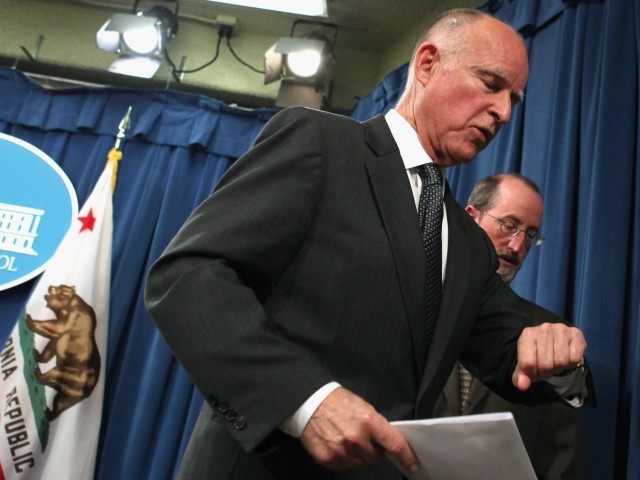

No one can accuse Governor Jerry Brown of failing to think big–big spending, that is.

Just as Brown signed the largest state budget in California’s history, weighing in at over $115 billion, he has called upon the California legislature to raise new taxes to fund transportation infrastructure–roads, highways, bridges and the like.

That has raised considerable questions about why Governor Brown did not insist on including sufficient funding for this “brick-and-mortar” function of state government in the state’s official spending plan. It’s especially eyebrow raising when the budget does include billions of dollars for Brown’s pet project–constructing high-speed rail to connect the San Francisco Bay Area and Southern California–with a projected cost, at this point, of nearly $70 billion.

“California’s existing transportation infrastructure is in serious need of repairs and upgrades, and of course new projects are needed,” said Orange County Transportation Authority Chairman Jeffrey Lalloway in an interview with Breitbart News Network. “These investments should have first call on available tax dollars, and should not be thrown into a debate over whether we need a tax increase.”

State officials say that roughly $60 billion in funds will be needed to bring the state’s aging transportation infrastructure up to speed.

Brown’s call for higher taxes from the legislature faces an uphill battle, given that in last year’s elections Democrats lost their two-thirds supermajorities in both houses of the legislature. That means multiple Republican State Senators and Assemblymembers would have to concur, along with every Democrat. Raising taxes in California requires a two-thirds vote of each chamber.

Out the gate, in response to the governor calling a special session on transportation, both the GOP Senate Caucus and the GOP Assembly Caucus have released proposals to fund transportation by shifting existing spending priorities.

That contrasts with Capitol Democrats. Assembly Speaker Toni Atkins is proposing a fee for drivers that might be as much as $50 per year, and Senator Jim Beall, Jr., has called for a ten-cent hike in the state gas tax, as well as an increase in vehicle license fees.

These are in addition to a myriad of other tax increase proposals already introduced by Democrats, including higher taxes on commercial property taxes, cigarettes, and even real estate transactions.

The fundamental question that will dominate this special session is whether Democrats can refuse to fund a basic state government function with existing revenues, and then use that artificially created “need” to leverage GOP votes for higher taxes.

__________

Jon Fleischman is the Politics Editor of Breitbart California. A longtime participant, observer and chronicler of California politics, Jon is also the publisher at www.flashreport.org. His column appears weekly on this page. You can reach Jon at jfleischman at breitbart.com.

COMMENTS

Please let us know if you're having issues with commenting.