow.

Gross claims he was pleased with the El-Erian hiring. However: “Cracks soon began to appear in this alliance, however, as El-Erian sought to force PIMCO out of its core focus on bonds and related fixed income securities and instead become a general-purpose investment management firm offering stocks, commodities, hedge funds and real estate, and hedge fund-like products to investors.”

Bill Gross warned that PIMCO could suffer another “Lehman moment” due to the type of “mortgages and leveraged real estate investments being led by a younger PIMCO managing director named Dan Ivascyn were under the control of portfolio managers who were, to varying degrees, independent from the PIMCO Investment Committee.”

Although blackjack-playing Gross says he was happy sticking to what he understood, he charges that El-Erian became angry that he would have to bear sole responsibility and blame for the high-risk, high-fee investments he had expanded at PIMCO. Gross says El-Erian abruptly resigned as co-Chief Investment Officer and co-Chief Executive Officer of PIMCO on January 20, 2014.

Gross blames a PIMCO managing director, Andrew Balls, for leaking news of the abrupt departure to a reporter at the Financial Times, where Balls had previously worked. Two days later, the FT broke the story and blamed Gross for El-Erian’ resignation. According to the lawsuit:

Both the initial Financial Times article and numerous follow-up media pieces heaped praise on El-Erian and cast criticism on Mr. Gross. Glossed over—or even left entirely unmentioned was any comment on El-Erian’s abrupt departure from a company that he had been hired to eventually lead, or of El-Erian’s abysmal performance on managing his PIMCO fund.

Gross claims there was a palace coup coupled with a smear campaign that eventually forced him out of PIMCO. After receiving a $300 million of the $1.3 billion firm profit bonus pool in 2013, Bill Gross’ lawsuit claims that he is owed the $250 million he was on track to pocket from PIMCO in 2014.

PIMCO responded that Gross’ lawsuit is without merit.

COMMENTS

Please let us know if you're having issues with commenting.