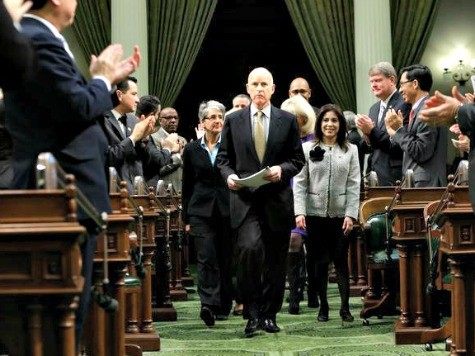

Two special sessions of the state legislature that will convene Monday to consider raising taxes, at Governor Jerry Brown’s request.

Brown said in June that he was never asked during his 2014 reelection campaign whether he would keep his 2010 pledge not to raise taxes without voter approval. However, the Sacramento Bee notes that Brown was, in fact, asked–and chose not to answer.

The prospective tax hike sessions are intended to address two issues: repairing California’s roads, and health care for the poor. To pay for each, Brown and the Democrats want to raise the gas tax and possibly raise a tax on cigarettes.

Brown’s recent budget failed to include enough money for highway repair.

In the past, the Democratic supermajority would have made passage easy, but with the supermajority lost, Brown and the Democrats must persuade GOP legislators to join them in order to win approval of two-thirds of lawmakers in both houses of the Legislature.

Some GOP representatives have hinted that they might support the gas tax hike, the first in 20 years, if the funds can only be used for fixing the roads.

Brown said in June 2015, “I ran for office when this state had a $27 billion deficit, and I said I wasn’t going to raise taxes unless the people said that’s what they wanted through an initiative. And I kept my promise. When I ran the second time, I didn’t say that – and you didn’t ask me.” But in September 2014, the Sacramento Bee pointed out that Brown had indeed been asked, but danced around the issue, writing, “Asked if his 4-year-old tax pledge would extend into next term, Brown said he is focused on Propositions 1 and 2, the $7.5 billion water bond and a budget reserve measure on the ballot.”

Sen. Jim Beall (D-San Jose) has proposed tax hikes of 12 cents on gas, 22 cents on diesel fuel, $100 for vehicle registration fees, $100 for electric vehicles, and $35 for gas-powered vehicles and hybrids. The suggested cigarette tax would add $2 per pack.

COMMENTS

Please let us know if you're having issues with commenting.