Governor Jerry Brown’s $750-million tax incentive program may be an attempt to shut the stable door after the horses have bolted. Toyota and Occidental Petroleum are already packing their bags and moving to Texas, where costs of doing business are lower and incentives are higher.

Ironically, the new tax incentives approved last year by the California legislature, which are now coming to fruition, come on the heels of the sizable tax increase heralded by Brown in 2012 with the passage of Proposition 30. Although Prop 30 addressed high income individuals, it positioned California as one of the highest taxed states in the nation. Consequently, that is not a strong selling feature for companies considering leaving California or for those companies looking to relocate here.

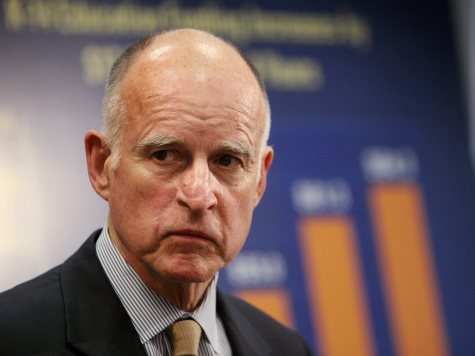

Nevertheless, the Governor contends that the new tax program will help California retain companies and change the business climate for the better. “These tax credits will spur new jobs and help communities hardest hit by the recession,” Brown claims.

According to the Los Angeles Times, the tax credits are essentially threefold:

- A reduction in sales tax on the purchase of some equipment used to produce goods, specifically in the manufacturing, food processing, biotech and R&D industries

- An employment tax credit for hiring challenged groups such as veterans and former prisoners

- An income tax credit to those companies that invest in new jobs anywhere in the state

Significantly, for now the new employment tax incentives are restricted to only three pilot zones: portions of Riverside, Merced and Fresno counties. The Times reported that Larry Vaupel, Riverside’s economic development manager, worries that benefits from the new program will be meager because the law dictates that only certain census tracts qualify for new hires to live.

COMMENTS

Please let us know if you're having issues with commenting.