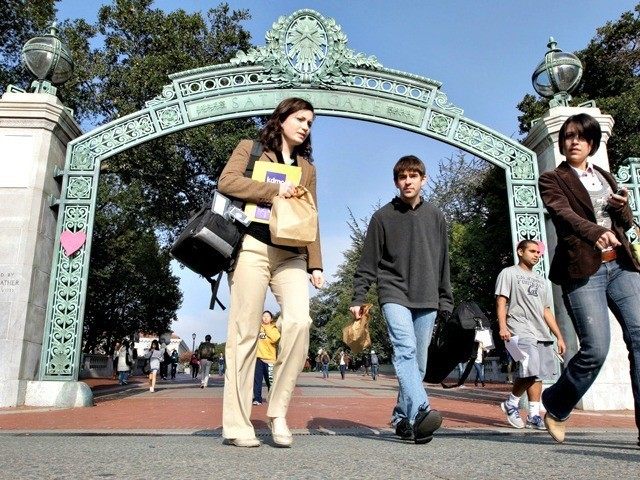

With University of California tuition more than doubling in the last decade, about two-thirds of Californians now rate affordability at America’s largest public college system as poor. Despite Federal Reserve warnings about default risks for student loans, the UC system intends to raise tuition by 5 percent next year and 21.5 percent over the next 5 years.

A university degree was once perceived as the social elevator to a higher net worth. But the Federal Reserve Bank of New York estimates that 40 million Americans have racked an average of four loans with an outstanding net balance of $29,000 to obtain a college education.

Total student loan debt is 1.16 trillion, after growing by $77 billion in 2014,. according to the Fed. With a 160 percent rise over the last decade, student debt is now the second largest category of debt in America.

Student loan programs only “deem” 17 percent of borrowers to be officially “delinquent,” despite the fact that just 37 percent of all student borrowers are making regularly scheduled payments. The reason for such a low delinquency rate is that nearly half of all borrowers are “deemed” to be either still in school, in deferral, or in one of the various programs that allow students to avoid officially being labeled as “delinquent.” But 63 percent of all student borrowers are not reducing their outstanding debt balances.

Looking back at the students that left college in 2005, the Fed found the average loan program’s standard ten-year debt amortization schedule should have meant that 90 percent of student loans borrowing would already be repaid. But a decade later, 62 percent of all 2005 student debt is still outstanding.

More than half of borrowers that left school in 2005 with “high balances” of more than $50,000 have either missed payments for at least four successive months, gone into default, or entered some kind of loan restructuring program. About 22 percent of the student borrowers now actually owe more today than when they left college in 2005.

Former students’ inability or unwillingness to repay loans appears to be increasing. For the student borrowers that left college in 2010 with total outstanding balances of $78 billion, $71 billion remains unpaid. That means that 91 percent of the original loan balances is still outstanding.

The liberal Brookings Institute has argued that rising student debt and slow repayments are not particularly worrisome, because low interest rates afford “modest payments” that students should be able manage after leaving school.

But the Fed warns that “widespread failure to repay is a problem” for American taxpayers, since most student loan programs were effectively nationalized during the Obama Administration. With rising costs for tuition and limited job availability for a person with some college education, the Fed commented, “Student loans have the highest delinquency rate of any form of household credit, having surpassed credit cards in 2012.”

The Fed also worries the burden of large amounts of debt on households’ balance sheets will affect the student borrowers’ long-term economic behavior. Their research suggests rising student debt “contributed to the recent decline in the homeownership rate and to the sharp increase in parental co-residence among millennials.”

Over the last decade, inflation has fallen, and it dropped under 2 percent last year. Regardless, UC tuition rose much faster than inflation–and that trend is continuing.

COMMENTS

Please let us know if you're having issues with commenting.