Hefty tax breaks enjoyed by sports franchise owners allows for the new Los Angeles Clippers proprietor Steve Ballmer to save about 50% of his recent purchase price.

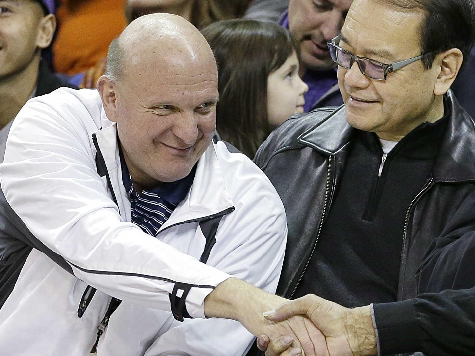

Ballmer bought the Clippers after Donald Sterling was relieved of his duties in August for $2 Billion, which means the former Microsoft CEO looks to receive about $1 Billion dollar in tax benefits over the next 15 years.

Dennis Howard, a professor emeritus at the University of Oregon’s Warsaw Sports Marketing Center observed that “It’s a huge part of this business that never gets talked about. It changes your sense of what he’s really paying.”

Meanwhile, Jack Barcal an associate professor at USC’s Leventhal School of Accounting contends that he doesn’t think that Ballmer bought the team just for the write-offs, but instead thinks that “he did this for the enjoyment.”

The tax incentives stem from a court ruling imparted decades ago, according to the Los Angeles Times, when legendary sports franchise owner Bill Veeck, persuaded the IRS to grant additional tax incentives for players salaries. Veeck is best remembered for sending a midget to the plate to confound an opposing pitcher, which proved successful when the St. Louis Browns’ diminutive Eddie Gaedel drew a four pitch walk.

Significantly, when an owner buys a franchise he essentially buys the contract rights to the team’s players and acquires very few tangible assets. Given that the players represent the franchise’s basic value, that value depreciates each year that the contract transpires. Much like a farmer who buys a plow, that plow depreciates each year and the farmer gets depreciation write-offs according to IRS rules.

In the case of the Clippers, the IRS will allow Ballmer to depreciate over 15 years up to 50% of the $2 billion he spent on buying the team in much the same way the farmer can depreciate that plow.

COMMENTS

Please let us know if you're having issues with commenting.