The California State Controller has announced that sales, income and corporate tax revenue came in $530.4 million, 7.8%, below budget for the month of May. That substantial budget miss comes less than two weeks after the California Bureau of State Audits found a $31.65 billion in accounting misstatements. With Governor Brown and the Legislature battling over how to spend the state’s expected surplus, the Controller just announced that a big piece of that “fun money” just got wiped out.

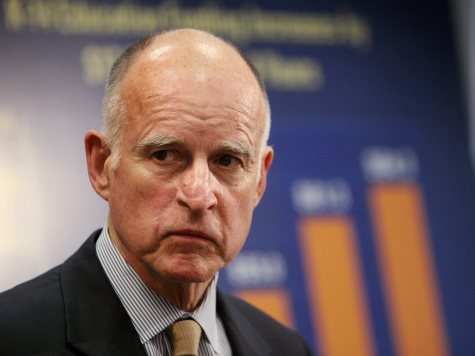

California’s Governor Jerry Brown, who is seeking an unprecedented fourth term, has been crowing about how the state has been raking in capital gains taxes from the hot stock market and the $7 billion increase in income and sales taxes that voters approved in 2012. Breitbart California reported that Brown has been battling a Friday budget deadline to put aside surplus money for a rainy day fund and to pay down the state’s $355 billion in debt and pension obligations. His Democrat allies in the state legislature would rather spend an extra $3 billion of the expected surplus on urban planning and rescuing low-income communities that are supposedly being damaged carbon pollution.

California jobs were hammered in the Great Recession after 2007. The Bay Area, from San Francisco to San Jose, has seen a strong recovery. Southern California and the Central Valley are still suffering, but hoped for a rebound this summer.

But the Controller’s office announcing net revenues of -$389.1 million surprised Wall Street analysts and knocked the surplus down to $1.8 billion. Brown’s budget for the 2015 fiscal year had expected a rising surplus for May and June. He had been so confident about the state’s financial strength that he told reporters in Sacramento, “Our credit rating is going up,” at a celebration of his primary victory party. “If we get the right kind of budget, it’ll go up again.”

State Controller John Chaing said: “The overall budgetary health remains stable and there is no threat to the state’s ability to pay its bills on time and in full.” But he cautioned, “As lawmakers finalize their spending decisions in the coming days, my office urges fiscal restraint with an eye toward slashing the billions of dollars in debt accrued during the great recession.”

This type dour talk is very different from prior cheerleading. Chaing has good reason to be concerned because the California state budget miss was across the board, with sales tax at -$98.6 million, income tax at -$254.2, and corporate tax at -$177.6 million. California cash reserves were $4.9 billion over projections, but only because the state quietly borrowed $8.5 billion from trust accounts and banks to cover the shortfall.

COMMENTS

Please let us know if you're having issues with commenting.